- Loading...

IMPORTANT: BE SURE THAT YOU HAVE REVIEWED THE LIMITATIONS, AND PRICING, HERE - Service Bureau - 1099-NEC Reporting Details.

BEFORE YOU START

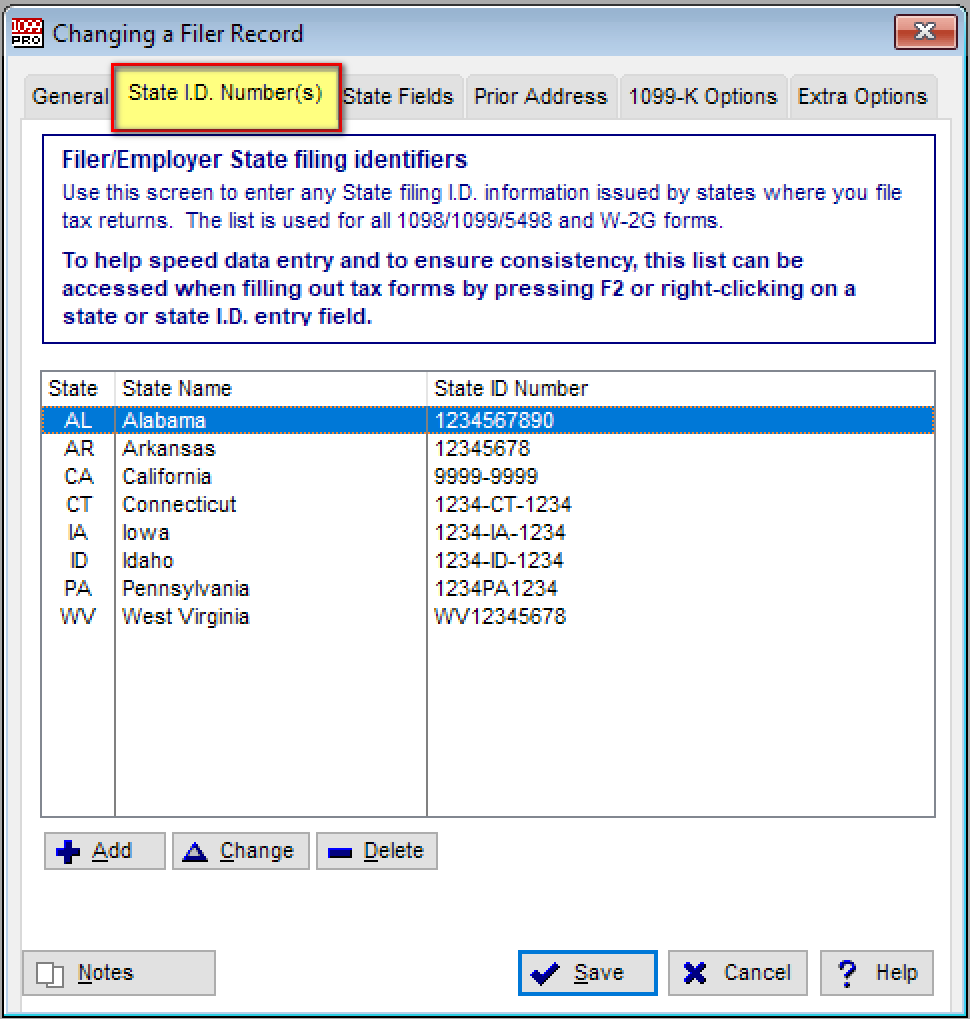

- Be sure that you have entered in your State ID Numbers (State Withholding Account Numbers), if you have any, for each filing entity you have.

- Note: State ID Numbers (State Withholding Account Numbers) are generally only required if you perform withholding in a specific state. You may, or may not, have these depending on your company.

- To do so, go to Manage Filers → Click on your filing entity → Select "State ID Number(s).

- Be sure that you have your

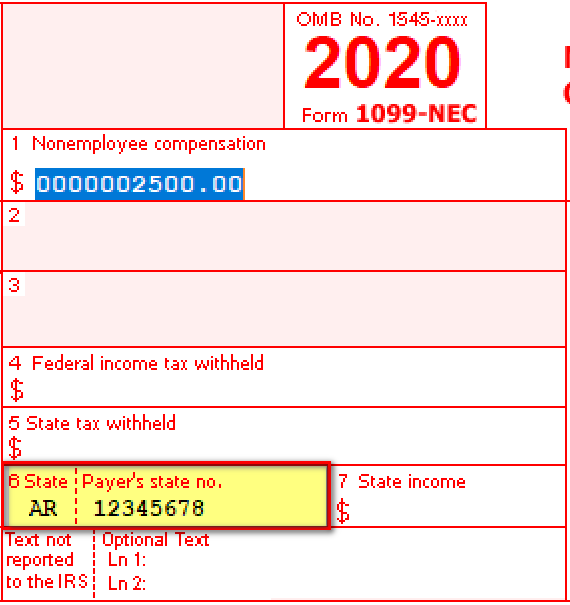

- State ID Numbers (State Withholding Account Numbers), if you have any, on the 1099-NEC tax record(s).

