- Loading...

Can you tell me more about what to do for any states that are unsupported?

- Yes! Please see Service Bureau - 1099-NEC Reporting Details for which states are supported by the Service Bureau.

- You can research these states to file via paper or can purchase the Enterprise software to create the state electronic file that can then be submitted under an account that you make at that state.

How is the Tax State determined in the software?

- The Tax State is set on each 1099-NEC. It is not based on the Filer tax state.

- The Tax State can be set on each individual record via import or manual entry.

- The Tax State is determined based on the below logic.

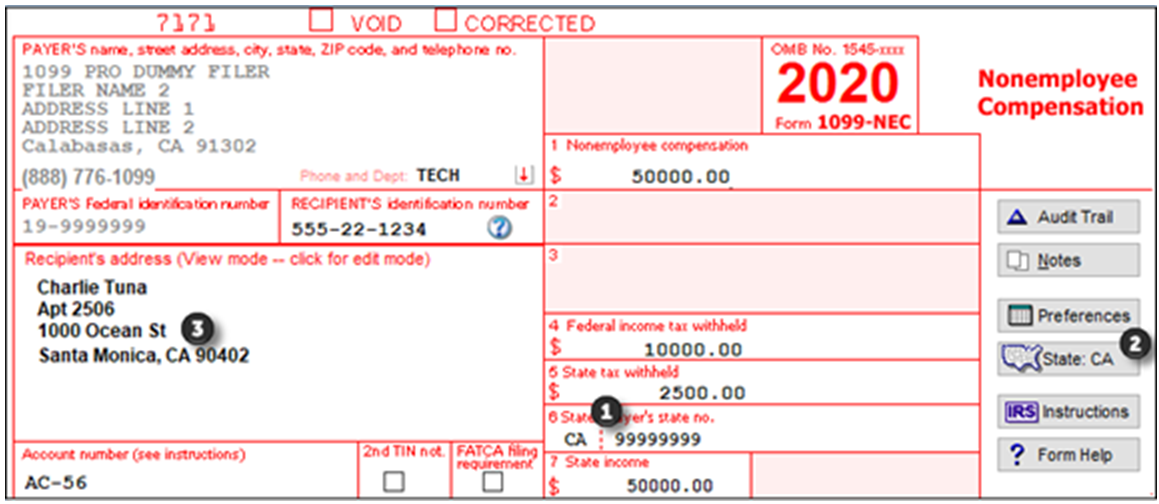

- Explicit State Withholding Boxes (1)

- If the state withholding box is completed on a tax form, for a specific tax state, then that state is the "tax state" regardless of the Tax State Override (#2) or the Recipient Address (#3) below. Forms with explicit state withholding boxes include: 1099-B, 1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-MISC, 1099-NEC, 1099-OID, 1099-R, W-2G, 1042-S and W-2.

- Generally, you are required to have a State ID Number / State Withholding Account Number when utilizing the Explicit Tax State box.

- Note: If you do not have a State ID Number / State Withholding Account Number for a state, it is best to leave the explicit tax state box blank and import/enter your tax state in the 2nd option below.

