- Loading...

New Service Bureau Processing Guidelines: Effective September 2022

Because Corporate Suite software was not designed to report prior year* filings via the Service Bureau, users must enter our transmitter information, create an electronic file, manually post the file on our secure FTP site, and then notify the Service Bureau. The Service Bureau downloads this file from our FTP site and processes it. Standard Service Bureau rates apply.

* Includes all Prior Year Original, Correction, and Replacement records.

Step 1—Enter Service Bureau TCC

- On the Corporate Suite menu bar -> File -> Electronic Filing Transmitter.

- Select the type of transmitter.

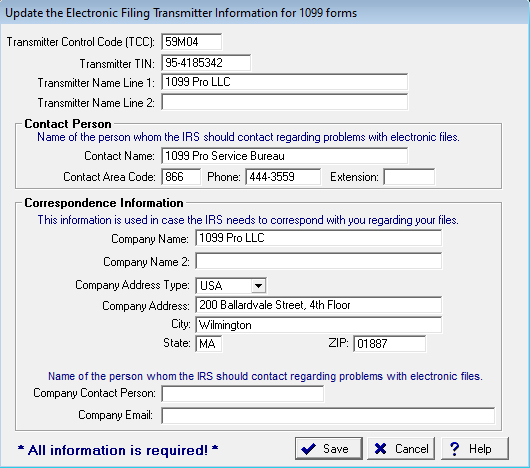

- Update the Electronic Filing Transmitter Information screen:

- Transmitter Control Code (TCC)

- Enter 59M04 only for 1099/1098/5498 series form types

- Enter 22CW0 for 1042-S forms

- Transmitter TIN: 95-4185342 (the dash is required)

- Transmitter Name: 1099 Pro LLC

- Contact Name: 1099 Pro Service Bureau

- Contact Phone: 866-444-3559

- Company (TCC Owners) Address: 200 Ballardvale Street, 4th Floor, Wilmington, MA 01887

- Click "Save".

Step 2—Create Electronic File

- On the Corporate Suite menu bar -> Filing -> Create IRS and State Electronic Files.

- Select the form type to process.

- At the Begin a New eFile Generation Screen, click “Create an IRS FIRE or AIR eFile” button.

- In the Create Electronic File Wizard, select appropriate options.

- For guidance, search “1099 Electronic Filing Wizard” in the Corporate Suite help file.

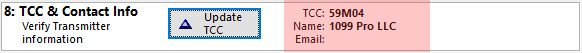

- At “Step 8: TCC & Contact Info”, verify that the correct TCC, name, and email are selected.

- Select “Create File” to generate prior year eFile.

Step 3—Manually Upload File

This process requires you to manually upload your electronic file to our SOC I Type II Service Bureau via FTP.

- In your web browser go to https://uploads.1099pro.com/.

- Login ID: 1099upload

- Password: 2004

- After Login, click the “Upload” button and browse for your electronic file. In a standard installation, this file is located at C:\1099 Pro\Pro99CS\MagFiles and is suffixed with ".IRS" or ".TXT" or ".XML" (depending on the file type).

Overview

Content Tools