Can you tell me more about what to do for any states that are unsupported?

- Yes! There are currently (10) unsupported states/territories:

- Un-supported states: AS, GU, HI, IN, LA, MP, NM, PA, RI, VI

- Of these, six (AS, GU, MP, PA, RI, VI) weren't in the Combined Federal/State Filing Program to begin with. If you weren't previously reported directly to these states then nothing has changed!

- Finally, that leaves only four states (HI, IN, LA, NM) that are in the Combined Federal/State Filing Program that are unsupported.

- IF you don't have any records in these states, or if your records don't meet the reporting thresholds, then there is nothing that you have to do!

- You can research these states to file via paper or can purchase the Enterprise software to create the state electronic file that can then be submitted under an account that you make at that state.

Does anyone else offer state direct reporting to these states?

- We are not aware of any other company that offers as extensive of a filing service as we do or that has the alternate option of providing software that you can use in-house for your own reporting.

- The 1099 Pro Enterprise software, or Corporate Suite software, allows you to create your own state direct files and submit them directly to states (on your own).

- Certain specialized accounting firms may offer this service but it is likely that they are using our service on the back-end or are hand-filing only for a small, select, group of clients.

- In the end, every single CPA, Accountant, and even the states themselves were shocked that the 1099-NEC was not included in the CFSF Program. Many states do not even have their reporting portals operational yet!

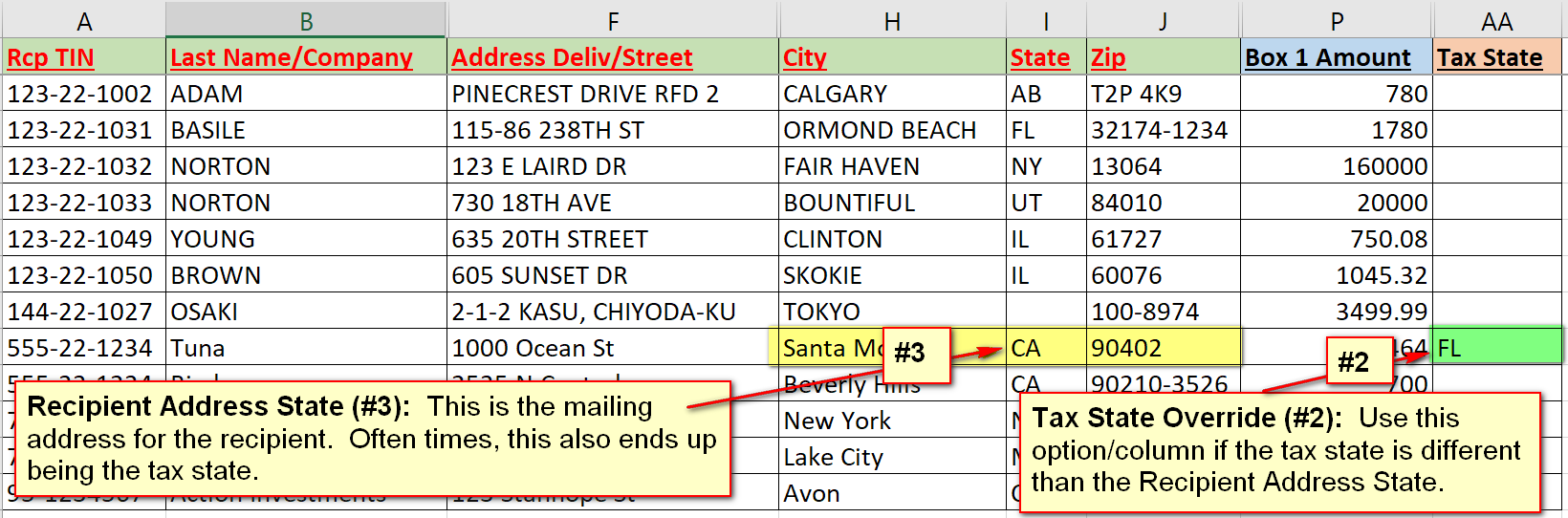

How is the Tax State determined in the software?