- State Income box, if applicable, on the 1099-NEC tax record(s).

- These can be imported or manually entered.

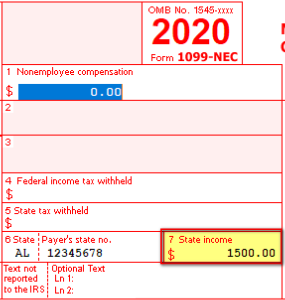

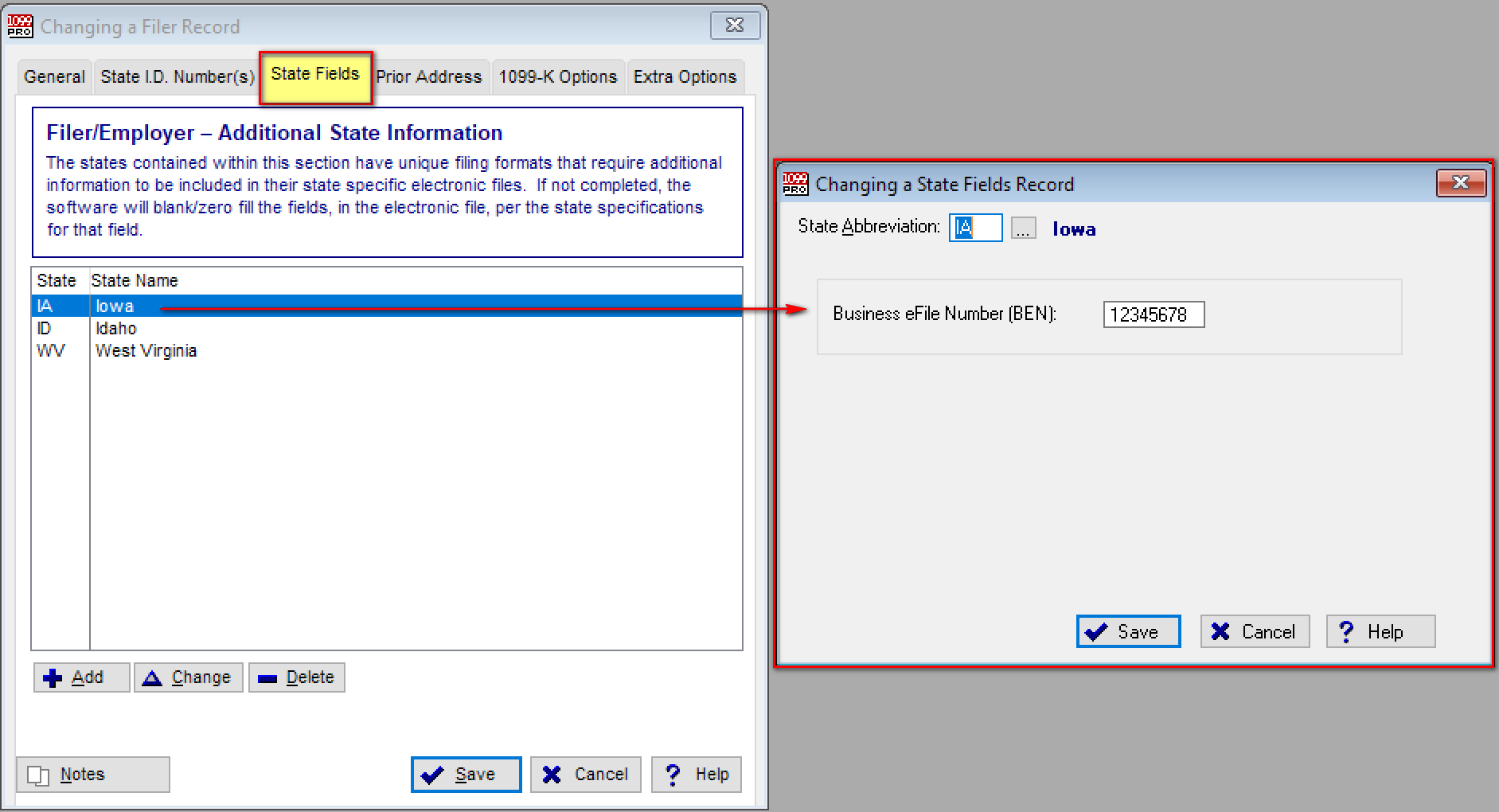

- Be sure that you have entered in the extra "State Fields" if you are reporting to Iowa (IA), Idaho (ID), or West Virginia (WV).

