- Loading...

- Created by Laura Rothman, last modified on Oct 28, 2022

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 38 Next »

Service Bureau Rates & Fees

Most Service Bureau rates are posted at https://www.1099pro.com/servPricing.asp. Also see Service Bureau - 1099-NEC State Reporting Pricing.

We generally do not issue Service Bureau quotes. This is because there are many variables that can affect your final price, including services selected, number of forms, number of filers, and the number of uploads. Obtain a self quote at https://www.1099pro.com/servPricing.asp.

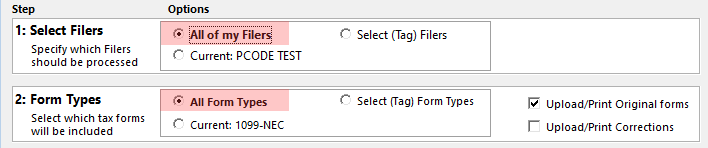

When possible, submit "All of my Filers" and "All Form Types" in a single upload. There are minimum fees for all uploads, so submitting less uploads saves you money. Additionally, large volume uploads may automatically qualify for discounted rates!

In the Service Bureau Upload Wizard, make below selections to select all eligible forms in a single upload. You are responsible for thoroughly reviewing your Control Totals prior to submitting uploads to the Service Bureau.

Standard services minimum upload fees:

- Full Service (Print/Mail/eFile) = $85 min

- Print & Mail Only = $85 min

- eFile Only - Original Forms (first upload of the season) = $85 min

- eFile Only - Original Forms (subsequent uploads) = $45 min

- eFile Only - Corrected Forms = $45 flat

- NEC State Reporting = Service Bureau - 1099-NEC State Reporting Pricing

Full Service and eFile Only uploads may also incur Filer fees. Rates are subject to change.

- Full Service Customers

- The base rate to Print/Mail/eFile a form is $1.50 each. If this type of upload contains 56 or less forms, you would be billed the $85 minimum fee (i.e., 56 x 1.50 = 84.00).

- Print & Mail Only Customers

- The base rate to Print & Mail Only a form is $1.24 each. If this type of upload contains 68 or less forms, you would be billed the $85 minimum fee (i.e., 68 x 1.24 = 84.32).

- eFile Only Customers - Original Forms (first upload of the season per software authorization code)

- The base rate to eFile Only a form is $0.25 each. If this type of upload contains 339 or less forms, you would be billed the $85 minimum fee (i.e., 339 x .25 = 84.75).

- eFile Only Customers - Original Forms (subsequent uploads per software authorization code)

- The base rate to eFile Only a form - after submitting your initial eFile Only upload of the tax year - is $0.25 each. If this type of upload contains 179 or less forms, you would be billed the $45 minimum fee (i.e., 179 x .25 = 44.75).

- eFile Only Customers - Corrected Forms

- Flat fee per upload, regardless of number of Filers, is $45.

In addition to the minimum fee, you may also incur Filer fees.

A Filer is the company, entity, or individual issuing a tax form to a recipient.

- Full Service (Print/Mail/eFile) uploads are allowed 1 complimentary Filer. Each additional Filer is billed at $5 each. There is a $500 Filer Surcharge cap per upload.

- eFile Only - Original Forms - uploads are allowed 1 complimentary Filer. Each additional Filer is billed at $5 each. There is a $500 Filer Surcharge cap per upload.

- NEC State Reporting uploads are allowed 1 complimentary Filer. Each additional Filer is billed at $5 each. There is no Filer Surcharge cap for this service type.

- Print & Mail Only uploads have no Filer fees.

- eFile Only - Corrected Forms - have no Filer fees.

Scheduling Requests

Pending release late November 2022.

You are responsible for submitting your data via an Upload File by your scheduled Upload Date. You do not need to call us on your Upload Date! See Submitting Your Upload, below, for guidance in this process.

Rush processing is not available. Customers interested in guaranteed January 31st mail &/or eFile services must submit a good Upload File by their scheduled Upload Date. Rush processing was offered in prior years. In order to guarantee turnaround AND provide a high level of service to customers who do upload on time, we have discontinued the offering.

You may be able to request an IRS filing extension. The IRS/SSA do not offer filing extensions for 1099-NEC or W-2. Extensions to mail most Recipient copies are not available.

If you are unable to submit by your scheduled Upload Date, you should upload as soon as possible. There is no need to notify the Service Bureau to inform us that your Upload will be late. The Service Bureau will make a good faith effort to process all Upload Files received after their Upload Date as quickly as possible.

Contracts & Deposits

- Print Services: If submitting a combined total of 2,000 or more forms for Print services, an executed contract and paid deposit are required to perform services. Email SB@1099pro.com to initiate this process.

