- Loading...

- Created by Laura Rothman, last modified by Tina Caraco on Dec 08, 2023

Submitting Your Upload

You are responsible for submitting your data via an Upload File within our Service Bureau Upload Deadlines. You do not need to call us to submit your Upload File! Review our Service Bureau Uploads - Overview and Service Bureau Uploads - Detailed, below, for guidance in submitting your upload.

- Purchase TY 2023 software.

- No appointment is necessary* upload at any time during our Service Bureau Upload Deadline for Guaranteed Processing.

- *If submitting 10,000 or more forms for Print and Mail services, an executed contract and paid deposit are required to perform services. Please email SB@1099pro.com to initiate the contract and provide the required deposit amount.

- Calendar our Upload Deadline dates.

- Import your data into our software.

- Run the required software update.

- Within your software, create your Service Bureau Upload File.

- Carefully review Control Totals.

- Electronically submit your Service Bureau Upload File.

- Receive Service Bureau emails as your data is received/processed/accepted.

- Pay invoice promptly upon receipt.

Welcome to the Service Bureau!

If submitting a total of 10,000 or more forms for Print services, you should also have an executed Service Bureau contract and paid your deposit. It is your job to install our software, import your data, then review it for accuracy. During our Upload Window, you will create an upload file — within our software — then electronically transmit it to us. We receive your file and push it for processing. Final invoices are generated after we process your upload.

How do I import? Our software includes a user-friendly Import Wizard interface; please see:

- How to Import Using Standard Maps (aka Sample Import Files) video - https://www.1099pro.com/videos.asp

- Review Service Bureau Import Tips

Where are the sample import files? Download new import files each tax year.

How do I create & submit my Service Bureau upload?

- How to Print & Mail via the Service Bureau video - https://www.1099pro.com/videos.asp

- Filing Electronically via the Service Bureau video - https://www.1099pro.com/videos.asp

- Creating Bulk TIN Uploads via the Service Bureau video - https://www.1099pro.com/videos.asp

What am I checking on my Control Totals? Review EVERY page of your Control Totals to verify the Filers and Form Types included, the total dollar amounts reported, and the Services selected.

- View an example - Control Totals Example - NEC 2021.pdf

Can I submit outside of the Upload Window?

- Please submit your upload within our Upload Window. If you are running late, submit as soon as you can. Rush processing is not available. The Service Bureau will process uploads scheduled and/or received outside of the Upload Window as quickly as possible, however without the guaranteed turnaround.

- View our Filing Timeline and Reporting Deadlines.

Do I have to run the software update?

- YES! The update enables Service Bureau upload functionality! The update is scheduled for released in early January and will be posted on our WIKI.

- Single-user installations will receive a pop-up notification in their software when the update is available.

- Multi-user installations must run the update via their Admin/Server (not the individual Workstations).

- Please make advance arrangements with your internal IT to run the January update (and any other updates) as soon as it is released.

What happens after I submit my upload?

The Service Bureau receives your upload, then your designated Service Bureau contact is emailed through each stage of processing. If there is an issue with your upload, we will contact you directly via email - please monitor your email including spam folder!

- Upload Received—This email indicates that the Service Bureau has received your upload file and queued it for review. An upload identifier number is referenced on this and the following emails.

- Upload Approved—This email indicates that the Service Bureau has reviewed your upload file's Control Total reports. Your file has been approved for Print+Mail and/or eFiling, per your upload type.

- In January you may instantly receive approval or your approval may be delayed by 1-2 business days. Check your spam folder for emails from SB@1099pro.com.

- Tax Forms Have Been Printed—For Print uploads only, this email serves as confirmation that your forms have been printed. Forms will be delivered to USPS for mailing the second business day after the date of this email.

- For example, if you receive this email on Monday, your forms will be delivered to USPS by Wednesday.

- IRS/SSA Upload Accepted—For eFiling uploads only, this email confirms that your upload has been accepted by the IRS/SSA. The IRS/SSA reference number is provided for your records.

- Service Bureau Invoice—This email includes the Service Bureau invoice for this upload (the upload identifier number is referenced in the WO# field). Payment terms are Net Due on Receipt.