- For instance, Iowa (IA) requires you to enter your Business eFile Number (BEN) if you perform withholding.

- For instance, Iowa (IA) requires you to enter your Business eFile Number (BEN) if you perform withholding.

METHOD 1 - SERVICE BUREAU PRINT & MAIL, ADD-ON

- Video Tutorial - https://youtu.be/RbwBRsW4bwY

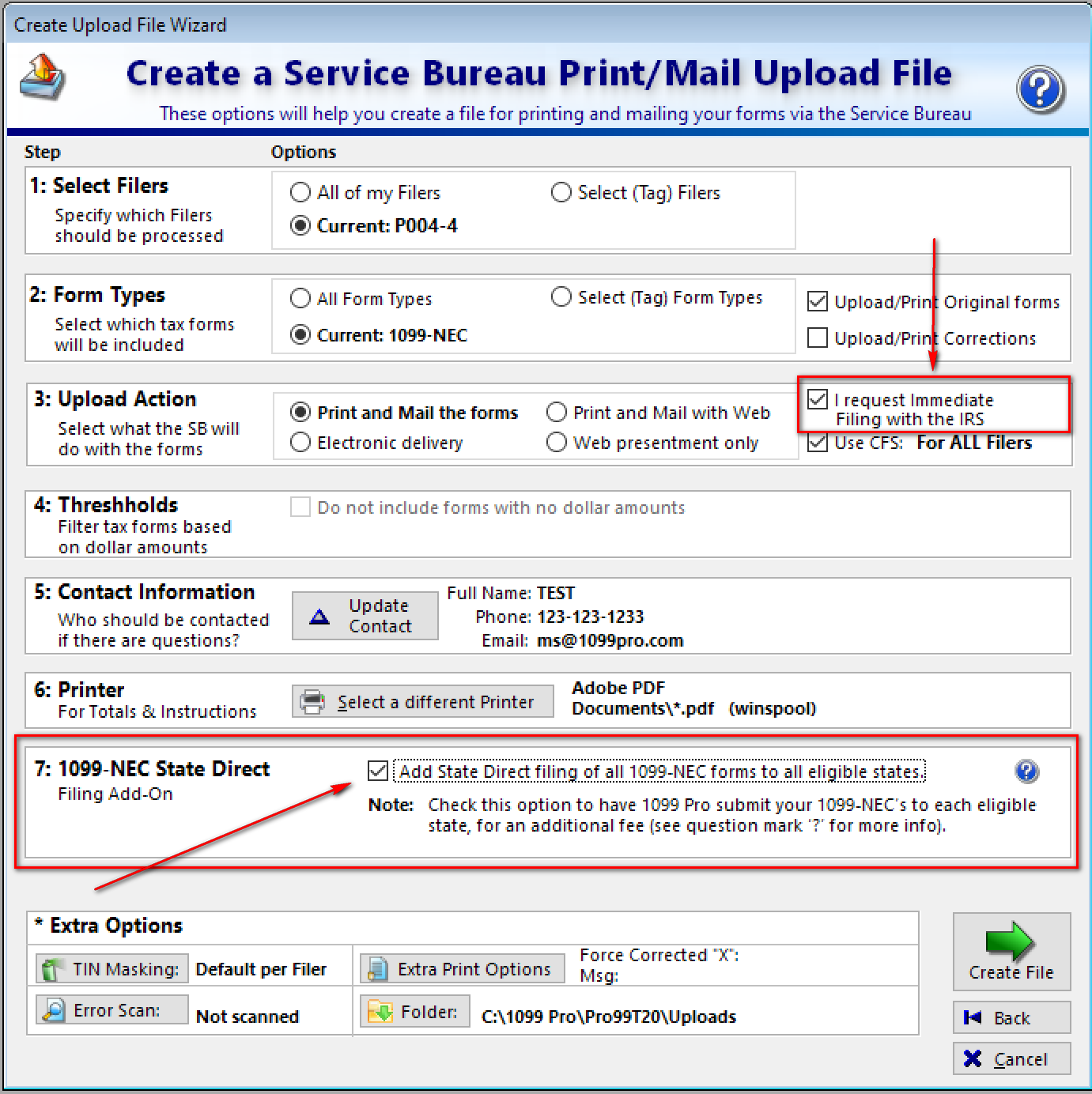

- If you are submitting a print & mail upload and you select the below criteria then you will have the opportunity to select the Service Bureau 1099-NEC State Direct Filing Add-On.

