- Loading...

Eligible Records

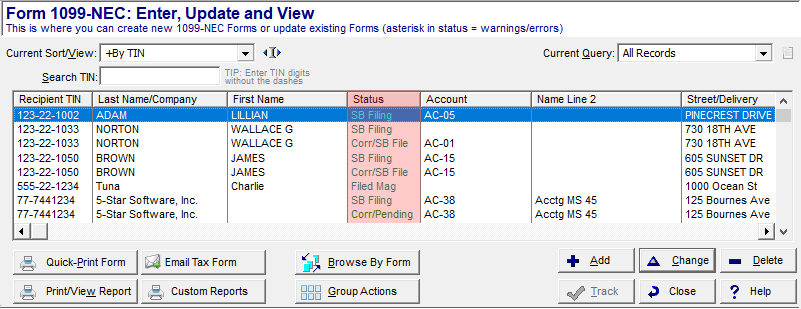

Only filed records are eligible for corrections. View a record's status at the Work With My Tax Forms screen in your software.

- Records with an SB Filing, SB Print+File, or Filed Mag status are eligible to correct. See Correct a Form.

- Records with a Corr/SB File or Corr/Mag status have been corrected and filed. There is a special process to correct an already corrected form, see Correct a Corrected Form.

- Records with a Pending or Corr/Pending status can be edited simply by selecting the "Change" button.

- Records with an SB Printed or Printed status can also be edited via the "Change" button; but first you will need to reset them to pending status when prompted.

Correct a Form

Most 1099 Pro software corrections must be processed manually, one-by-one, at the Work With My Tax Forms screen—the exception is Corporate Suite which allows the import of Type 1 corrections. Watch a video tutorial on corrections, https://www.1099pro.com/videos.asp.

Correct a Corrected Form

This process corrects an already filed, corrected form.

Correction Tips

- To effectively VOID a record; zero out any fields containing dollar amounts.

- To change the TYPE of TIN; delete the entire number and then enter it with the dashes appropriately placed for an SSN or EIN.

- Recipient mailing address changes can be processed as a correction for printing purposes; however, these types of corrections are not eligible for filing with the IRS. Records with only corrected CITY, STREET ADDRESS, STATE or ZIP CODE changes are automatically excluded from Corrected IRS files.

- All fields with revised information values turn BLUE.

- The bottom of the form includes a brief summary of any changes in the "Correction Type" box.

- The Payer/Filer/Employer field is not available to correct at this screen.

Overview

Content Tools