- The Tax State is set on each 1099-NEC. It is not based on the Filer tax state.

- The Tax State can be set on each individual record via import or manual entry.

- The Tax State is determined based on the below logic.

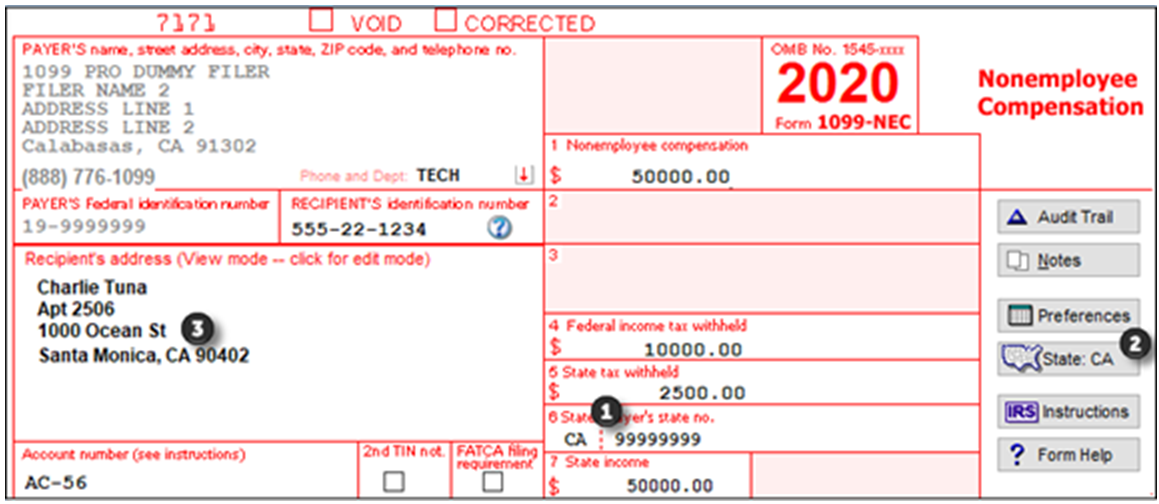

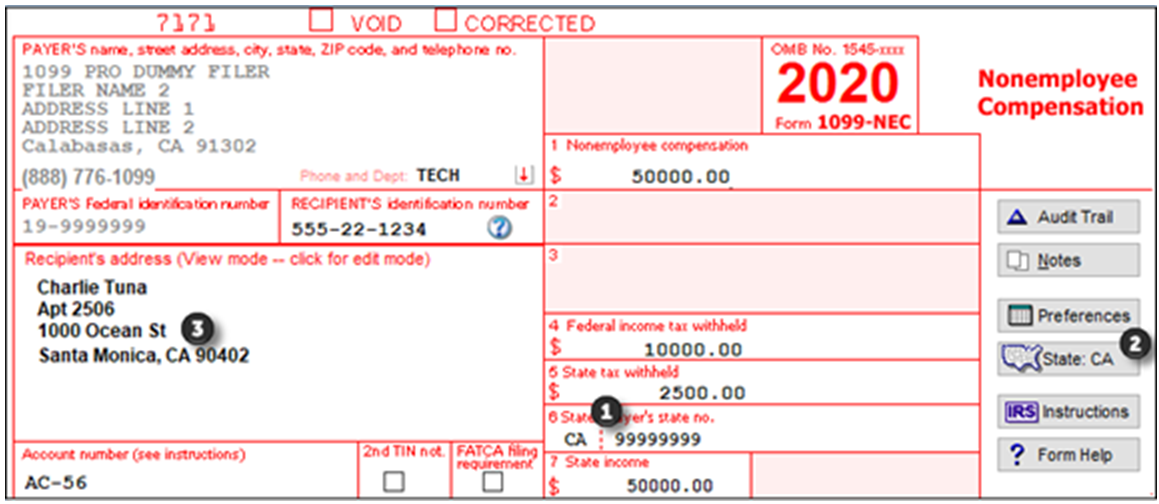

- Explicit State Withholding Boxes (1)

- If the state withholding box is completed on a tax form, for a specific tax state, then that state is the "tax state" regardless of the Tax State Override (#2) or the Recipient Address (#3) below. Forms with explicit state withholding boxes include: 1099-B, 1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-MISC, 1099-NEC, 1099-OID, 1099-R, W-2G, 1042-S and W-2.

