- Loading...

CP2100, 972CG, W-9's & B Notices Explained

The IRS has exacting requirements for the filing of information returns. Failure to comply with requirements can result in IRS notices, backup withholding requirements and ultimately, significant filer penalties. It is always in a filer's best interest to fully comply with requirements—ideally, prior to filing information returns. This informational document discusses how to address IRS notices, penalties related to noncompliance, and concludes with a TIN Management Checklist.

FILER RESPONSIBILITIES

Filers of information returns must:

- File information returns on time.

- File electronically, when required.

- Report correct recipient name/TIN data.

- Respond to IRS notices in a timely manner.

IRS GUIDANCE & PUBLICATIONS

Filers are expected to fully comply with information return reporting requirements, as outlined in the following IRS/SSA documents:

- General Instructions for Certain Information Returns

- Pub. 1220 Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G

- Pub. 1187 Specifications for Electronic Filing of Form1042-S, Foreign Person's U.S. Source Income Subject to Withholding

- Specifications for Filing Forms W-2 and W-2c Electronically (EFW2/EFW2C)

- Pub. 1281 Backup Withholding for Missing and Incorrect Name/TIN(s)

Noncompliance initially results in CP2100/CP2100A Notices, followed later by Notice 972CG. To avoid significant penalty exposure, filers should anticipate these annual notices and upon receipt, take immediate action.

CP2100/CP2100A NOTICES

When information returns contain invalid, missing, or incomplete recipient name/TIN data, the IRS issues CP2100/CP2100A Notices. These notices inform a filer that they may be responsible for initiating backup withholding. CP2100 Notices are issued to filers with 51 or more recipient name/TIN mismatches; CP2100A Notices are issued to filers with 50 or less. Extensive IRS guidance on these notices is available in IRS Pub. 1281.

Issuance—CP2100/CP2100A Notices are issued six to eight months after the original IRS filing deadline. Filers typically receive them in October of the same calendar year. Reference the TIN Management Checklist for important information on second and third CP2100/CP2100A Notices.

Response—Compare the recipients listed on the CP2100/CP2100A Notice against your records (including on file Forms W-9) to ensure that name/TIN data was correctly reported. Some name/TIN mismatches may be due to spelling errors, formatting issues, and other issues. Review Common Reasons for Name/TIN Mismatches.

If unable to correct invalid name/TIN data in-house:

- Within 15 business days of receipt of the CP2100/CP2100A Notice, issue First B Notices to any recipient with invalid name/TIN data.

- If the recipient responds, keep the completed Form W-9 (included within the B Notice) on file and update the recipient's information. Generate corrections and IRS file, as appropriate.

- Within 30 business days of receipt of the CP2100/CP2100A Notice, begin backup withholding on recipients who have not responded with accurate name/TIN data.

- Forms subject to backup withholding include: 1099-B, 1099-DIV, 1099-INT, 1099-K, 1099-MISC, 1099- NEC, 1099-OID, 1099-PATR and W-2.

For information on second and third CP2100/CP2100A Notices, see the TIN Management Checklist.

Noncompliance—Expect penalty Notice 972CG. Carefully adhering to the above CP2100/CP2100A, Form W-9 and B Notice processes may provide filers creditability in waiving (abating) the penalty.

1099 PRO SOFTWARE TIP #1 |

|---|

| CP2100/2100A Notices are issued only to filers of forms containing federal withholding boxes. These forms include: 1042-S, 1099-B, 1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-MISC, 1099-NEC, 1099-OID, 1099-PATR, 1099-R, and W-2G. Filers of forms not containing federal withholding boxes may receive Notice 972CG (without prior notice) 18 months after the original filing deadline. Did you know? Use Corporate Suite's TIN Management Utility to import or manually enter CP2100/CP2100A Notices. Quickly generate W-9, W-9S, W-8 series and B Notice recipient mailings via the user-friendly wizard. Track recipient responses to information requests and update, escalate, and close, as appropriate. |

NOTICE 972CG, NOTICE OF PROPOSED CIVIL PENALTY

IRS Notice 972CG proposes filer penalties for information returns:

- Filed late,

- Filed on incorrect media (i.e., filed on paper when electronic filing was required), and/or

- Reporting incorrect or missing recipient name/TIN data.

Penalties range from $50 to $560 per return (due dates 1/01/2021 thru 12/31/2021). The maximum penalty for large businesses is $3,392,000 and for small businesses is $1,130,500. Per IRS Pub.1586 Reasonable Cause Regulations & Requirements for Missing and Incorrect Name/TINs,

"There are no maximum penalty limitations for failures that are due to intentional disregard."

