Sample Excel Import File: 1098 2020.xlsx1098_2line_import_example.xlsx |

|

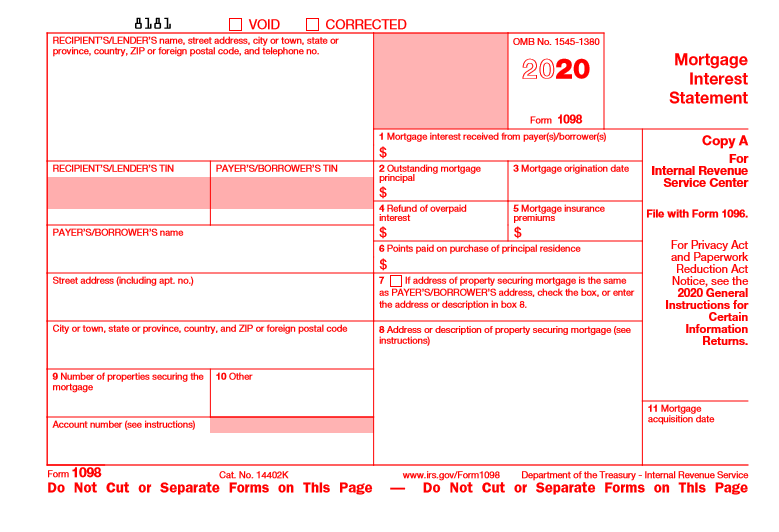

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Box 1 Amount | 12 | Amount | Box 1: Mortgage interest received from payer(s)/borrower(s) | |

Box 2 Amount | 12 | Amount | Box 2: Outstanding mortgage principal | |

Box 3 Date | 10 | Date | Box 3: Mortgage origination date | MM/DD/YYYY or M/D/YYYY |

| Box 4 Amount | 12 | Amount | Box 4: Refund of overpaid interest | |

| Box 5 Amount | 12 | Amount | Box 5: Mortgage insurance premiums | |

| Box 6 Amount | 12 | Amount | Box 6: Points paid on purchase of principal residence | |

| Box 7 Checkbox | 1 | Checkbox | Box 7: Is address of property securing mortgage same as PAYER'S/BORROWER'S address... | X / Y / T / 1 = Checked |

| Box 8 All Lines | 72, 80 for CS | Text | Box 8: Address of property securing mortgage (see instructions) | First 39 characters used for IRS reporting |

| Box 9 Number | 2 | Text | Box 9: Number of properties securing the mortgage | |

| Box 10 All Lines | 60 | Text | Box 10: Other | First 39 characters used for IRS reporting |

| Box 11 Date | 10 | Date | Box 11: Mortgage Acquisition Date | MM/DD/YYYY or M/D/YYYY |

| See Form Common Fields | Form fields common to all form types. | |||