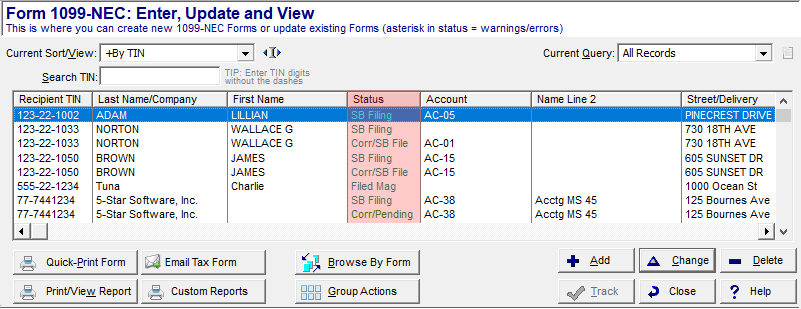

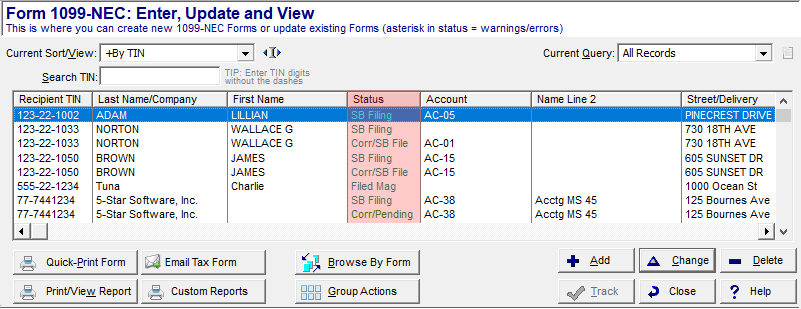

Only filed records are eligible for corrections. View a record's status at the Work With My Tax Forms screen in your software.

Most 1099 Pro software corrections must be processed manually, one-by-one, at the Work With My Tax Forms screen (the exception is Corporate Suite). Watch a video tutorial on corrections, https://www.1099pro.com/videos.asp, or view detailed instructions under Corrections FAQs. Most correction uploads do not require a Service Bureau appointment (the exception is Force Type 1 Corrections, as discussed later).

You will need to void the form type issued in error. Then create a new original record in the accurate form type. The Recipient will then have a corrected form and an original form. Both the correction and original form need to be provided to the Recipient and IRS filed. |

To effectively VOID a record you will need to initiate a correction, then zero out any fields containing dollar amounts. Do this by tabbing through the tax form fields in your software. |

To change the TYPE of TIN you must highlight the entire TIN number, then click "DELETE" on your keyboard. Next, manually enter the TIN with the appropriately placed dashes.

|

Recipient mailing address can be corrected for printing purposes; however, mailing address corrections are ineligible for IRS filing. Records with only corrected CITY, STREET ADDRESS, STATE or ZIP CODE changes are automatically excluded from Corrected IRS files. You may need to file corrected state files separately - contact the state directly for guidance. |

You can only correct Filer data for Pending records in the software.

If you IRS filed records and later realized your Filer data was inaccurate, you will need to contact the IRS directly. Search "How to report incorrect payer name and/or TIN" in the IRS General Instructions for Certain Information Returns. |

The cost to submit eFile Only corrections is $45 per upload. Standard rates apply for Print uploads. Watch a video tutorial on corrections, https://www.1099pro.com/videos.asp

|

This is the same process as for desktop, unless submitting a Prior Year correction. In which case, see Corporate Suite Prior Year eFiles. |

This process corrects an already filed, corrected form. Follow this process closely to avoid issues.

|

This is a Corporate Suite feature, available for Type 1 corrections only. Contact your Corporate Suite Account Manager for guidance or email CorporateSuite@sovos.com. |

The Service Bureau can Force Type 1 Corrections to correct DOLLAR AMOUNTS only (no Name, TIN, Account Number, or wrong form type* corrections). This involves creating a duplicate filer and importing records with good dollar amounts to it, then submitting uploads in a specific format as directed by Service Bureau management. This service is intended for customers with very high volume, dollar amount only corrections. The Service Bureau reserves the right to decline the service. There is a $500 fee for this service in addition to standard Service Bureau rates. For further information on this service, email SB@1099pro.com. Do NOT submit uploads for this service without advance Service Bureau Manager consent. * IMPORTANT - READ ME: The Service Bureau cannot Force Type 1 Corrections to correct a form type filed in error (for example, 1099-MISC forms were erroneously filed instead of 1099-NEC forms). Nor can we Force Type 1 Corrections to issue zero corrections. To resolve either of these issues, email the Service Bureau immediately and we MAY be able to contact the IRS and request the file be marked as BAD. This allows the Filer 60 days from the date of initial IRS submission to submit an Original Replacement file. The Service Bureau does not guarantee that we can get a file marked as BAD. The Service Bureau reserves the right to decline the service. There is a fee for this service. If you filed the wrong form type (or need to issue zero corrections) and cannot get the file marked as BAD:

|