- Loading...

Release Notes

IMPORTANT: You will need a 2019 Authorization Code starting with the letter 'C' BEFORE installing this update!

NEW:

- Electronic Filing - Flat wizards.

- 2019 IRS/SSA Updates - All final 2019 IRS PDF's & Instructions included.

- 2019 IRS/SSA Updates - 2019 samples files are included. A complete set can also be found here - 2019 Tax Year - Import Templates and Maps.

- 2019 Forms are now available.

- Form 1098: New Box 11 Mortgage Acquisition Date.

- Form 1098-T: Removed Box 3.

- Form 1098-F: Fines, Penalties and Other Amounts. (new form).

- Form 1099-G: New Checkbox for 2nd TIN Notice.

- Form 1099-PATR : New Box 7 Qualified Payments.

- Form 1099-B:

- 2018 Check Box 3 → 2019 Check Box 12.

- 2018 Check Box 12 → 2019 Check Box 3 part 1.

- New Check Box 3 -Part 2 Qualified Opportunity Fund (QOF).

- Form W-2: Box 9 removed.

- Form 1042-S:

- New Box 1 Income Code.

- New Checkbox 7c.

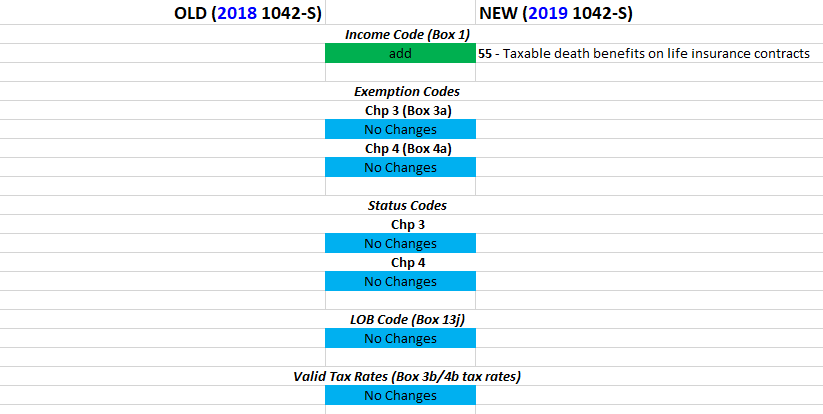

- New and Updated 1042-S form codes.

IMPORTANT: Please review the following 2019 1042-S code changes and make any required changes to your data or imports.

UPDATED:

- 2019 IRS/SSA Updates - 2019 W-2 maximums/limits.

- 2019 IRS/SSA Updates - Latest GIIN list included.

- 2019 IRS/SSA Updates - Business rules are updated for the 2019 form changes.

- 2019 IRS/SSA Updates - W-2G withholding options updated.

- General - Visual enhancements to modernize the user interface.

- General - Comprehensive help file is overhauled.

FIXED:

- Electronic Filing - Name Line 3 was not being generated in 1187 1042-S eFile.

- ACA - ALE members starting with 0 on 1094-C was software to crash.

- General - A number of other small fixes and enhancements are also included in this release.

Overview

Content Tools