Eligible Records

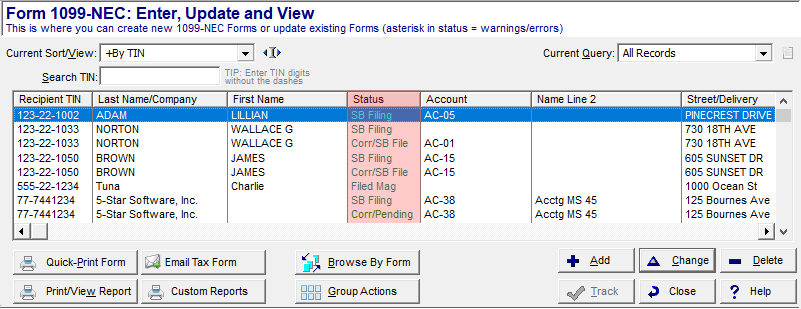

Only filed records are eligible for corrections. View a record's status at the Work With My Tax Forms screen in your software.

- Records with an SB Filing, SB Print+File, or Filed Mag status are eligible to correct. See Correct a Form.

- Records with a Corr/SB File or Corr/Mag status have been corrected and filed. There is a special process to correct an already corrected form, see How to Correct a Corrected Form, below.

- Records with a Pending or Corr/Pending status can be edited simply by selecting the "Change" button.

- Records with an SB Printed or Printed status can also be edited via the "Change" button; but first you will need to reset them to pending status when prompted.

Correct a Form

Most 1099 Pro software corrections must be processed manually, one-by-one, at the Work With My Tax Forms screen (the exception is Corporate Suite). Watch a video tutorial on corrections, click here, or view detailed instructions under Corrections FAQs. Most correction uploads do not require a Service Bureau appointment (the exception is Force Type 1 Corrections, as discussed later).

Correction FAQs

You will need to void the form type issued in error. Then create a new original record in the accurate form type. The Recipient will then have a corrected form and an original form. Both the correction and original form need to be provided to the Recipient and IRS filed. |

To effectively VOID a record you will need to initiate a correction, then zero out any fields containing dollar amounts. Do this by tabbing through the tax form fields in your software. |

To change the TYPE of TIN you must highlight the entire TIN number in your 1099 Pro software, then click "DELETE" on your keyboard. Next, manually enter the TIN with the appropriately placed dashes. - SSN = 000-00-0000

- EIN = 00-0000000

|

Recipient mailing address can be corrected for printing purposes; however, mailing address corrections are ineligible for IRS filing. Records with only corrected CITY, STREET ADDRESS, STATE or ZIP CODE changes are automatically excluded from Corrected IRS files. You may need to file corrected state files separately - contact the state directly for guidance. |

You can only correct Filer data for Pending records in the software. - At the 1099 Pro menu bar → File → Filers List.

- At the Filer Master List screen, select the filer and click "Change".

- Make the filer edits and click "Save".

- The software prompts you to update all pending records with the new filer data. Click "Yes".

If you IRS filed records and later realized your Filer data was inaccurate, you will need to contact the IRS directly. Search "How to report incorrect payer name and/or TIN" in the IRS General Instructions for Certain Information Returns. |

The cost to submit eFile Only corrections is $45 per upload. Standard rates apply for Print uploads. Watch a video tutorial on corrections, click here. - Correct your forms.

- At the 1099 Pro menu bar → IRS → File Electronically via the Service Bureau.

- At the Begin a New Service Bureau Upload Session screen, select the "Filing with the IRS Upload" button.

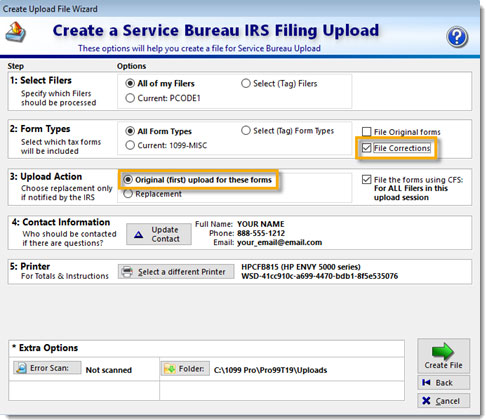

- At the Create a Service Bureau IRS Filing Upload screen:

- In Step 1: Select ALL Filers (if appropriate).

- In Step 2: Select ALL Form Types (if appropriate) and check the "File Corrections" box.

- In Step 3: Select "Original (first) upload for these forms".

- Click "Create File" to continue to the next screen and submit this upload to the Service Bureau.

- After successfully uploading your files, you will receive an automated email from the Service Bureau.

|

This process corrects an already filed, corrected form. Follow this process closely to avoid issues. - Create a duplicate filer. Use the Payer Code (PCode) field to differentiate—and thus isolate—otherwise identical filer data.

- On the menu bar select File → Filers List.

- At the Filer Master List screen click "Add".

- At the Adding a Filer Record screen complete all fields identically to the original filer.

- In the Payer Code (PCode) field enter "CORR" (for corrections).

- In the Location Code field enter "1" or any other value of your selection.

- Click "OK" to save the Filer.

- Under Filer / PCode "CORR", create a NEW record with the identical information as the FIRST corrected return.

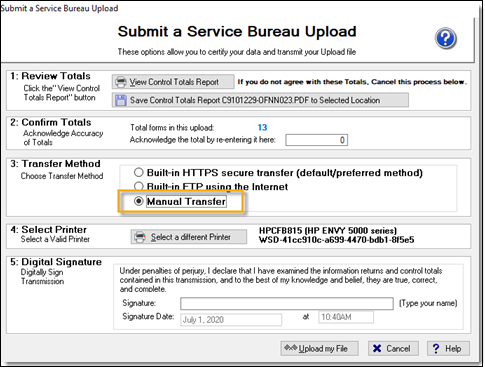

- Update the record status to FILED. Do this by forcing a dummy Service Bureau Filing for it—make sure to select "MANUAL TRANSFER" at Step 3 (see image).

- Paperwork prints out after you click "Upload My File". Discard the paperwork and DO NOT POST the file on the Service Bureau FTP site.

- For Filer / PCode "CORR", go to the Work With My Tax Forms screen and create a correction of the record as you normally would.

- Submit corrections to the Service Bureau, as appropriate.

|

This is a Corporate Suite feature, available for Type 1 corrections only. Contact your Corporate Suite Account Manager for guidance or email CorporateSuite@sovos.com.

|