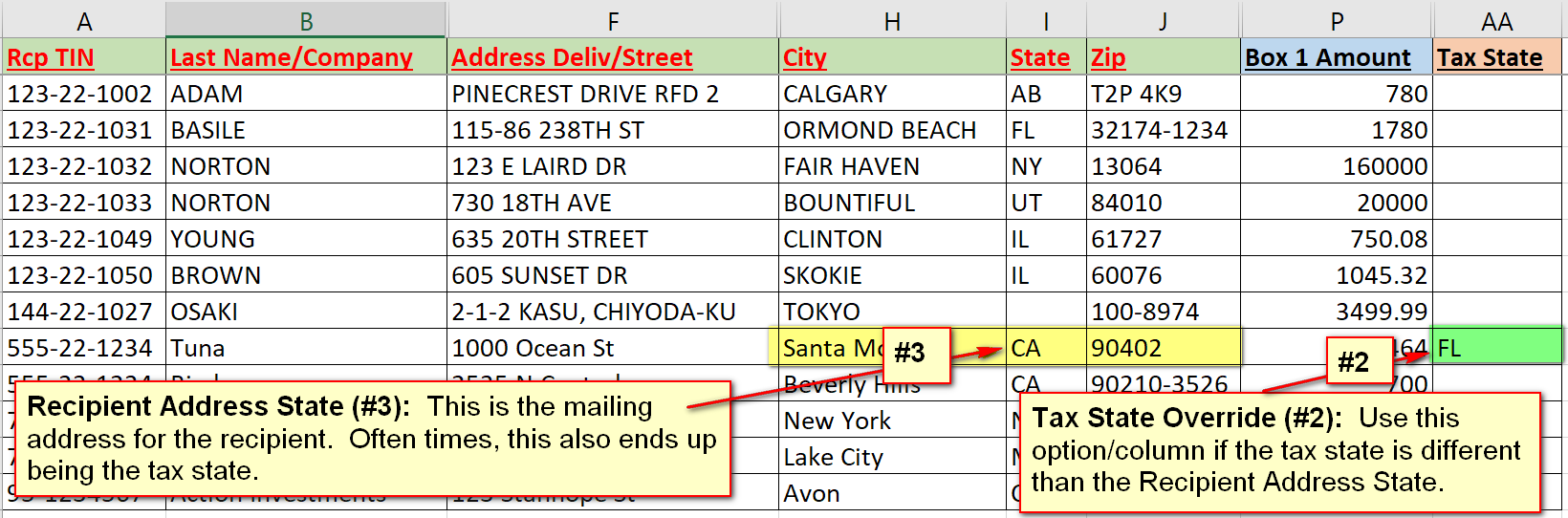

- Tax State Override (2)

- If you use the optional "Override default for State tax reporting" button, located on the right hand pane of the form entry window, the selected state overrides the recipient's state in their address.

- Please see the diagrams below for more information on how to use this field.

- Recipient Address (3)

- If there is no state withholding and a different state is not selected in the "Tax State Override" box as discussed above, then the state in the recipient address is used.

- Diagram / Display Notes:

- Explicit State Withholding Boxes (1)

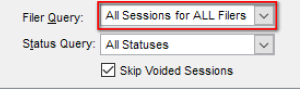

How do I know which 1099-NEC records were reported to the state(s) by the Service Bureau?

- Please navigate to the 'Service Bureau Upload Session Log" screen (shown below). Then look under the "Upload Task" column and you will see any state filing sessions.

- Note: If you have multiple filers, please make sure you have "All Sessions for ALL filers" selected in the filer query in the upper right. By default, the display is only for the sessions related to your current filer.

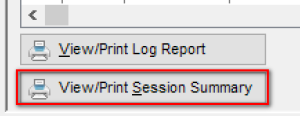

- Next, select "View/Print Session Summary" near the bottom left of the screen

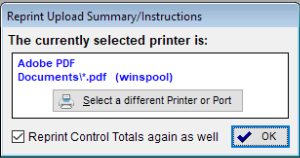

- A popup will appear to select a printer (we recommend saving to a PDF printer)

- Also, select the checkbox to "Reprint Control Totals again as well". This will give you a state by state summary breakdown of the dollar amounts.

