You are viewing an old version of this page. View the current version.

Compare with Current

View Page History

« Previous

Version 7

Next »

Overview

Bulk TIN Match rates are posted online at https://www.1099pro.com/serv_TIN_Matching.asp.

- Cost is per upload (may include up to 100k recipient Name/TINs)

- Customers must purchase and use the current tax year software to submit for this service.

- During September - December, the Service Bureau accepts bulk TIN match uploads from both TY 2021 and 2022 software products.

- All uploads must be submitted via the software's built-in Bulk TIN Match Wizard.

- The Service Bureau cannot process .any manual texts file such as XLS, .TXT, .CSV, etc.

Submitting Your Data

Watch our video tutorial - https://www.1099pro.com/videos.asp.

Workaround Method

For customers who submit multiple bulk TIN match files, and/or use our software exclusively for bulk TIN match services, see:

Bulk TIN Match Results

Bulk TIN Match Results - Bulk TIN results are returned via email, with a ZIP attachment, within 1-2 business days. If you cannot receive ZIP files via email, we can post results on our secure FTP site. Email SB@1099pro.com for help.

FAQs

What Name/TIN records are eligible?

The records included in your Bulk TIN Match upload are determined by your selected filer(s) and form type(s); however, certain records are automatically excluded. Thus, your Bulk TIN Upload file may contain fewer records than the number of tax forms you issued this year.

- Only active records are included. Corrected records with a Zero status (Zero/Pending or Zero/Filed) and deleted records are excluded.

- Duplicate records are excluded, see What are stripped records?, below.

- Invalid records (e.g., TIN missing or incomplete, name missing) are excluded.

What are stripped records?

In accordance with IRS guidelines to prevent phishing for name/TIN combinations, duplicate records are automatically stripped from bulk TIN files. For example, if you issued three 1099s to "Jane Doe", only the first "Jane Doe" name/TIN combination is included in your upload file. Likewise, if you issued multiple forms to TIN "123-45-6789", only the first "123-45-6789" name/TIN combination is included in your upload file. You may legitimately be issuing a dozen records to unique individuals with the name "Jane Doe", however you cannot submit them all in a single upload. This is per the IRS, not a bug in our software.

Isolate Stripped Records

Corporate Suite and 1099 Pro Enterprise (not 1099 Pro Professional nor 1042-S Pro) allow you to generate a list of stripped records from your Bulk TIN Match upload file. For guidance in this process, search "Stripped" in your software help file.

What do results look like?

Your zipped results include Text and Excel files.

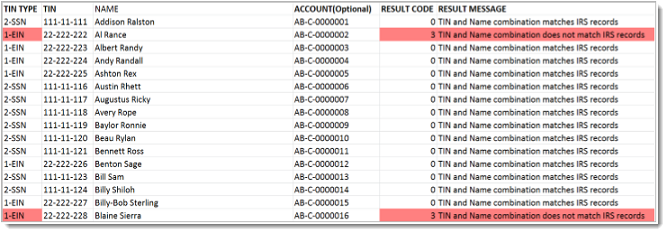

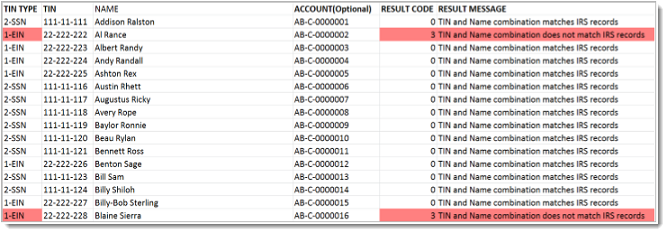

Excel file results are provided in an easy-to-read format. Mismatches, highlighted in red, are described in the "Result Message" column.

Your text file results are provided in a TIN Type,TIN,Name,Account,Response format. For example, the following sample lines indicate that the TIN provided by Matthew Mulberry is 2 - Not Currently Issued, and the TIN provided by Acme Incorporated is 0 - Matches IRS records.

1;183421111;Matthew Mulberry;89765;2

2;562611111;Acme Incorporated;89765;0

What do IRS coded responses mean?

Code | Response |

|---|

0 | Name/TIN combination matches IRS records. |

1 | Missing TIN or TIN not 9-digit number. |

2 | TIN not currently issued. |

3 | Name/TIN combination does NOT match IRS records |

4 | Invalid request (i.e., contains alphas, special characters) |

5 | Duplicate request. |

6 | (Matched on SSN), when the TIN type is (3), unknown, and a matching TIN and name control is found only on the NAP DM1 database. |

7 | (Matched on EIN), when the TIN type is (3), unknown, and a matching TIN and name control is found only on the EIN/NC database. |

| (Matched on EIN and SSN), when the TIN type is (3), unknown, and matching TIN and name control is found on both the EIN/NC and NAP DM1 databases. |