- Criteria 1: If you have selected the 1099-NEC form type, in any way, on Step 2 "Form Types".

- This can be whether you select "All Form Types", which includes the 1099-NEC, or if you select the 1099-NEC form type directly.

- Criteria 2: If you have also selected the "I request immediate filing with the IRS".

- Many users select this option, when uploading 1099-NEC forms, because the 1099-NEC forms have the same IRS deadline for printing, mailing, and electronic filing to the IRS. This saves the extra step of submitting a second IRS electronic filing upload.

- Criteria 1: If you have selected the 1099-NEC form type, in any way, on Step 2 "Form Types".

- Once the above two criteria are selected Step 7 "1099-NEC State Direct" will become visible. Check the checkbox to add the limited 1099-NEC state filing feature to your order.

- If you select this 1099-NEC State Direct Add-On, the software will first create two uploads once you hit "Create File".

- Upload 1: This will be your print, mail, and IRS electronic filing upload.

- You will be asked to signed the control totals for it before submitting.

- Upload 2: This will be your 1099-NEC state direct electronic filing upload. It will automatically start a new upload process and cycle through all the eligible states in your order.

- The control totals will likely be different than those of your IRS filing upload. This is because:

- Not every state requires the 1099-NEC to be reported directly.

- Many states have dollar value thresholds for reporting and only records above those thresholds are included.

- The Service Bureau does not support every state that requires 1099-NEC state direct reporting.

- The control totals will likely be different than those of your IRS filing upload. This is because:

- Upload 1: This will be your print, mail, and IRS electronic filing upload.