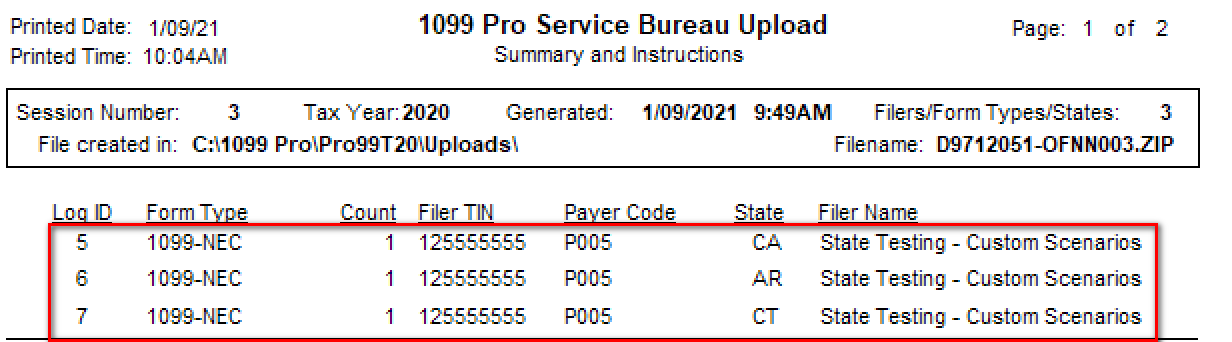

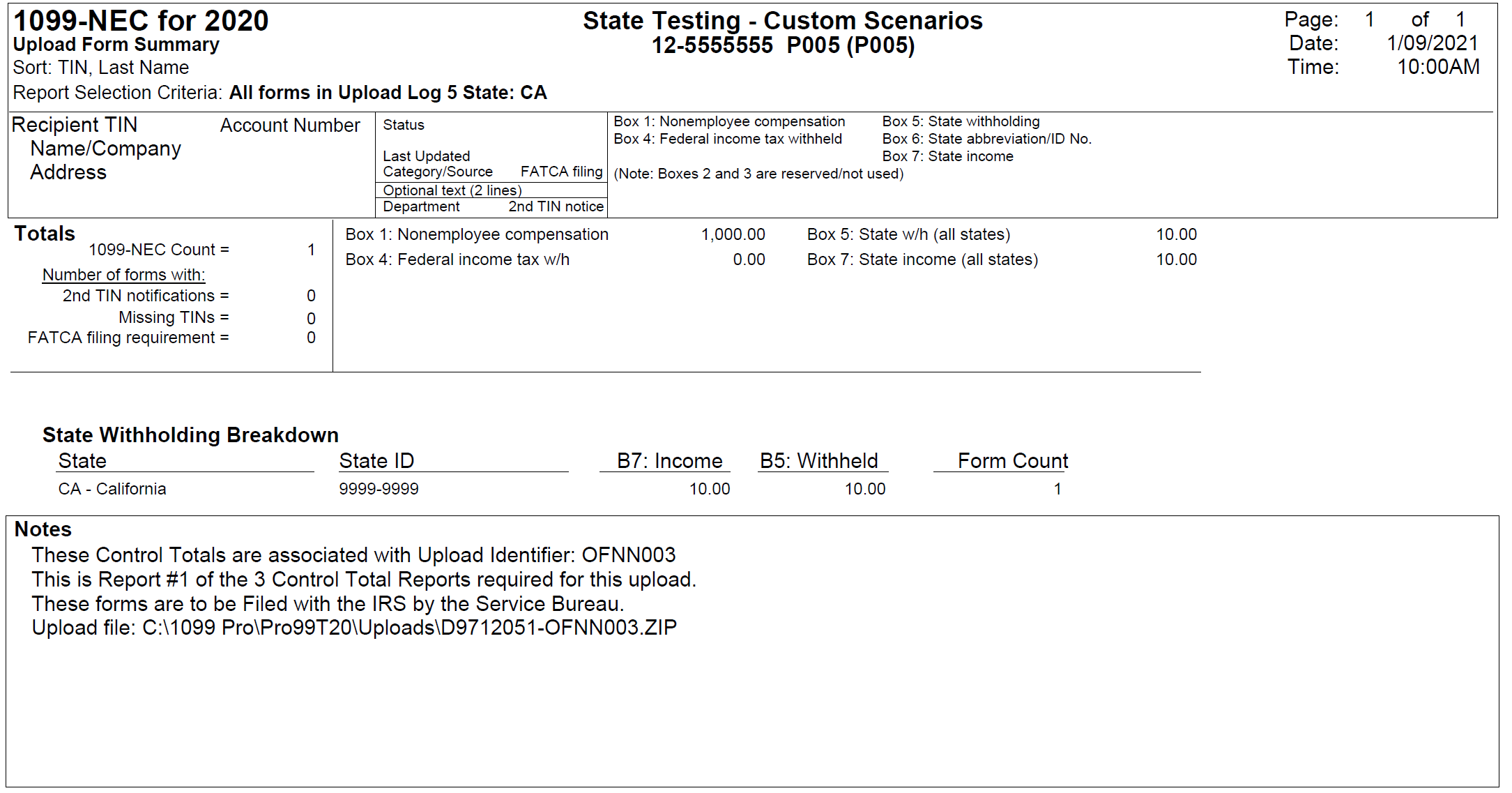

- Sample Session Summary Report

- Sample Control Totals Report

Transmitter Control Code (TCC) questions for creating state electronic files with the Enterprise software.

- What is the Transmitter Control Code (TCC)?

- The Transmitter Control Code (TCC) is an IRS issued code that is used by the IRS FIRE system to validate the transmitting entity.

- Additionally, the TCC, and related information is entered into the Enterprise software and is utilized when creating electronic files.

- Do I need a TCC to create a state electronic file with the Enterprise software?

- Yes. The software will require that your TCC information is entered before you can create an electronic file.

- The states require this TCC info to be present, for the general file structure, but they do not validate against it or have access to the IRS database for verifying if it is valid.

- What do I do if I do not have a TCC but need to make the state electronic files with Enterprise?

- Please enter a fake TCC code, i.e "XXXXX", along with your company's real contact information.

- The states do not care about the validity of the TCC (as it is an IRS / Federal code) but they do care about the other related contact information.

