- In Line 14 "1H" means No Offer of coverage*

- Line 15 would be blank in this case

- Line 16 would be "2A" Employee not employed during the month **

Even though form 1095 has a void box, voiding a 1095 form isn't supported by the IRS. Thus the only way to void a form is to create a correction & remove the Employee Offer and Coverage via codes.

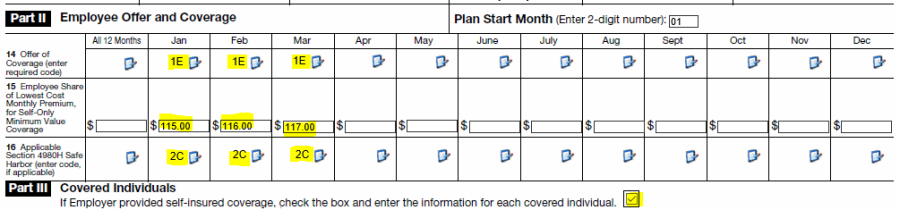

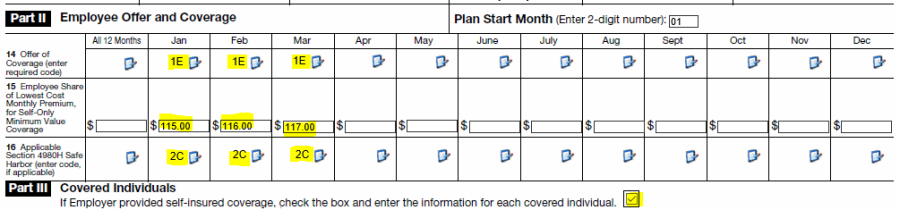

For example suppose you issued a 1095-C a former employee who left the company in 2014:

When finished, go to your Work In Progress and click on the "Transmittal Required" button to fill out a Non-Authoritative Transmittal. When finished with the Transmittal, move all of your forms from WIP into your cart and finish checking out."

*1H - No Offer of coverage (employee not offered any health coverage or employee offered coverage that is not minimum essential coverage, which may include one or more months in which the individual was not an employee).

**2A - Employee not employed during the month. Enter code 2A if the employee was not employed on any day of the calendar month. Do not use code 2A for a month if the individual was an employee of the employer on any day of the calendar month. Do not use code 2A for the month during which an employee terminates employment with the employer.