METHOD 2 - SERVICE BUREAU IRS ELECTRONIC FILING, ADD-ON

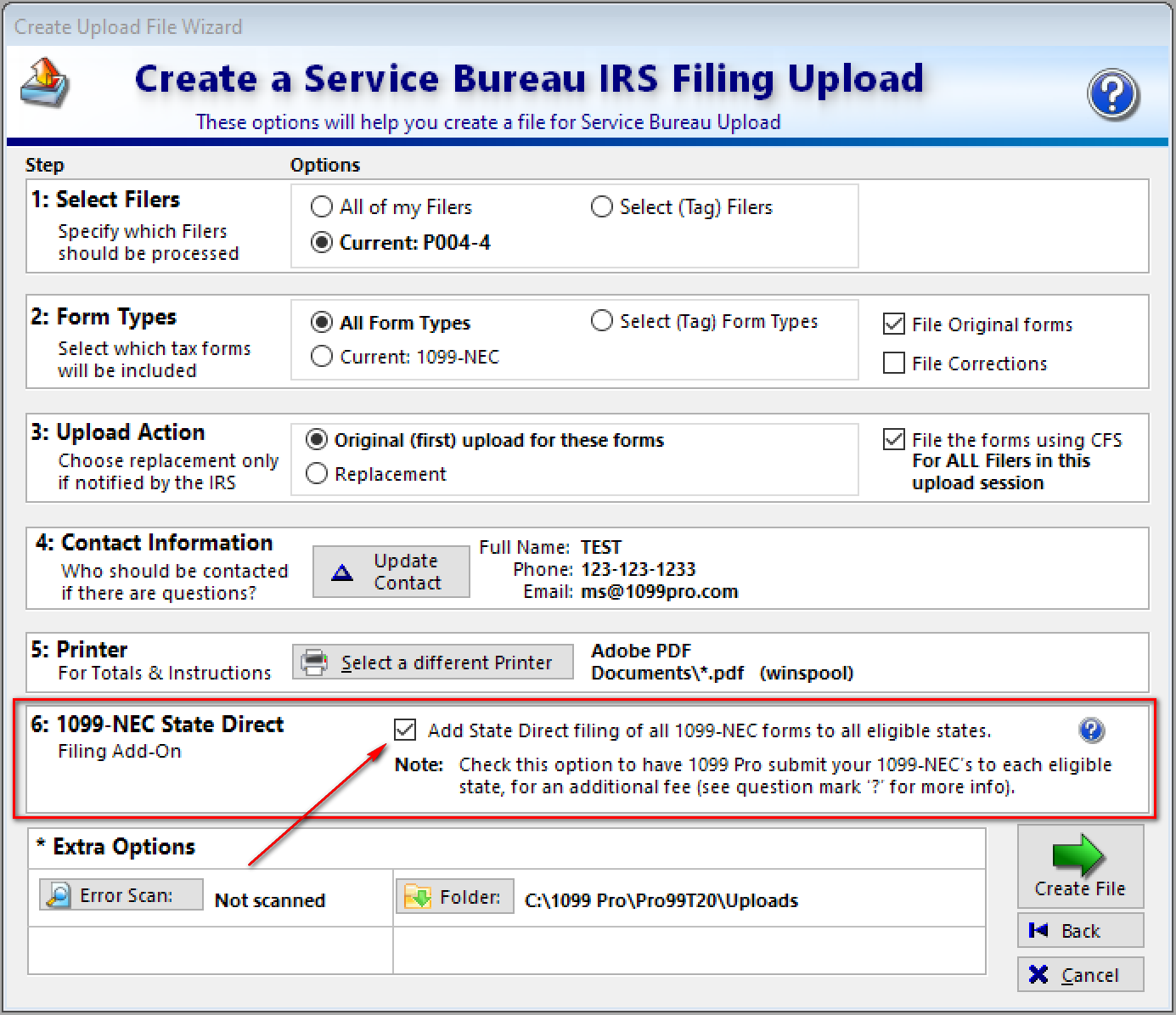

- If you are submitting a Service Bureau IRS electronic filing upload and you have the 1099-NEC form type included then you will have the opportunity to select the Service Bureau 1099-NEC State Direct Filing Add-On.

- Once the above two criteria are selected Step 6 "1099-NEC State Direct" will become visible. Check the checkbox to add the limited 1099-NEC state filing feature to your order.

- If you select this 1099-NEC State Direct Add-On, the software will first create two uploads once you hit "Create File".

- Upload 1: This will be your IRS electronic filing upload.

- You will be asked to signed the control totals for it before submitting.

- Upload 2: This will be your 1099-NEC state direct electronic filing upload. It will automatically start a new upload process and cycle through all the eligible states in your order.

- The control totals will likely be different than those of your IRS filing upload. This is because:

- Not every state requires the 1099-NEC to be reported directly.

- Many states have dollar value thresholds for reporting and only records above those thresholds are included.

- The Service Bureau does not support every state that requires 1099-NEC state direct reporting.

- The control totals will likely be different than those of your IRS filing upload. This is because:

- Upload 1: This will be your IRS electronic filing upload.

METHOD 3 - 1099-NEC STATE ONLY FILING

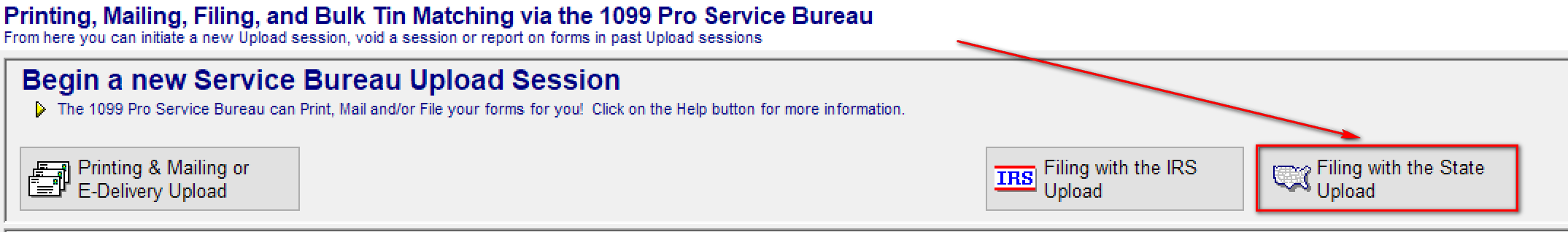

- To create a 1099-NEC state only Service Bureau upload please select the "Filing with the State Upload" button from the Service Bureau screen.

