- Loading...

Common Form 1042-S Filing Errors

The following errors will cause your IRS submission to be rejected by the IRS (per IRS Pub. 1187 specs). Prior to creating an IRS upload, ensure that you are running the most recent version of 1042-S Pro software, see Software Download Site.

Box 13b Error:

All forms must show a Tax Country Code in Box 13b, including those with Recipient mailing addresses in USA.

- Box 13b is located above the Recipient Name and Address field on the tax form entry screen. Box 13b is obscured when the Recipient Name and Address box is expanded (Image 1).

Image 1

- Box 13b is labeled "RCP TAX COUNTRY NAME" in the 1042-S sample import file (Image 2) and titled "Box 13b—Recipient's Country Code" on the physical 1042-S form. Be careful not to confuse the RCP COUNTRY NAME and RCP TAX COUNTRY NAME import fields.

Image 2

- Box 13b cannot be blank.

- Do not use "United States" or "US".

- Include full Country Name (not an abbreviation) in the field “RCP TAX COUNTRY NAME” in your import file. 1042-S Pro converts the country name to the correct country code.

Canadian Address Type Error:

Forms with Recipient Mailing Addresses in CANADA must 1) be flagged as Address Type “C” and 2) include a valid Province Code. Include a “C” in the field “RCP ADDRESS TYPE” and a Province Code in the field “Rcp State US/Canada” in your import file (see Image 2).

Other Address Type Error:

Forms with Recipient Mailing Addresses outside the USA and CANADA must be flagged as Address Type “O” (Other). Include an “O” in the field “RCP ADDRESS TYPE” and the full Country Name (not an abbreviation) in the field “Rcp Country Name” in your import file.

Box 2 Error:

Box 2 Gross Income must show an amount of at least $0.50. If not, the amount automatically rounds down to ZERO prior to E-Filing, causing your entire file to be rejected by the IRS.

Boxes 13f & 13g Error:

Either Boxes 13f and/or 13g must contain a Status Code, as applicable—both boxes cannot be blank. Include a Status Code in one or both of the fields “Rcp Ch3 Status” and “Rcp Ch4 Status” in your import file.

Unique Form ID Number:

Any import record(s) with an invalid or duplicated Unique Form ID Number will be rejected. 1042-S Pro auto-populates this field if this number is missing in your import file.

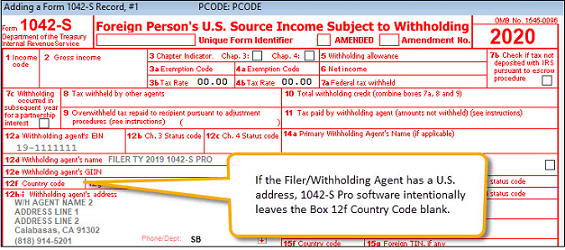

Box 12f Country Code:

Per IRS Pub. 1187 (9/2020), "..filers are now permitted to enter "U.S." as Country Code in positions 258-259 (even though "U.S." is not a code on the list provided at Foreign Country Code List for Modernized e-File.) If the withholding agent has a U.S. address, leave the province code in positions 256-257 blank."

Positions 258-259 reflect Box 12f Country Code data (Image 3). Box 12f codes are populated directly from the Filer (Withholding Agent) record. You cannot modify Box 12f at the Adding or Changing a Form 1042-S record screen. Although "U.S." is allowed in positions 258-259, it is not required and 1042-S Pro software intentionally leaves these positions blank.

Image 3