- Loading...

Release Notes

IMPORTANT: You will need a 2021 Authorization Code starting with the letter 'E' BEFORE installing this update!

NOTE: SOFTWARE MUST BE AT LEAST ON v2020.20.16 TO APPLY THIS UPDATE.

Important

- Tax Year 2021 is locked off for Electronic Filing and Service Bureau Uploads.

NEW:

- All 2021 tax forms and instructions have been updated with IRS changes.

- All business rules and custom queries have been updated for 2021 form fields.

- All 2021 sample import files and Excel data shells have been added.

- All reports have been updated for 2021 tax form changes.

- All help files have been updated for 2021.

- Paper Filing - Enabled for 1099 & W-2 forms.

- 2021 Reprint Scheduler and templates v2021.12.15.

FORM CHANGES:

- Form 1099-DIV:

- New Box 2e (Section 897 ordinary dividends)

- New Box 2f (Section 897 capital gain)

- Form 1099-MISC:

- Form Title is now Miscellaneous Income

- New Box 11 (Fish purchased for resale)

- Form 1099-NEC:

- New Box 2 Checkbox (Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale)

- Removed FATCA Checkbox

- Form resized so now it can fit up to 3 per page

- Form 1099-PATR:

- Expiration of certain credits reported in Box 12

- The Indian Employment Credit

- Second Generation Biofuel Producer credits

- The Production Credit for Indian Coal Facilities

- Expiration of certain credits reported in Box 12

- Form W-2G:

- 2020 Box 11 First I.D. → 2021 Box 11 First identification

- 2020 Box 12 Second I.D. → 2021 Box 12 Second identification

- Form W-2:

- The Social Security Wage Base is $142,800 for Tax Year 2021

- Social Security tax withheld amount should not exceed $8,853.60 ($142,800 × 6.2%).

- The Tax Year 2021 Social Security and Medicare coverage threshold for Household wages is now $2,300 ($100 increase from 2020).

- Penalties increased - The higher penalty amounts apply to returns required to be filed after December 31,2021.

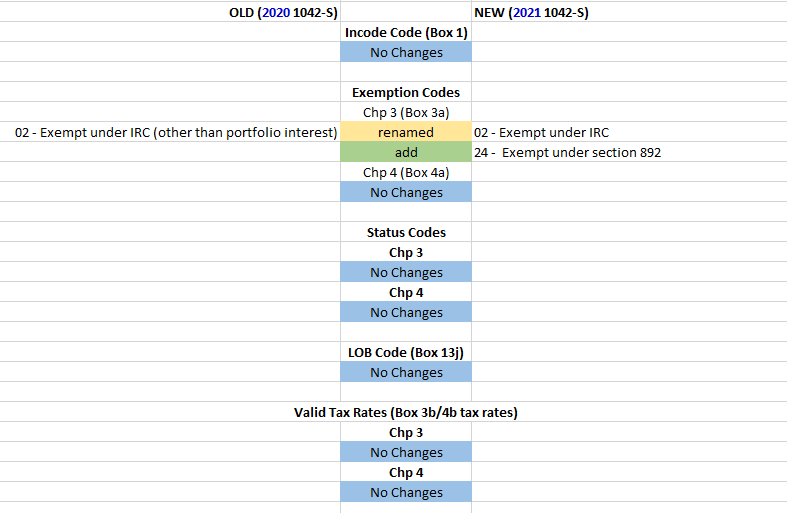

- Form 1042-S:

- Chapter 3 Exemption

- 2020 Code: 02 Exempt under IRC (other than portfolio interest) → 2021 Code: 02 “Exempt under IRC”

- New Chapter 3 Exemption Code: 24 Exempt under section 892

- Chapter 3 Exemption

IMPORTANT: Please review the following 2021 1042-S code changes and make any required changes to your data or imports.

UPDATED:

- Federal Thresholds - Updated per IRS form changes.

- State Thresholds - Updated per Tax Year 2021 state issued reporting requirements.

- General

- Pro Central - Updated tax reporting deadlines and penalty amounts.

- Latest Help file.

FIXED:

Coming Soon

- 2021 eFileViewer

- 2021 Web Presentment API

Overview

Content Tools