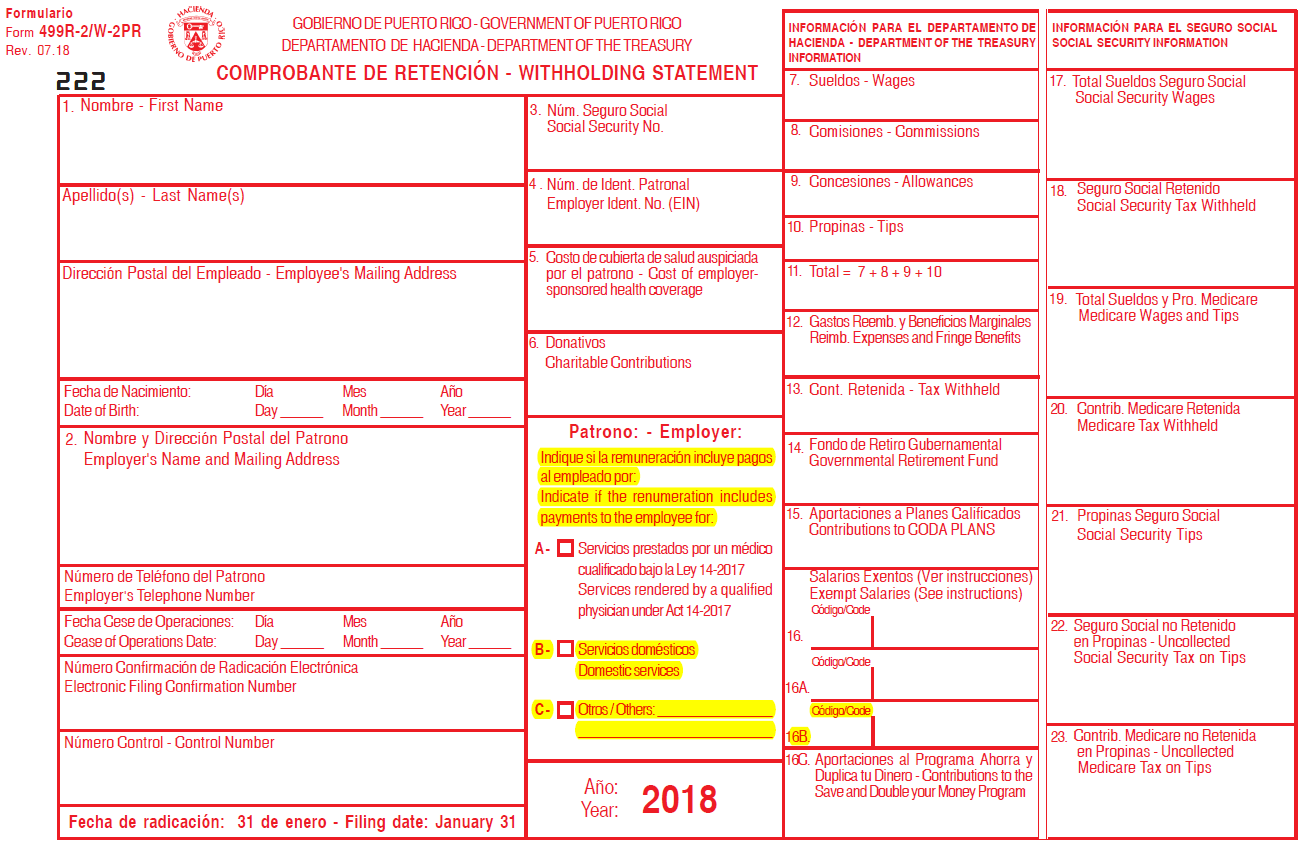

Sample Import Template File: 499R-2 2018 Import.xlsx |

|

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Cease Ops Date | 8 | Date | Cease of operations date | MM/DD/YYYY or M/D/YYYY |

Box 5 Amount | 12 | Amount | Cost of employer health coverage | |

Box 6 Amount | 12 | Amount | Charitable contributions | |

| Box 7 Amount | 12 | Amount | Wages | |

| Box 8 Amount | 12 | Amount | Commissions | |

| Box 9 Amount | 12 | Amount | Allowances | |

| Box 10 Amount | 12 | Amount | Tips | |

| Box 11 Amount | 12 | Amount | Total = 7+8+9+10 | |

| Box 12 Amount | 12 | Amount | Reimb expenses and fringe benefits | |

| Box 13 Amount | 12 | Amount | Tax withheld | |

| Box 14 Amount | 12 | Amount | Governmental retirement fund | |

| Box 15 Amount | 12 | Amount | Contributions to CODA plans | |

| Box 16 Amount | 12 | Amount | Exempt salaries (see instructions) | |

| Box 16a Amount | 2 | Text | Exempt salaries code | |

| Box 16b Amount | 12 | Amount | Contributions to save and double prg | |

| Box 16c Amount | 12 | Amount | Other Exemption Codes | |

| Box 17 Amount | 12 | Amount | Social security wages | |

| Box 18 Amount | 12 | Amount | Social security tax withheld | |

| Box 19 Amount | 12 | Amount | Medicare wages and tips | |

| Box 20 Amount | 12 | Amount | Medicare tax withheld | |

| Box 21 Amount | 12 | Amount | Social security tips | |

| Box 22 Amount | 12 | Amount | Uncoll social security tax on tops | |

| Box 23 Amount | 12 | Amount | Uncoll medicare tax on tips | |

| See Form Common Fields | Form fields common to all form types. | |||

Form 499R-2:

Hacienda 499R-2 form and instructions: 499R-2 2018 Form & Instructions