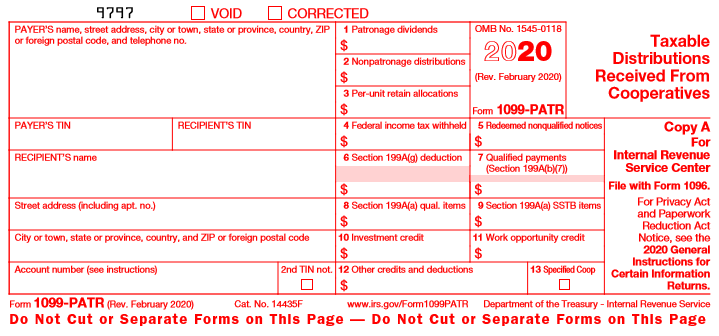

Sample Excel Import File: (Preliminary) 1099-PATR 2020.xlsx |

Please note: See the revised instructions for boxes 2, 5, 6, 7, 8, and 9, later. Extension of certain credits. Certain credits reported in box 12 have been extended. See IRS Instruction for 2020 1099-PATR, Box 12 For Paper Filing - Changed the box calculations for the 2020 1096 form due to the form restructuring. Please visit page 2 of the Form 1096 for more details. |

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| 2nd TIN Notice | 1 | Checkbox | Second TIN Notice | X / Y / T / 1 = Checked |

Box 1 Amount | 12 | Amount | Box 1: Patronage dividends | |

Box 2 Amount | 12 | Amount | Box 2: Nonpatronage distributions | |

Box 3 Amount | 12 | Amount | Box 3: Per-unit retain allocations | |

| Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5 Amount | 12 | Amount | Box 5: Redeemed nonqualified notices | |

| Box 6 Amount | 12 | Amount | Box 6: Section 199A(g) deduction | |

| Box 7 Amount | 12 | Amount | Box 7: Qualified payments (Section 199A(b)(7)) | |

| Box 8 Amount | 12 | Amount | Box 8: Section 199A(a) qual. items | |

| Box 9 Amount | 12 | Amount | Box 9: Section 199A(a) SSTB items | |

| Box 10 Amount | 12 | Amount | Box 10: Investment credit | |

| Box 11 Amount | 12 | Amount | Box 11: Work opportunity credit | |

| Box 12 Amount | 12 | Amount | Box 12: Other credits and deductions | |

| Box 12 Credit Form | 6 | Text | Box 12: Credit form description | 8835, 8844, 8896, 8932, 8941, EPAS, 8864, 6478, 8845 |

| Box 13 Checkbox | 1 | Checkbox | Box 13: Specified Cooperatives | X / Y / T / 1 = Checked; See IRS Insutrctions |

| See Form Common Fields | Form fields common to all form types. | |||

IRS 1099-PATR Form: 1099-PATR 2020 FormIRS 1099-PATR Instructions: 1099-PATR 2020 Instructions |