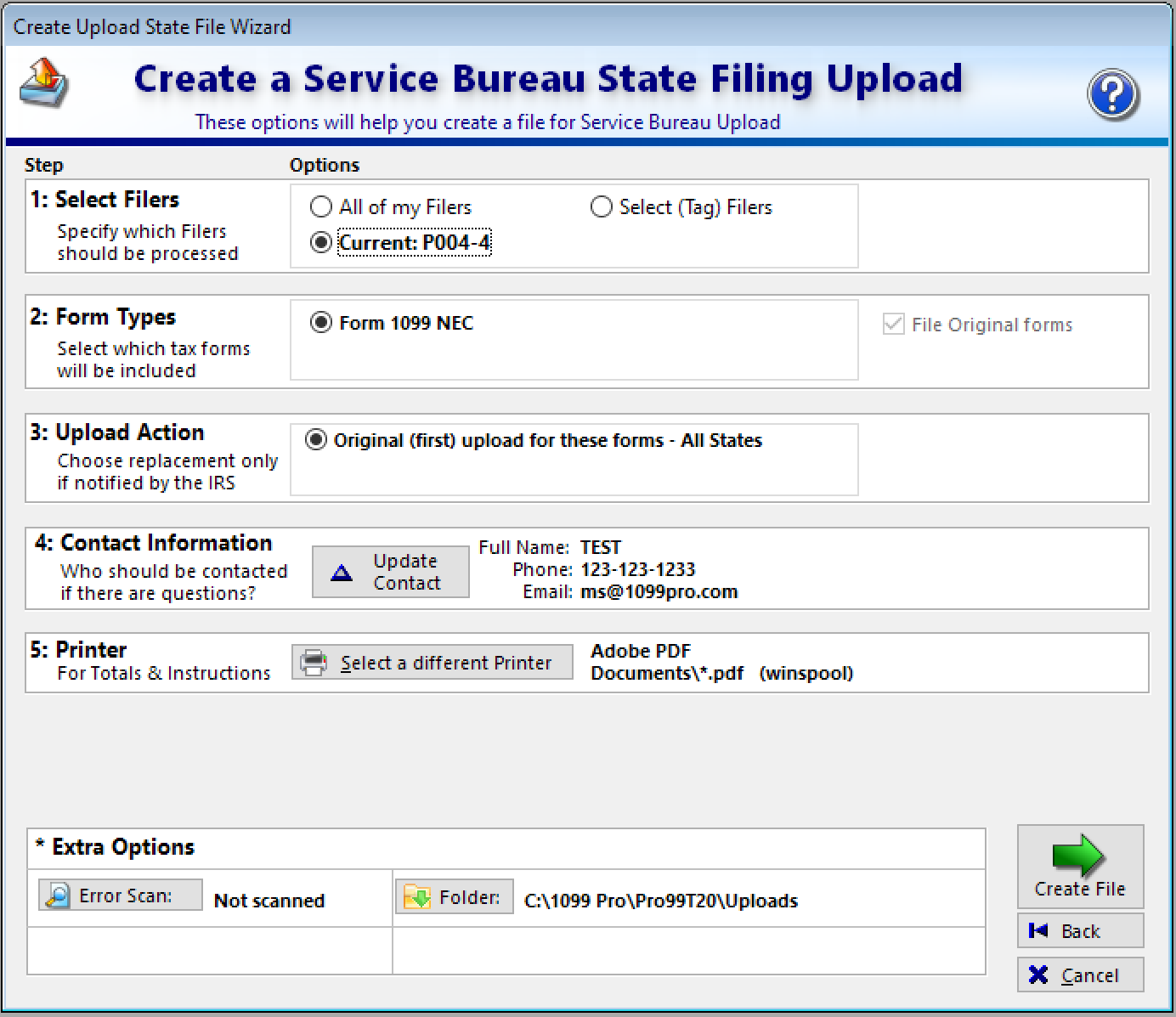

- This will open the 1099-NEC State Filing Upload Wizard. This method will only process 1099-NEC records for state filing (not printing/mailing or IRS electronic filing).

- This process can be run before, or after, any printing/mailing or IRS electronic filing upload. It is designed so that it can be run at any time.

- Once you click "Create File" the software will cycle through all eligible states and create one single upload for you to sign off on.

- Upload: This will be your 1099-NEC state direct electronic filing upload.

- The control totals will likely be different than the total number of 1099-NEC records that you have. This is because:

- Not every state requires the 1099-NEC to be reported directly.

- Many states have dollar value thresholds for reporting and only records above those thresholds are included.

- The Service Bureau does not support every state that requires 1099-NEC state direct reporting.

- The control totals will likely be different than the total number of 1099-NEC records that you have. This is because:

- Upload: This will be your 1099-NEC state direct electronic filing upload.

Overview

Content Tools