- Loading...

Overview

Bulk TIN Match rates are posted online at https://desktop.1099pro.com/serv_TIN_Matching.asp.

- Cost is per upload (may include up to 100k recipient Name/TINs).

- No appointment required for Bulk TIN Match uploads.

- Customers must purchase and use the current tax year software to submit for this service.

- During September - December, the Service Bureau accepts bulk TIN match uploads from both TY 2024 and 2025 software products.

- All uploads must be submitted via the software's built-in Bulk TIN Match Wizard.

- The Service Bureau cannot process flat files such as XLS, .TXT, .CSV, etc.

Submitting Your Data

Watch our video tutorial below on how to upload the Bulk Tin Matching file "Via the Service Bureau".

Workaround Method

For customers who submit multiple bulk TIN match files, and/or use our software exclusively for bulk TIN match services, see:

- How to Easily Submit Multiple Bulk TIN Files - Bulk TIN Match Upload Wizard - Workaround (December 2022).pdf

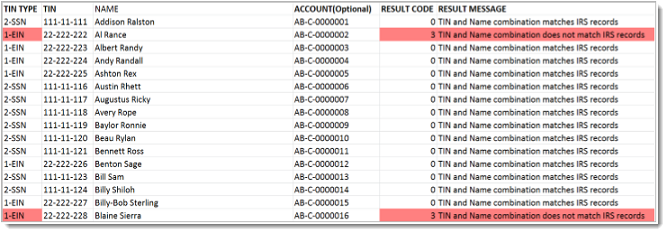

Bulk TIN Match Results

Bulk TIN results are returned via email, with a ZIP attachment, within 1-2 business days. If you cannot receive ZIP files via email, we can post results on our secure FTP site. Email SB@1099pro.com for help.

FAQs

______________________________________________

If you require further information, please visit our revised website:

https://desktop.1099pro.com/ or email us directly at sb@1099pro.com.

Overview

Content Tools