- Loading...

British Virgin Islands (VG):

- Added Custom Jurisdiction selection for British Virgin Islands (VG) who requires their GIIN to be passed into the SendingCompanyIN field in XML.

- XML element - 'TransmittingCountry' - Must use the code "VG".

- the 'SendingCompanyIN' must be the BVI's ID: 000000.00000.TA.092

Cayman Islands (KY):

- Added Custom Jurisdiction selection for Cayman Islands (KY) who requires their GIIN to be passed into the SendingCompanyIN field in XML.

- XML element - 'TransmittingCountry' - Must use the code "KY".

- the 'SendingCompanyIN' must be the Cayman Island's ID: 000000.00000.TA.136

Singapore (SG):

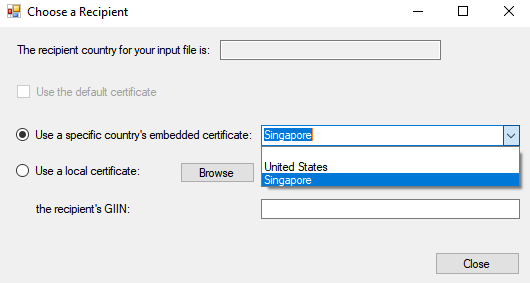

- Embedded - the Singapore certificate when using the IDES Packager.

- XML element - 'ReceivingCountry' - Must use the code "SG".

- XML element - 'Warning' - To reinstate this element and leave it blank

- XML element - 'Contact'- However, IRAS requires this element to be left blank.

- XML element - 'TransmittingCountry' - Must use code "SG". Currently, the code used is whatever IRS Country Code is listed for the FI.

- XML element - 'MessageRefId'

Reporting SGFIs are strongly encouraged to structure the MessageRefld in the following format: <GIIN><Date and time of file creation><2-digit incremental number>, where:- <GIIN> refers to the Global Intermediary Identification Number ("GIIN") assigned to the Reporting SGFI by the US IRS. SMBC Singapore Branch's GIIN is ISVZ8J.00000.BR.702

- <Date and time of file creation> needs to be in this format: YYYYMMDDHHMMSS format

- The <2-digit incremental number> would start at '00' and increase to '99' when a file is produced on the same day.

- Example: A Reporting SGFI, with GIIN 123456.00000.SL.702, prepares a FATCA Return for Reporting Year 2019 on 21 May 2020 at 7:20:22pm. The MessageRefID for the FATCA Return that it generates for the day is "123456.00000.SL.7022020052119202200".

- XML element - 'DocRefId'

- Sample entries generated by software (there are various 'DocRefId' entries in each XML file generated):

- Specified format (minimum of 21 characters): <GIIN><period character(.)><Unique Value across all time for the Reporting SGFI>

- In respect of the <Unique Value across all time for the Reporting SGFI>, IRAS recommends Reporting SGFIs to use the globally unique identifier ("GUID"). The DocRefId must not include any non-alphanumeric characters, excluding periods and dashes. (Prohibited non-alphanumeric characters include, but are not limited to, _, @, +, &, ! and *). GUID has a specific format - in the form 8-4-4-4-12 for a total of 36 characters (32 alphanumeric characters and 4 hyphens)

- Example: A Reporting SGFI, with GIIN of S519K4.99999.SL.702, prepares a FATCA Return for Reporting Year 2019. The unique reference for the account report is 12291cc2-37cb-42a9-ad74-06bb5746b60b. The DocRefId for the account report will be formatted as "S519K4.99999.SL.702.12291cc2-37cb-42a9-ad74-06bb5746b60b".

The below additional customizations are new for TY 2020 reporting Singapore (SG):

For more information please see: IRAS Reference link

Account Holder TIN should be ‘AAAAAAAAA’ on XML

- Blank TIN on form

- Individual is checked

- Entity + Specified US person is checked.

Account Holder TIN should be a single blank on XML

- Blank TIN on form

- Entity is checked + Owner Documented FFI

- Entity is checked + Passive NFFE

Reporting FI Tin should always be filled with Filer GIIN

- Filer Category must be 02 or 07

Reporting FI TIN should be filled with TDT Entity Reference ID

- Filer Category must be 09

- On XML gen will prompt user to enter ID, example: TDT 1234567890

Invalid records will be left behind the XML and a warning will be displayed at XML gen and in the mag logs.

- Valid filer category 02, 07 and 09 – all others are invalid

- Valid account holder types – Individual, Entity (Owner Documented FFI), Entity (Passive NFFE) – all others are invalid.

The below additional customizations are new for TY 2021 reporting Singapore (SG) pending:

- Populate the ORG_TIN data element with the foreign TIN, and the “TIN Issued by” element with the issuing country code for the foreign Entity Account Holder. The TIN value can consist of alphanumeric and unprohibited symbols; and

- If there is no foreign TIN available for the foreign Entity Account Holder, the Reporting SGFI should include its country code in the “TIN Issued by” element and the characters “NA” in the ORG_TIN data element (e.g. if Entity Account Holder is tax resident in the Cayman Islands but has no TIN, the Reporting SGFI should include SG in the “TIN Issued by” element and the characters “NA” in the ORG_TIN data element).

Overview

Content Tools