Issuance—Notice 972CG is issued approximately 18 months after the original IRS filing deadline. Notices are commonly received in September/October of the subsequent calendar year. Sometimes the individual responsible for filing the original information returns is no longer employed by the filer. Nonetheless, filers are ultimately responsible for the actions (or non-actions) of their employees and typically cannot claim reasonable cause due to employee failure to comply with IRS requirements. Per Pub. 1586, page 3:

"…acting in a responsible manner for missing and incorrect TINs generally includes making an initial solicitation (request) for the payee's name and TIN and, if required, annual solicitations. Mitigating factors or events beyond the filer's control alone are not sufficient to establish reasonable cause. "

Response—Pay the penalty or if you disagree with it, attempt to waive (abate) it. Regardless of how you proceed, respond to the notice within 45 calendar days of its issuance date (60 days if overseas).

- If you fully agree, submit payment of the penalty.

- If you partially disagree, submit the appropriate payment amount. Include a signed statement documenting why part of the penalty should be waived.

- If you fully disagree, submit a signed statement documenting why the proposed penalty in its entirety should be waived. You must be able to clearly demonstrate reasonable cause. For guidance, see Pub. 1586, How to Answer Notice 972CG.

Should the IRS have questions regarding a proposed abatement, they will issue Letter 1948C. If received, reply promptly to avoid automatic IRS denial of the request. If the proposed abatement is accepted, the IRS replies with Letter 1948C. If it is denied, expect Letter 854C and a balance due notice.

Noncompliance—Filers who do not respond to Notice 972CG in a timely manner, and remit required payment, should expect to receive Notice of Penalty Charge CP15/CP215. This notice consists of a bill for the proposed penalty amount with additional, accrued interest fees until payment in full is received.

1099 PRO SOFTWARE TIP #2 |

|---|

| Did you know? Corporate Suite's TIN Management Utility also imports 972CG Notices and Bulk TIN Match results. Quickly generate W-9, W-9S, W-8 series and B Notice recipient mailings via the user-friendly wizard. The Information Request Summary Report documents all attempts to obtain accurate recipient data—a useful tool in demonstrating that a filer has exercised its due diligence! |

NAME CONTROL OVERVIEW

Reporting accurate recipient name/TIN data requires a basic understanding of the IRS name control process. Per Pub. 1586, page 13:

"All information returns filed must include a correct name/TIN combination to allow for the matching of the information reported against the income included on the payee's income tax return. A verification check is performed to determine whether a name/TIN combination is correct by matching it against a file containing all SSNs issued by SSA and against a file containing all EINs and other TINs issued by IRS... If a match can be made, it is considered correct. If a match is not found, the name/TIN combination is considered incorrect."

Review Pub. 1586, Section IX. IRS Matching Process and Name Controls, for guidance on reporting individuals, sole proprietors, partnerships and single-member LLCs, corporations, estates, trusts, and fiduciaries, and other organizations.

Reporting Accurate Data

Filers are responsible for reporting accurate recipient name/TIN data in the appropriate fields. The formatting of a recipient TIN (i.e., EIN = 99-9999999 vs. SSN = 999-99-9999) is directly tied to name control. If all nine digits of a TIN are correct, but the formatting is incorrect, the recipient record fails name control and generates a name/TIN mismatch.

If concerned that your TINs are inaccurately formatted, 1099 Pro software allows unformatted TINs (e.g., 999999999) which may increase the likelihood that the recipient name/TIN combination will pass name control. However, when removing TIN formatting, other issues may result later when importing filed recipient name/TIN data into external applications.

1099 PRO SOFTWARE TIP #3 |

|---|

| Did you know? Name control fields are governed by IRS Pub. 1586. Accordingly, 1099 Pro intentionally leaves the Name Control field blank, in electronic files, so that the IRS develops its own name control—thus providing filers the highest likelihood of recipient name/TIN matches! |

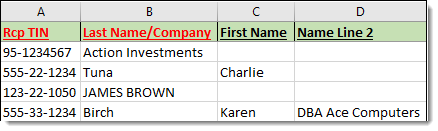

1099 PRO SOFTWARE - PROPER DATA FORMATTING

Sample Import File Examples

1099 Pro sample import files illustrate how to populate fields for name control success (Image 1). For example:

- Action Investments is a corporation with an EIN.

- Charlie Tuna and James Brown are individuals with SSNs.

- Karen Birch is a sole proprietor with an SSN.

Image 1

1099 Pro Software Examples

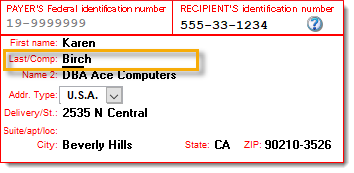

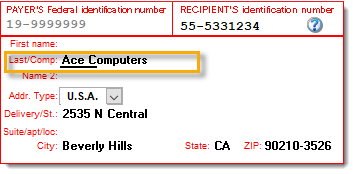

The below screenshots highlight the importance of correctly entering recipient name/TIN data.

