Overview

Sovos 1099 Pro provides guidance for Rejected IRS eFiles originally submitted via our Service Bureau. After a file is rejected, it must be fixed and then submitted as a Replacement. The Service Bureau only processes Replacements for files originally submitted via our Service Bureau.

Rejections for Self-Filers (or Other Vendors)

The Service Bureau cannot process Replacement eFiles if the original eFile was submitted directly to the IRS (or filed by another vendor). Those who need to replace a Prior Year eFile that was submitted directly to the IRS (or filed via another vendor), must manually edit the prior year file to current tax year specifications. Reference IRS Pub. 1220 or 1187, as appropriate. The Service Bureau does not provide guidance on manual edits to prior year eFiles, nor can we edit files on your behalf.

State Rejections

The Service Bureau does not provide guidance on NEC State rejections. Contact the respective state agency for guidance with state rejects.

Understanding Rejections

Understanding why eFiles get rejected by the IRS can help you better prepare your original data. The IRS may reject eFiles due to:

- General Issues

- Excessive Withholding

- High Percentage of Missing TINs

1042-S Specific:

Very rarely, an eFile may be rejected due to a software issue. When this happens, our programmers replace the file on your behalf at no cost.

Corrections & Rejections

Corrections and rejections rhyme, but that's about all they have in common. If an eFile is rejected, it must be Replaced and not Corrected. This is because a rejected record was never Accepted by the IRS; and if it was not Accepted, then there is no Original record to Correct. If a rejected record is corrected prior to issuing the Replacement - it creates extra work and cost for you to resolve (and creates confusion for your tax form recipients).

Replacing Rejections

Service Bureau personnel will directly contact you with specific instructions on resolving your rejection. Depending on the type of rejection, you may be asked to provide a statement to the IRS (under penalties of perjury), or fix data in your eFile and then submit it as a properly coded Replacement file. The Service Bureau reserves the right to decline replacement assistance to customers whose files were IRS rejected due to suspicious or fraudulent concerns.

The 45 Day Window

From the time your eFile is rejected you have 45 days to submit a Good Replacement file to the IRS. The Service Bureau will contact you directly with guidance to resolve your specific rejection issue(s). Please be patient in the latter half of January while we prioritize Original filings - we will not start rejection outreach until after January 31st & March 15th, respectively.

Frequently Asked Questions

You could, but we don't recommend it. If you provide a Good Replacement file within 45 days of the rejection - your initial filing date is used to determine if you filed by the IRS deadline. If you decide instead to submit a new Original file - but do so AFTER the forms IRS filing deadline - you may incur IRS late filing penalties. We recommend replacing the reject and avoiding possible penalties. |

Yes, if you don't the IRS will reject the filing again. |

No, only include the same form types (for the same Recipients) &/or Filers in the Replacement file. |

Yes, if you determine that those forms and/or Filers should never have been submitted for filing. |

Possibly, discuss with Service Bureau personnel prior to attempting. Generally, your best bet is manually resolving the reject errors individually. |

Yes. Consider marking an "X" in the Corrected box and adding a custom message on the forms to avoid recipient confusion (search "Advanced Print Options" in your software help file). You can email forms via your 1099 Pro software (search "Email Tax Form"), you can print them yourself in-house, or submit them to the Service Bureau for Print & Mail. |

Resolve & Submit Replacement Upload

To resolve, carefully follow these steps:

- At the Service Bureau Upload Session screen, select the Rejected Upload and click the "Reset (Void) Upload" button located in the lower right corner of screen. Forms revert to a Pending status and are eligible for edits.

- Go to the Work With My Tax Forms screen and edit records, per the IRS rejection.

- Service Bureau personnel will contact you as quickly as possible to provide guidance on your rejection. Please be patient.

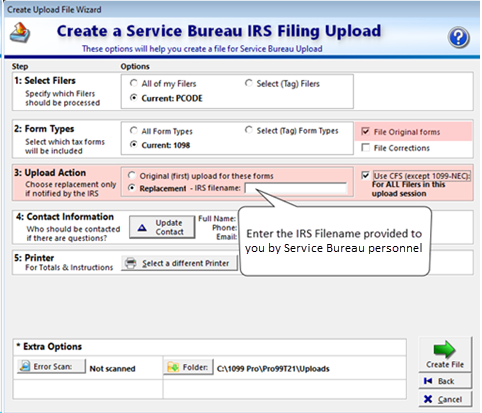

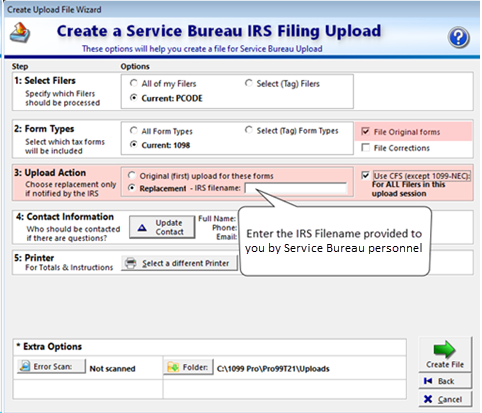

Submit replacement upload:

- At the Service Bureau Upload Session screen, select the "Filing with the IRS Upload" button.

- Select only the form type(s) and Filer(s) from the initial upload.

- At Step 2, select FILE ORIGINAL FORMS.

- At Step 3, select REPLACEMENT and enter the IRS Filename: (Typically starts with ORIG, will be provided by Service Bureau personnel)

- Create and submit upload as usual.

Questions?

Email SB@1099pro.com. Please be patient in the latter half of January while we prioritize Original filings - we will not respond to rejection inquiries until after January 31st & March 15th, respectively. Thank you for your understanding.