- Generally, you are required to have a State ID Number / State Withholding Account Number when utilizing the Explicit Tax State box.

- Note: If you do not have a State ID Number / State Withholding Account Number for a state, it is best to leave the explicit tax state box blank and import/enter your tax state in the 2nd option below.

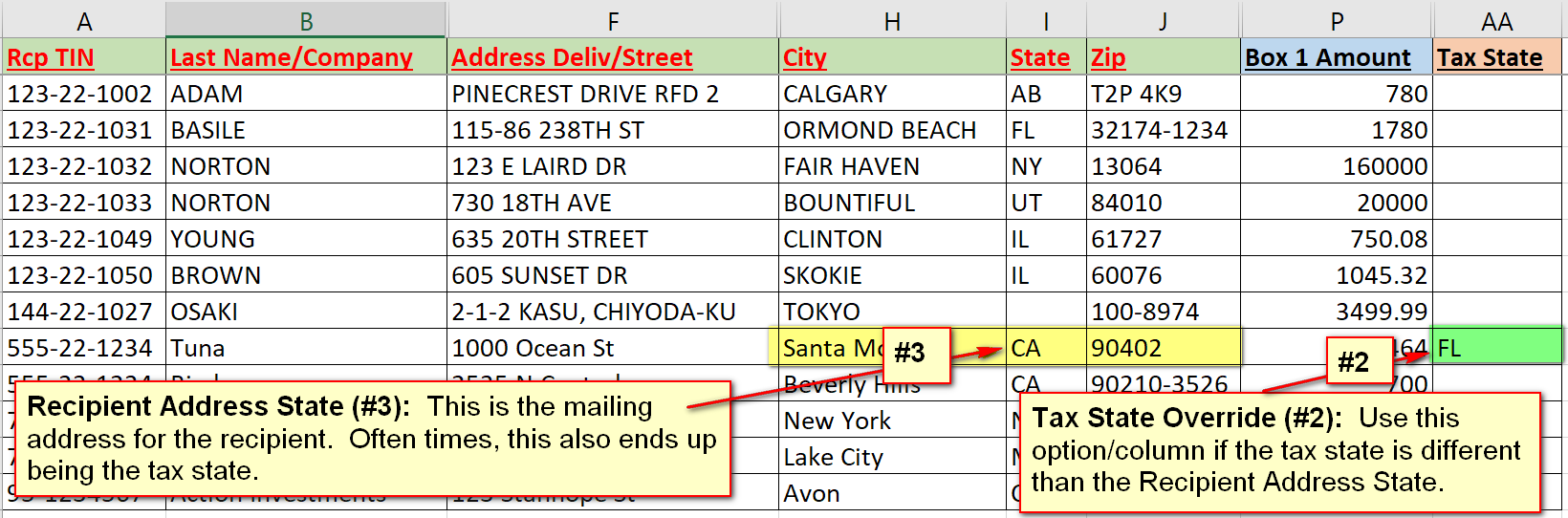

- Tax State Override (2)

- If you use the optional "Override default for State tax reporting" button, located on the right hand pane of the form entry window, the selected state overrides the recipient's state in their address.

- Please see the diagrams below for more information on how to use this field.

- Recipient Address (3)

- If there is no state withholding and a different state is not selected in the "Tax State Override" box as discussed above, then the state in the recipient address is used.

