- Loading...

Can you tell me more about what to do for any states that are unsupported?

- Yes! There are currently (9) un-supported states/territories:

- Un-supported states: AS, GU, HI, IN, LA, MP, PA, RI, VI

- Of these, six (AS, GU, MP, PA, RI, VI) weren't in the Combined Federal/State Filing Program to begin with. If you weren't previously reported directly to these states then nothing has changed!

- Finally, that leaves only three states (HI, IN, LA) that are in the Combined Federal/State Filing Program that are unsupported.

- IF you don't have any records in these states, or if your records don't meet the reporting thresholds, then there is nothing that you have to do!

- You can research these states to file via paper or can purchase the Enterprise software to create the state electronic file that can then be submitted under an account that you make at that state.

- Un-supported states: AS, GU, HI, IN, LA, MP, PA, RI, VI

Does anyone else offer state direct reporting to these states?

- We are not aware of any other company that offers as extensive of a filing service as we do or that has the alternate option of providing software that you can use in-house for your own reporting.

- The 1099 Pro Enterprise software allows you to create your own state direct files and submit them directly to states (on your own).

- Certain specialized accounting firms may offer this service but it is likely that they are using our service on the back-end or are hand-filing only for a small, select, group of clients.

- In the end, every single CPA, Accountant, and even the states themselves were shocked that the 1099-NEC was not included in the CFSCF Program. Many states do not even have their reporting portals operational yet!

How is the Tax State determined in the software?

- The Tax State is set on each 1099-NEC. It is not based on the Filer tax state.

- The Tax State can be set on each individual record via import or manual entry.

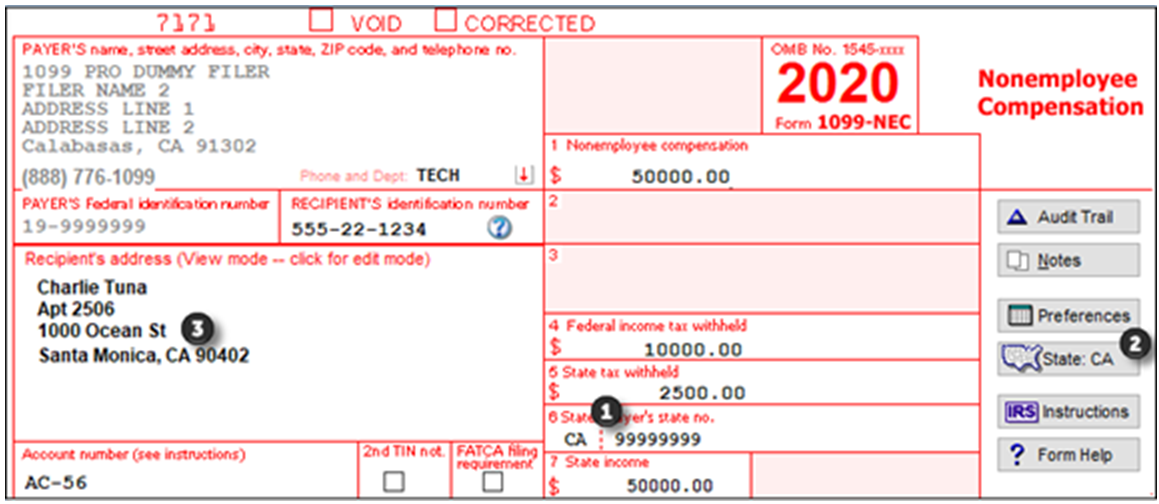

- The Tax State is determined based on the below logic. Users can set explicit tax states with the

- Explicit State Withholding Boxes (1)

- If the state withholding box is completed on a tax form, for a specific tax state, then that state is the "tax state" regardless of the Tax State Override (#2) or the Recipient Address (#3) below. Forms with explicit state withholding boxes include: 1099-B, 1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-MISC, 1099-NEC, 1099-OID, 1099-R, W-2G, 1042-S and W-2.

- Generally, you are required to have a State ID Number / State Withholding Account Number when utilizing the Explicit Tax State box.

- Tax State Override (2)

- If you use the optional "Override default for State tax reporting" button, located on the right hand pane of the form entry window, the selected state overrides the recipient's state in their address.

- Recipient Address (3)

- If there is no state withholding and a different state is not selected in the "Tax State Override" box as discussed above, then the state in the recipient address is used.

- Explicit State Withholding Boxes (1)

Overview

Content Tools