Welcome to the Service Bureau! By late December you should have a scheduled upload date. If submitting a total of 2,000 or more forms for Print services, you should also have an executed Service Bureau contract and paid your deposit. It is your job to install our software, import your data, then review it for accuracy. On or before your scheduled upload date you will create an upload file—within our software—and transmit it to us electronically. We receive your file, review it for accuracy, and push it for processing. Final invoices are generated after we process your upload.

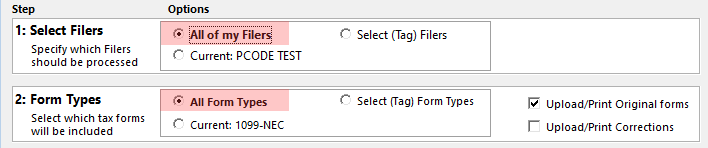

How do I import? Our software includes a user-friendly Import Wizard interface; please see: Where are the sample import files? Download new import files each tax year as the IRS updates them regularly. How do I create & submit my Service Bureau upload? What am I checking on my Control Totals? Review every page of your Control Totals to verify the Filers and Form Types included, the total dollar amounts reported, and the Services selected. Can I submit after my scheduled upload date? - Please upload by your scheduled Upload Date. If you miss your Upload Date, submit as soon as you can. Rush processing is not available.

- View our Filing Timeline and Reporting Deadlines.

Do I have to run the software update? - Yes, the update enables Service Bureau upload functionality! The update is scheduled for released in early January and will be posted on our WIKI.

- Multi-user installations must run the update via their Server (not the individual Workstations). Please make advance arrangements with your internal IT to run the January update (and any other updates) as quickly as it is released.

What happens after I submit my upload? The Service Bureau receives your upload, then your designated Service Bureau contact is emailed through each stage of processing. If there is an issue with your upload, we will contact you directly via email. - Upload Received—This email indicates that the Service Bureau has received your upload file and queued it for review. An upload identifier number is referenced on this and the following emails.

- Upload Approved—This email indicates that the Service Bureau has reviewed your upload file's Control Total reports. Your file has been approved for Print+Mail and/or eFiling, per your upload type.

- Tax Forms Have Been Printed—For Print uploads only, this email serves as confirmation that your forms have been printed. Forms will be mailed the second business day AFTER the date of this email.

- IRS/SSA Upload Accepted—For eFiling uploads only, this email confirms that your upload has been accepted by the IRS/SSA. The IRS/SSA reference number is provided for your records.

- Service Bureau Invoice—This email includes the Service Bureau invoice for this upload (the upload identifier number is referenced in the WO# field). Payment terms are Net Due on Receipt.

If you need help, review our Technical FAQs, Video Tutorials, and Support options. |