- Loading...

Eligible Records

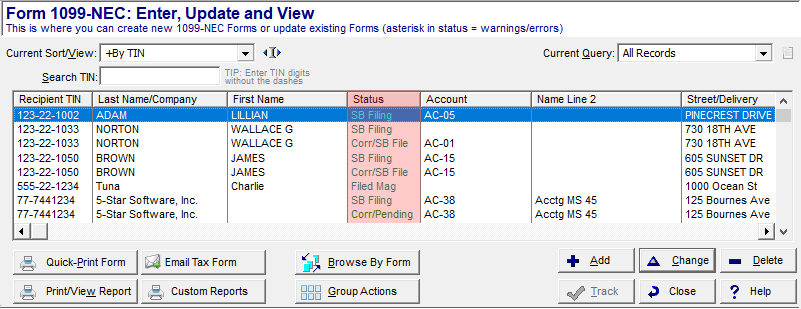

Only filed records are eligible for corrections. View a record's status at the Work With My Tax Forms screen in your software.

- Records with an SB Filing or Filed Mag status are eligible to correct. See Correct a Form.

- Records with a Corr/SB File or Corr/Mag status have been corrected and filed. There is a special process to correct an already corrected form, see Correct a Corrected Form.

- Records with a Pending or Corr/Pending status can be edited simply by selecting the "Change" button.

- Records with an SB Printed or Printed status can also be edited via the "Change" button; but first you will need to reset them to pending status when prompted.

Only forms that have been filed with the IRS/SSA are eligible to be corrected. Prior to filing with the IRS/SSA, it is only necessary to change (or update) the form. Most 1099 Pro software corrections must be processed manually, one-by-one, at the Work With My Tax Forms screen—the exception is Corporate Suite which allows the import of Type 1 corrections. Watch Correcting Forms in 1099 Pro Software (YouTube video) or reference the below step-by-step instructions.

Overview

Content Tools