- For help reconciling invoices to uploads, search "Reconcile" in your 1099 Pro software help file.

If you need help, review our Technical FAQs, Video Tutorials, and Support options.

Many customers prefer to submit all forms for Print, Mail and eFile services in January. This ensures eFiling is not overlooked or forgotten later in the season. Submitting all forms for all services in a single upload is the most cost-effective way to use our services!

As a reminder, forms 1099-NEC and W-2 forms must be eFiled by January 31st. For other form types with a March 31st filing deadline, you absolutely can submit them in January for eFiling - however please thoroughly review your data prior to filing it early. Correcting filed forms is more complicated (and expensive) than correcting non-filed ones. See Reporting Deadlines.

Scheduling Requests

There is no need to Schedule an upload date. You will need to upload to the Service Bureau within the Upload Window timeframe.

The Service Bureau introduces Upload Windows to allow customers greater control and flexibility in submitting their data. Previously, customers had fixed upload dates. An "Upload Window" is the timespan that a customer may submit their scheduled upload(s) for guaranteed processing by the respective IRS/SSA deadline. Customers do not need to schedule to upload, simply upload within the Upload Window timeframe. If you have 10K forms or more for Print/Mail processing, please email SB@1099pro.com for a contract and prepaid deposit amount.

Customers who submit uploads – or submit Scheduling Requests – outside of our Upload Windows will have their files processed as quickly as possible. The Service Bureau does not guarantee turnaround for uploads received outside of our Upload Windows. Rush processing is not available - please plan accordingly.

View our Filing Timeline and Reporting Deadlines.

After submitting your initial Scheduling Request of the tax year, customers can submit additional uploads without further scheduling. This includes inside and outside of our Upload Windows (for Original, Late Original, and Correction uploads). Print uploads of 10,000 or more forms may be held for processing until contract and deposit requirements are met.

There are minimum upload fees. It is always most cost-effective to submit all forms for all filers in a single upload, when possible.

Rush processing is not available. Customers requiring guaranteed January 31st mail &/or eFile services must submit within our Upload Windows. The Service Bureau will process uploads scheduled and/or received outside of our Upload Windows as quickly as possible.

You may be able to request an IRS filing extension. The IRS/SSA do not offer filing extensions for 1099-NEC or W-2. Extensions to mail most Recipient copies are not available. Customers are responsible for filing their own extension requests - the Service Bureau cannot do this on your behalf.

If you are unable to submit within the Upload Window - you should upload as soon as possible. There is no need to notify the Service Bureau to inform us that your upload may be late. The Service Bureau will process uploads scheduled and/or received outside of the Upload Window as quickly as possible.

Service Bureau Rates & Fees

Most Service Bureau rates are posted at https://www.1099pro.com/servPricing.asp. Also see Service Bureau - 1099-NEC State Reporting Pricing.

If you have questions regarding this change, please email Support@1099pro.com.

We generally do not issue Service Bureau quotes. This is because there are many variables that can affect final invoices, including services selected, number of forms, number of Filers, and the number of uploads. Obtain a self quote at https://www.1099pro.com/servPricing.asp.

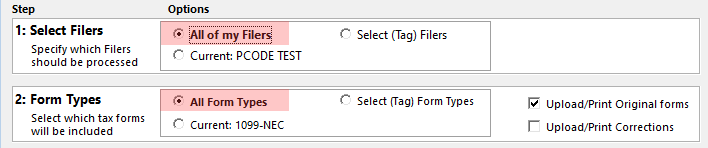

When possible, submit "All of my Filers" and "All Form Types" in a single upload. There are minimum fees for all uploads, so submitting less uploads saves you money. Additionally, large volume uploads may automatically qualify for discounted rates!

In the Service Bureau Upload Wizard, make below selections to select all eligible forms in a single upload. You are responsible for thoroughly reviewing your Control Totals prior to submitting uploads to the Service Bureau.