- Diagram / Display Notes:

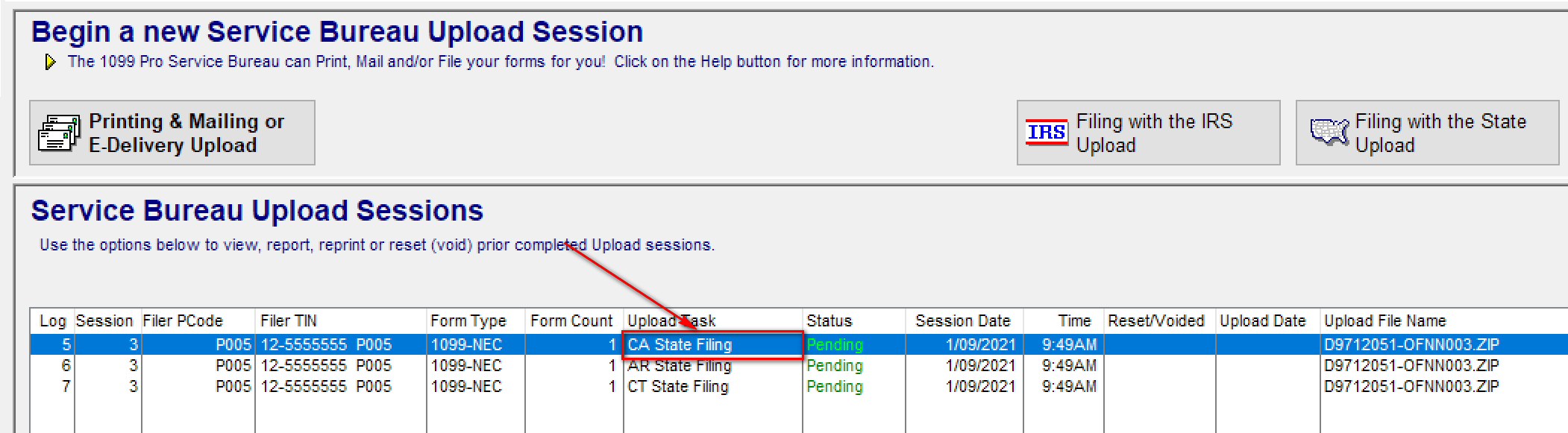

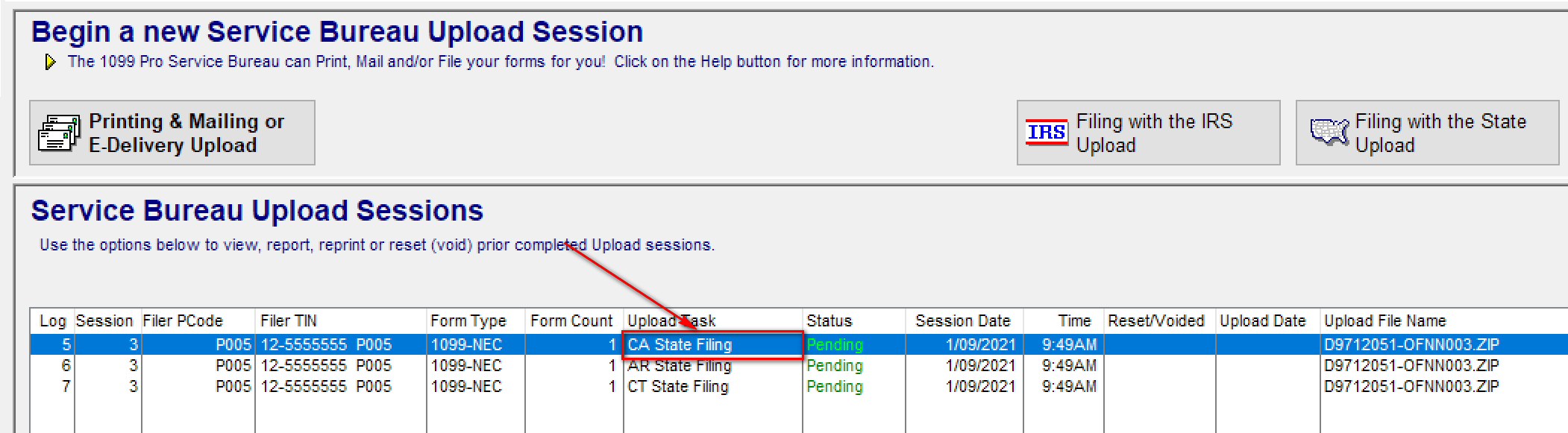

How do I know which 1099-NEC records were reported to the state(s) by the Service Bureau?

- Please navigate to the 'Service Bureau Upload Session Log" screen (shown below). Then look under the "Upload Task" column and you will see any state filing sessions.

- Note: If you have multiple filers, please make sure you have "All Sessions for ALL filers" selected in the filer query in the upper right. By default, the display is only for the sessions related to your current filer.

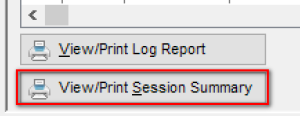

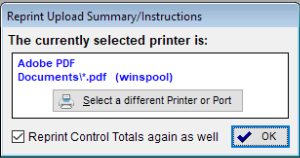

- Next, select "View/Print Session Summary" near the bottom left of the screen

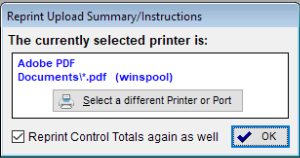

- A popup will appear to select a printer (we recommend saving to a PDF printer)

- Also, select the checkbox to "Reprint Control Totals again as well". This will give you a state by state summary breakdown of the dollar amounts.