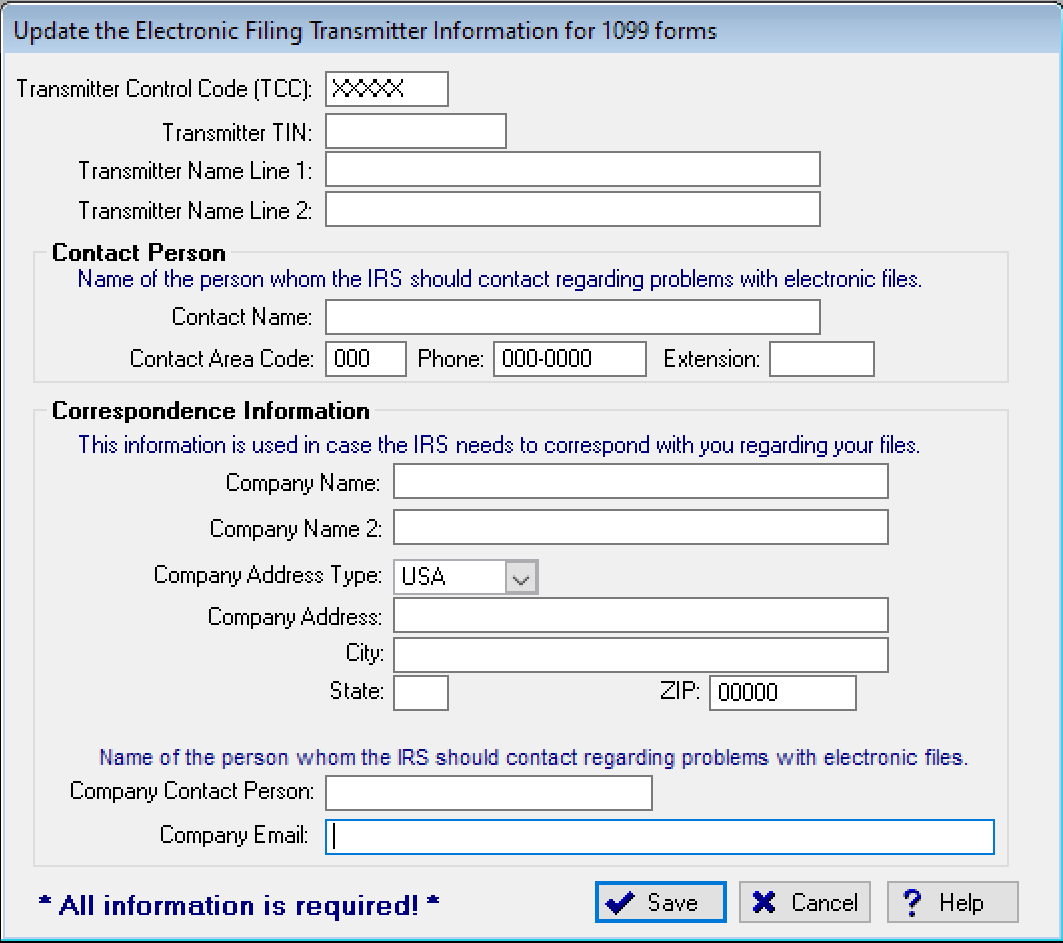

- How do I enter the TCC in the Enterprise software?

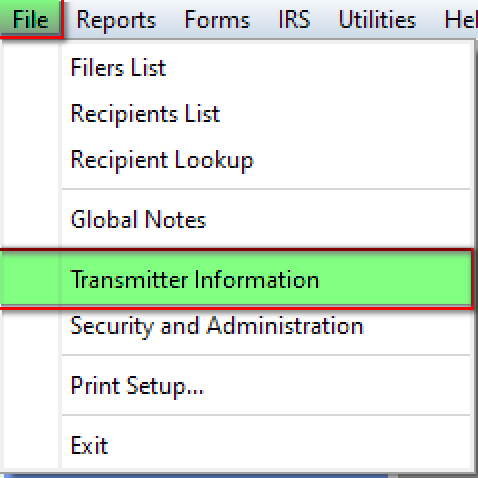

- Click on "File" in the upper left → Transmitter Information

- Complete the transmitter information & save. Use "XXXXX" for the Transmitter Control Code (TCC) itself.

- Click on "File" in the upper left → Transmitter Information

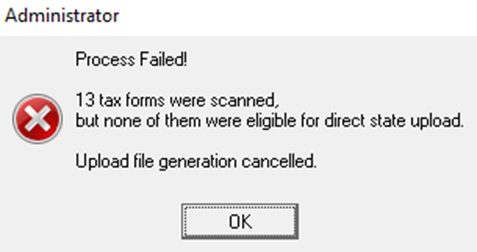

What does this "Process Failed!" message mean?

This "Process Failed!" message is indicating that during the scanned process, none of the forms were eligible per the state requirements.

Please Note: This message will appear if you have already selected state filing when you processed your original file.

Where do I send the Reconciliation Forms that I have to complete?

- Please send the reconciliation forms directly to each state! Do not send them to 1099 pro.

- Many times, the reconciliation form will have the mailing address on the form or we will have posted it on our information page.

- If there is no address provided, please contact the state to ask where to send the form.

Does 1099 Pro plan to support state corrections via the Service Bureau?

- No. Each state has extremely vague requirements surrounding how to process corrections, and limitations that prevent automation, and thus 1099 Pro cannot support them.

- 1099 Pro has provided some basic research on how states would like corrections to be handled. Please contact each state individually before proceeding with any course of action.

- Corrections Guidance - General - Corrections Reporting

- Generally, states require you to call in and talk to an individual who will provide guidance on how to proceed. Such guidance may be that the state will fix it for you, that the correction should be submitted on paper, that the correction should be submitted electronically in a specific format, that the entire file must be re-submitted, that a reconciliation form must be filed with the correction, the list goes on...

Overview

Content Tools