Standard services minimum upload fees:

- Full Service (Print/Mail/eFile) = $85 min

- Print & Mail Only = $85 min

- Print & Mail also includes E-Delivery and Online Access uploads

- eFile Only - Original Forms (first upload of the season) = $85 min

- eFile Only - Original Forms (subsequent uploads) = $45 min

- eFile Only - Corrected Forms = $45 flat

- ACA eFile Only = $250 min

- NEC State Reporting = Service Bureau - 1099-NEC State Reporting Pricing

Full Service and eFile Only uploads may also incur Filer fees. Rates are subject to change.

- Full Service Customers

- The base rate to Print/Mail/eFile a form is $1.50 each. If this type of upload contains 56 or less forms, you would be billed the $85 minimum fee (i.e., 56 x 1.50 = 84.00).

- Print & Mail Only Customers

- The base rate to Print & Mail Only a form is $1.24 each. If this type of upload contains 68 or less forms, you would be billed the $85 minimum fee (i.e., 68 x 1.24 = 84.32).

- eFile Only Customers - Original Forms (first upload of the season per software authorization code)

- The base rate to eFile Only a form is $0.25 each. If this type of upload contains 339 or less forms, you would be billed the $85 minimum fee (i.e., 339 x .25 = 84.75).

- eFile Only Customers - Original Forms (subsequent uploads per software authorization code)

- The base rate to eFile Only a form - after submitting your initial eFile Only upload of the tax year - is $0.25 each. If this type of upload contains 179 or less forms, you would be billed the $45 minimum fee (i.e., 179 x .25 = 44.75).

- eFile Only Customers - Corrected Forms

- Flat fee per upload, regardless of number of Filers, is $45.

- ACA eFile Only Customers

- The base rate to eFile Only ACA 1095 forms is $0.25 each. If this type of upload contains 999 or less forms, you would be billed the $250 minimum fee (i.e., 999 x .25 = 249.75).

- ACA eFile Only uploads requires significant manual processing on AIR, hence the higher minimum upload fee.

- The base rate to eFile Only ACA 1095 forms is $0.25 each. If this type of upload contains 999 or less forms, you would be billed the $250 minimum fee (i.e., 999 x .25 = 249.75).

In addition to the minimum fee, you may also incur Filer fees. Rates are subject to change.

A Filer is the company, entity, or individual issuing a tax form to a recipient.

- Full Service (Print/Mail/eFile) uploads are allowed 1 complimentary Filer. Each additional Filer is billed at $5 each. There is a $500 Filer Surcharge cap per upload.

- eFile Only - Original Forms - uploads are allowed 1 complimentary Filer. Each additional Filer is billed at $5 each. There is a $500 Filer Surcharge cap per upload.

- NEC State Reporting uploads are allowed 1 complimentary Filer. Each additional Filer is billed at $5 each. There is no Filer Surcharge cap for this service type.

- Print & Mail Only uploads have no Filer fees.

- eFile Only - Corrected Forms - have no Filer fees.

Contracts & Deposits

- Print Services: If submitting a combined total of 10,000 or more forms for Print services, an executed contract and paid deposit are required to perform services. Email SB@1099pro.com to initiate this process.

- eFile Only Services: No contract requirement.

The Service Bureau will not perform services until deposit payments are posted - please plan accordingly.

- Invoices up to $5,000 can be quickly paid online at https://www.1099pro.com/acctFindInvoice.asp.

- Invoices over $5,000 must be manually processed by AR@1099pro.com and will include a CC surcharge processing fee.

- ACH requests - email AR@1099pro.com

- Wire info - email AR@1099pro.com

- Duplicate invoices - email AR@1099pro.com

- Purchase Orders - email AR@1099pro.com

Download current W-9s at W-9 and NDA.

If mailing a Service Bureau deposit check via standard USPS, please allow UP TO 10 BUSINESS DAYS for us to receive and post it. The Service Bureau will not perform services until deposit payments are posted - please plan accordingly.

Via US Mail:

1099 Pro LLC

PO Box 2710

Carol Stream, IL 60132-22710

Via Overnight Delivery:

1099 Pro LLC #2710

5450 N. Cumberland Ave.

Chicago, IL 60656

Pay by ACH/Wire:

Please refer to your invoice or quote for ACH payment details or email AR@1099pro.com

- Include invoice number on payments.

- Overnight checks via FedEx, UPS or USPS Priority Mail.

- Do not send checks to our former mailing address in Calabasas, California.

