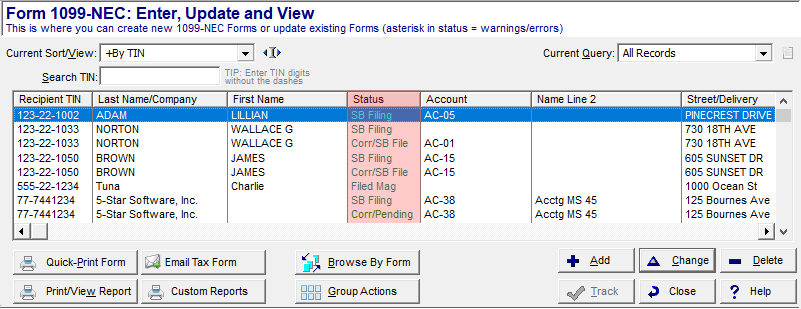

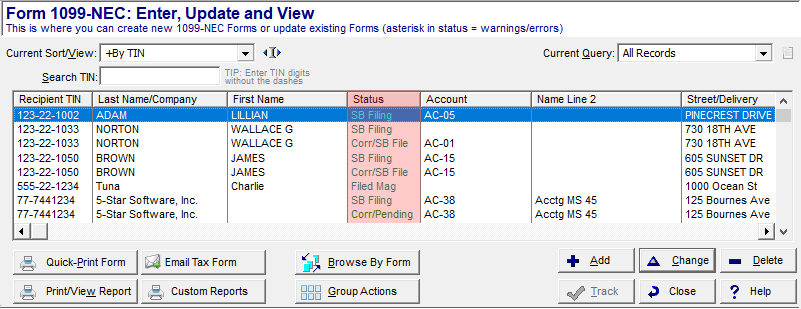

Only filed records are eligible for corrections. View a record's status at the Work With My Tax Forms screen in your software.

Most 1099 Pro software corrections must be processed manually, one-by-one, at the Work With My Tax Forms screen (the exception is Corporate Suite). Watch a video tutorial on corrections, https://www.1099pro.com/videos.asp, or view detailed instructions under Corrections FAQs. Most correction uploads do not require a Service Bureau appointment (the exception is Force Type 1 Corrections, as discussed later).

You will need to void the form type issued in error. Then create a new original record in the accurate form type. The Recipient will then have a corrected form and an original form. Both the correction and original form need to be provided to the Recipient and IRS filed. |

To effectively VOID a record you will need to initiate a correction, then zero out any fields containing dollar amounts. Do this by tabbing through the tax form fields in your software. |

To change the TYPE of TIN you must highlight the entire TIN number in your 1099 Pro software, then click "DELETE" on your keyboard. Next, manually enter the TIN with the appropriately placed dashes.

|

Recipient mailing address can be corrected for printing purposes; however, mailing address corrections are ineligible for IRS filing. Records with only corrected CITY, STREET ADDRESS, STATE or ZIP CODE changes are automatically excluded from Corrected IRS files. You may need to file corrected state files separately - contact the state directly for guidance. |

You can only correct Filer data for Pending records in the software.

If you IRS filed records and later realized your Filer data was inaccurate, you will need to contact the IRS directly. Search "How to report incorrect payer name and/or TIN" in the IRS General Instructions for Certain Information Returns. |

The cost to submit eFile Only corrections is $45 per upload. Standard rates apply for Print uploads. Watch a video tutorial on corrections, https://www.1099pro.com/videos.asp

|

This is the same process as for desktop, unless submitting a Prior Year correction. In which case, see Corporate Suite Prior Year eFiles. |

This process corrects an already filed, corrected form. Follow this process closely to avoid issues.

|

This is a Corporate Suite feature, available for Type 1 corrections only. Contact your Corporate Suite Account Manager for guidance or email CorporateSuite@sovos.com. |