- Loading...

IRS Release Status: FINAL

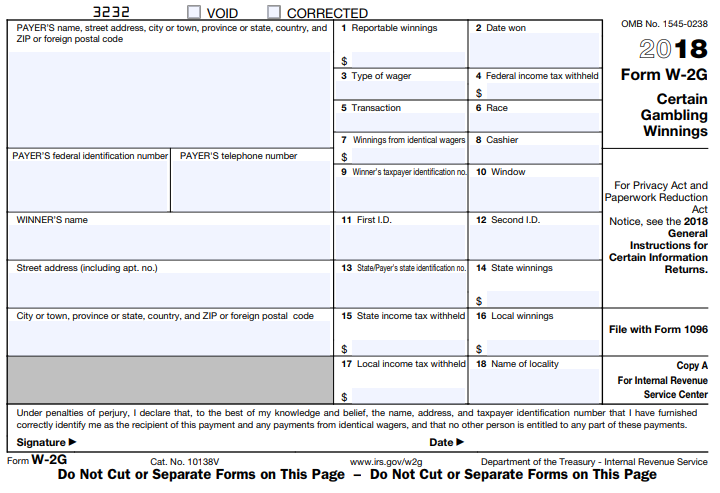

Sample Excel Import File: W-2G 2018.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| Box 1 Amount | 12 | Amount | Box 1: Reportable winnings | |

| Box 2 Date | 8 | Date | Box 2: Date Won | MM/DD/YYYY or M/D/YYYY |

| Box 3 Wager Type | 15 | Text | Box 3: Type of wager | |

| Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5 Transaction | 15 | Text | Box 5: Transaction | |

| Box 6 Race | 5 | Text | Box 6: Race | |

| Box 7 Amount | 12 | Amount | Box 7: Winnings from identical wagers | |

| Box 8 Cashier | 5 | Text | Box 8: Cashier | |

| Box 10 Window | 5 | Text | Box 10: Window | |

| Box 11 1st ID | 15 | Text | Box 11: First I.D. | |

| Box 12 2nd ID | 15 | Text | Box 12: Second I.D. | |

| Box 13 State | 2 | Text | Box 13: State/Payer's state identification no. | Use state abbreviation |

| Box 13 ID Number | 20 | Text | Box 13: State/Payer's state identification no. | Given by State Department of Revenue |

| Box 14 Amount | 12 | Amount | Box 14: State Winnings | |

| Box 15 Amount | 12 | Amount | Box 15: State income tax withheld | |

| Box 16 Amount | 12 | Amount | Box 16: Local Winnings | |

| Box 17 Amount | 12 | Amount | Box 17: Local income tax withheld | |

| Box 18 Locality | 14 | Text | Box 18: Name of locality | |

| Asset Number | 14 | Text | Asset Number | (CS Only) ID Number of Asset that Paid Winnings |

W-2G Form:

IRS W-2G Form: 2018 W-2G Form

IRS W-2G Instructions: 2018 W-2G Instructions

Overview

Content Tools