- Mailing address updated 12/8/2023(tc), email inquiries to AR@1099pro.com.

Issues - Read Me

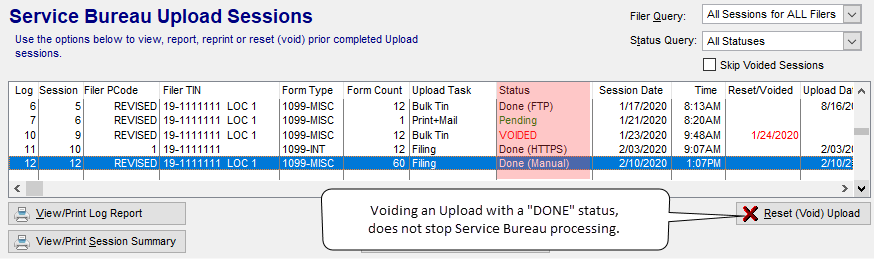

Any upload with a "Done (HTTPS)", "Done (FTP)" or "Done (Manual)" status has been transmitted to the Service Bureau for processing. Resetting a "Done" upload does NOT cancel the processing of the upload file that you submitted to the Service Bureau (it only resets the form status in your software). If you reset a "Done" upload and then submit a new upload, your data will be processed again! This creates additional costs, confusion to the recipient, and work for YOU.

On occasion, Service Bureau personnel may instruct you to Reset/Void a "Done" upload; otherwise use this button only for "Pending" uploads.

Uploads are processed almost immediately, particularly in January. Customers are responsible for THOROUGHLY reviewing their Control Totals prior to submitting an upload. We are unable to stop any uploads received by the Service Bureau.

- Print Jobs: The Service Bureau cannot stop print jobs, nor can we pull forms before they are delivered to USPS.

- efile Jobs: The Service Bureau cannot stop an IRS/SSA/State eFile jobs

Please investigate your uploads if we keep emailing you! You may have unfiled forms, pending uploads, or other situations requiring your attention. Review Service Bureau Upload Statuses to quickly determine necessary steps — and in many instances — resolve the issue yourself without contacting Support.

If your eFile is rejected, the Service Bureau will contact you directly with guidance, see Rejections. We begin rejection outreach after January 31st & March 15th, respectively.

Alternate Filing Options

All of our software products (with the exception of 1099 Pro Professional*) allow users to create electronic files, suitable for direct filing. Self-filing requires you to post your eFiles directly on the FIRE System, then monitor their status (Good - Accepted or Bad - Rejected).

To self-file you will need:

- 1099 Pro Enterprise, 1042-S Pro, or Corporate Suite software.

- An IRS issued TCC Number.

- Enter your TCC number in our software → menu bar → File → Transmitter Information. You can use one TCC to file on behalf of multiple filers.

- An IRS FIRE System account and logon credentials, visit https://fire.irs.gov/.

The above items are NOT required to eFile via the Service Bureau! The Service Bureau is available to all of our software customers for a fee, regardless of product purchased. Learn about our Print/Mail/eFile and Bulk TIN Match Services.

* 1099 Pro Professional users must eFile directly via the Service Bureau for a fee.

If self-filing a prior year electronic file, you must submit it via the current tax year specifications. This requires you to create the electronic file in the tax year appropriate version of our software, then manually edit the eFile in Notepad per current Pub. 1220 or 1187 specs. The Service Bureau does not provide guidance in editing prior year eFiles.

Prior year manual edits are NOT required to eFile via the Service Bureau! The Service Bureau automatically updates prior year eFiles to current tax year specs and submits them to the IRS for a fee. Learn about our Print/Mail/eFile and Bulk TIN Match Services.

Effective TY 2022, 1099 Pro software products no longer support IRS/SSA red Copy A and 1096/W-3/1042-T transmittal paper filings. All IRS/SSA filings must be filed electronically (either via the Service Bureau, for a fee, or self-filed with the IRS/SSA). Filing electronically ELIMINATES the need to submit 1096/W-3/1042-T transmittals to the IRS/SSA, as the transmittal data is contained within your electronic filing.

Related Topic: Service Bureau Info

- No labels