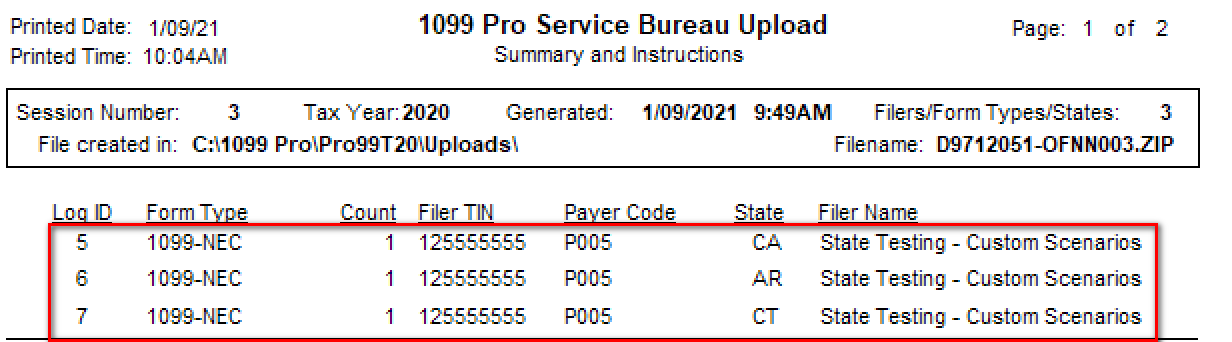

- Sample Session Summary Report

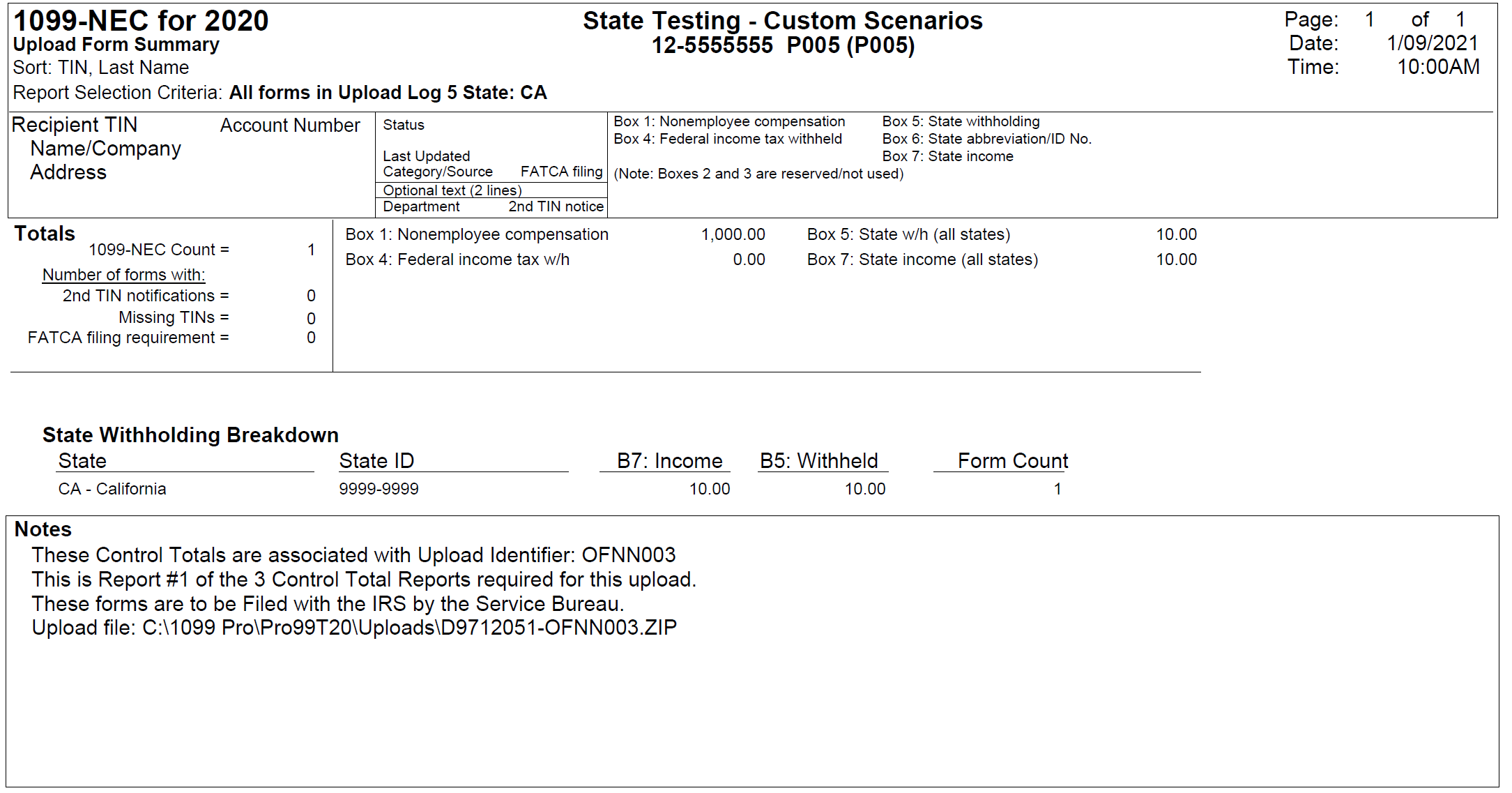

- Sample Control Totals Report

Does 1099 Pro plan to support state corrections via the Service Bureau?

- No. Each state has extremely vague requirements surrounding how to process corrections, and limitations that prevent automation, and thus 1099 Pro cannot support them.

- 1099 Pro has provided some basic research on how states would like corrections to be handled. Please contact each state individually before proceeding with any course of action.

- Corrections Guidance - General - Corrections Reporting

- Generally, states require you to call in and talk to an individual who will provide guidance on how to proceed. Such guidance may be that the state will fix it for you, that the correction should be submitted on paper, that the correction should be submitted electronically in a specific format, that the entire file must be re-submitted, that a reconciliation form must be filed with the correction, the list goes on...