Image 2 | Image 3 | |

Record issued to an individual with an SSN, acting as a sole proprietor. Name control is "BIRC". If the DBA had been incorrectly entered in the Last Name/Company field, this record would fail name control. | Record issued to a corporation with an EIN. Name control is "ACEC". If the recipient's EIN had been incorrectly formatted as an SSN, this record would fail name control. |

1099 PRO SOFTWARE TIP #4 |

|---|

| Did you know? 1099 Pro is serious about personally identifiable information (PII) security. 1099 Pro software offers optional recipient TIN masking on Forms 1042-S/1095/1098/1099/3921/5498/W-2G & W-2! |

COMMON REASONS FOR NAME/TIN MISMATCHES

There are many reasons a record might generate a name/TIN mismatch. 1099 Pro does not provide accounting or legal advice. It is the filer's responsibility to report accurate data.

Error | Description | Action |

Misspelled name | Recipient's name is misspelled or incorrect name is entered. | Reference recipient's on file Form W-9 and reissue, as necessary. |

Transposed TIN digits | Data entry or data manipulation error. | Reference recipient's on file Form W-9 and reissue, as necessary. |

TIN Incorrectly formatted | Individual with an SSN formatted as an EIN or corporation with EIN formatted as an SSN. See Image 3. | Review IRS Name Control. Reference recipient's on file Form W-9 and reissue, as necessary. |

Legal name change | Recipient has married or divorced and did not notify filer of legal name change. | Reissue Form W-9, as necessary. |

Sole proprietors | DBA is incorrectly entered in Last Name/Company field in software. See Image 2. | Enter DBA in Name Line 2 field, not Last Name/Company field. |

Upon receipt of updated recipient name/TIN data, generate and file corrections.

1099 PRO SOFTWARE TIP #5 | |

|---|---|

Did you know? Corporate Suite's TIN Management Utility not only generates W-9s and B Notices, it also associates documents with recipients. All information requests generated within Corporate Suite software include a unique barcode. Upon receipt of a completed W-9 or B Notice, scan the document(s) into a PDF file and then upload it into the Corporate Suite database. Corporate Suite intuitively matches the barcode on each page in the PDF file to the corresponding Information Request issued by the software . Pages without a barcode, such as a letter following a W-9, are assumed to be associated with the previous barcode and are inserted into the database, too. Corporate Suite and 1099 Pro software include a TIN Management Utility. Use to generate Forms W-9, 1st and 2nd B Notices, track recipient responses and more. Corporate Suite Form W-9s feature a scannable barcode. |

TIN MANAGEMENT CHECKLIST

Task | Timeline | Process | Done |

Validate TINs | Ongoing | Front End TIN Validations—Verify name/TIN data when onboarding new recipients via TINCheck.com. | |

Validate TINs | December | Back End TIN Validations—Verify name/TIN data at year's end via 1099 Pro's Bulk TIN Matching Service. | |

Name/TIN Mismatch Alert Email | April | Service Bureau customers receive courtesy notification of the number of name/ TIN mismatches in their upload file(s). Customers should:

| |

CP2100/ CP2100A | October | IRS issued notification for current tax year name/TIN mismatches. Customers who have previously resolved name/TIN mismatches and filed corrections may disregard the notice. Otherwise, act immediately to resolve the name/TIN mismatches.

* B Notices must list the reply by date, account number and BWH rate. Include a reply envelope or provide return address information. Must mail B Notices in envelopes marked "IMPORTANT TAX DOCUMENTS ENCLOSED". | |

Notice 972CG | October | IRS issued penalty for prior tax year name/TIN mismatches. Upon receipt of a 972CG Notice, filers must make an annual W-9 solicitation for any accounts (recipients) with missing or incorrect TINs. Make the solicitation by December 31 unless the notice was received in December—in which case, make the solicitation by January 31.

| |

TIN Planning | ASAP | Coordinate with Accounts Payable to implement front end TIN validations for future recipients. |

1099 PRO IS NOT AUTHORIZED, OR QUALIFIED, TO GIVE TAX ADVICE. THIS INFORMATION MAY NOT BE ACCURATE, MAY BE OUT OF DATE, IS MEANT TO BE USED FOR RESEARCH PURPOSES ONLY, AND SHOULD BE INDEPENDENTLY VERIFIED BY A CPA, TAX ATTORNEY, OR OTHER QUALIFIED PERSONNEL.