IMPORTANT: You will need a 2018 Authorization Code starting with the letter 'B' BEFORE installing this update!

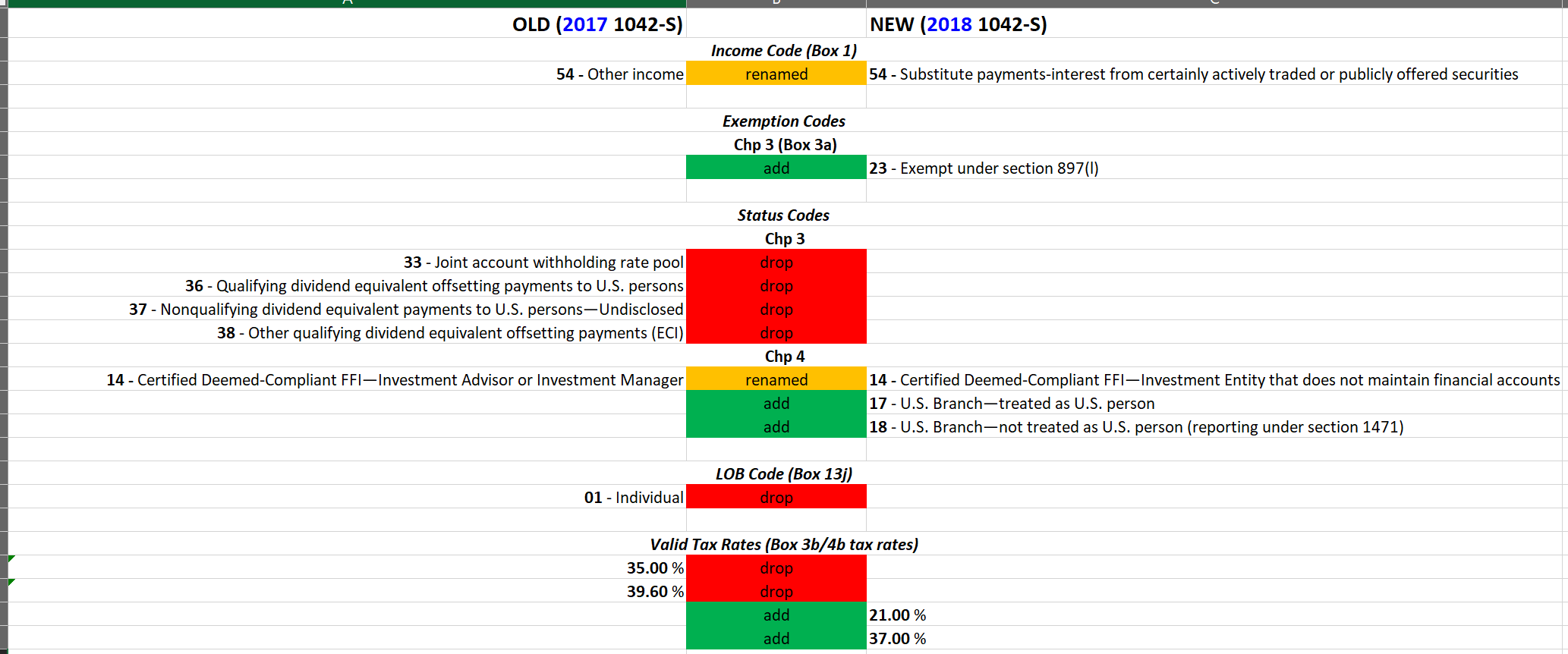

NEW: 2018 Forms are now available

Please select the below links for a complete description of all the IRS form updates.

NEW: All final 2018 IRS PDF's & Instructions included.

NEW: 2018 samples files are included. A complete set can also be found here - 2018 Tax Year - Import Templates and Maps.

NEW: Unfiled Forms summary report. This report breaks down filed vs. unfiled forms for original forms and corrections forms, respectively. It can be found under the "Reports" tab in the upper toolbar.

NEW: Administration preference option added to convert TINs of all zeroes to blanks on import. This option can be found in Security & Administration → Rules & Options → 1099/W-2/1042-S Update Preferences

NEW: Pro Central home screen that provides high level task overview, due dates, and links to help videos or services.

NEW: GPF reporting is turned on to help troubleshoot when software encounters errors during use.

NEW: Filer State ID updates now cascade to all Filer with a matching TIN. Previously, these updates could only cascade to the Payer Code (PCode) that they were applied to.

UPDATED: All reports affected by underlying IRS form type changes (listed above).

UPDATED: 2018 W-2 maxiumums/limits.

UPDATED: Latest GIIN list included.

UPDATED: Visual enhancements to modernize the user interface.

UPDATED: Left-hand toolbar re-organized into categories that simulate the overall filing timeline.

UPDATED: Business rules are updated for the 2018 form changes.

UPDATED: Comprehensive help file is overhauled.

UPDATED: Scheduler, Forms, and Report Manager services updated to log more information.

UPDATED: The electronic filing module has been activated for creating electronic files for submission to the IRS/SSA.

UPDATED: W-2G withholding options updated.

UPDATED: Puerto Rico e-file session tracking simplified. Removed upload result radio buttons as the upload result is immediately known if it is rejected.

UPDATED: Recipient List - report on large volume of recipients was processing slow.

UPDATED: Recipient List - Form Lookup tool speed enhancement.

UPDATED: Recipient List - Cascading recipient updates now displays the total number of forms with 1) Name/Address information updated, and 2) Account Numbers updated.

UPDATED: Recipient List - Recipient email now transfers to the tax form when manually creating a tax form using an existing recipient.

UPDATED: Recipient List - Removed ellipsis icons from 2nd tab of recipient entry window.

FIXED: W-2 state control totals report was printing an extra blank page.

FIXED: Country error code popup when generating a Service Bureau eFile for 1095-B records missing a country code.

FIXED: Length of W-2 G boxes was short than the 1220 specifications.

FIXED: Recipient import was not importing the Recipient Type.

FIXED: Filer import was not importing Canadian address type.

FIXED: Form 3922 extended control totals report was overlapping sum amounts.

FIXED: Filer country code import was not populating correctly.

FIXED: Security reports was reporting incorrect date ranges.

FIXED: Simplified preferences and options menu in Security & Administration.

FIXED: State amount corrections were displaying "Tax State" as the correction type instead of "State Amount".

FIXED: Custom state threshold rules were not able to be edited.

FIXED: Recipient changes were not cascading to eligible forms correctly.

A number of other small fixes and enhancements are also included in this release.