- eFile Only Services: No contract requirement.

Submitting Your Upload

- Purchase TY 2022 software.

- Submit your Service Bureau Scheduling Request.

- If submitting 2,000 or more forms for Print services, an executed contract and paid deposit are required to perform services. Contact SB@1099pro.com to initiate this process ASAP!

- Calendar your Upload Window.

- Import your data into our software.

- Run the required January software update.

- Within your software, create your Service Bureau Upload File.

- Carefully review Control Totals.

- Submit your Service Bureau Upload File.

- Receive Service Bureau emails as your data is received/processed/accepted.

- Pay invoice promptly upon receipt.

Welcome to the Service Bureau! By late December you should have a scheduled upload date. If submitting a total of 2,000 or more forms for Print services, you should also have an executed Service Bureau contract and paid your deposit. It is your job to install our software, import your data, then review it for accuracy. On or before your scheduled upload date you will create an upload file—within our software—and transmit it to us electronically. We receive your file, review it for accuracy, and push it for processing. Final invoices are generated after we process your upload.

How do I import? Our software includes a user-friendly Import Wizard interface; please see:

- How to Import Using Standard Maps (aka Sample Import Files) video - https://www.1099pro.com/videos.asp

Where are the sample import files? Download new import files each tax year as the IRS updates them regularly.

How do I create & submit my Service Bureau upload?

- How to Print & Mail via the Service Bureau video - https://www.1099pro.com/videos.asp

- Filing Electronically via the Service Bureau video - https://www.1099pro.com/videos.asp

- Creating Bulk TIN Uploads via the Service Bureau video - https://www.1099pro.com/videos.asp

What am I checking on my Control Totals? Review every page of your Control Totals to verify the Filers and Form Types included, the total dollar amounts reported, and the Services selected.

- View an example - Control Totals Example - NEC 2021.pdf

Can I submit after my scheduled upload date?

- Please upload by your scheduled Upload Date. If you miss your Upload Date, submit as soon as you can. Rush processing is not available.

- View our Filing Timeline and Reporting Deadlines.

Do I have to run the software update?

- Yes, the update enables Service Bureau upload functionality! The update is scheduled for released in early January and will be posted on our WIKI.

- Multi-user installations must run the update via their Server (not the individual Workstations). Please make advance arrangements with your internal IT to run the January update (and any other updates) as quickly as it is released.

What happens after I submit my upload?

The Service Bureau receives your upload, then your designated Service Bureau contact is emailed through each stage of processing. If there is an issue with your upload, we will contact you directly via email.

- Upload Received—This email indicates that the Service Bureau has received your upload file and queued it for review. An upload identifier number is referenced on this and the following emails.

- Upload Approved—This email indicates that the Service Bureau has reviewed your upload file's Control Total reports. Your file has been approved for Print+Mail and/or eFiling, per your upload type.

- Tax Forms Have Been Printed—For Print uploads only, this email serves as confirmation that your forms have been printed. Forms will be mailed the second business day AFTER the date of this email.

- IRS/SSA Upload Accepted—For eFiling uploads only, this email confirms that your upload has been accepted by the IRS/SSA. The IRS/SSA reference number is provided for your records.

- Service Bureau Invoice—This email includes the Service Bureau invoice for this upload (the upload identifier number is referenced in the WO# field). Payment terms are Net Due on Receipt.

If you need help, review our Technical FAQs, Video Tutorials, and Support options.

Many customers prefer to submit all forms for Print, Mail and eFile services in January. This ensures eFiling is not overlooked or forgotten later in the season. Submitting all forms for all services in a single upload is the most cost-effective way to use our services!

As a reminder, forms 1099-NEC and W-2 forms must be eFiled by January 31st. For other form types with a March 31st filing deadline, you absolutely can submit them in January for eFiling - however please thoroughly review your data prior to filing it early. Correcting filed forms is more complicated (and expensive) than correcting non-filed ones. See Reporting Deadlines.

Alternate Filing Options

All of our software products (with the exception of 1099 Pro Professional*) allows users to create electronic files, suitable for direct filing. To self-file you will need:

- An IRS issued TCC Number. Enter your TCC number in 1099 Pro Enterprise software → menu bar → File → Transmitter Information. You can use one TCC to file on behalf of multiple filers.

- IRS FIRE site logon credentials.

The above items are NOT required to eFile via the Service Bureau! The Service Bureau is available to all of our software customers for a fee, regardless of product purchased. Learn about our Print/Mail/eFile and Bulk TIN Match Services.

* 1099 Pro Professional users must eFile directly via the Service Bureau for a fee.

- No labels