- Loading...

Release Notes

IDES Packager ™

- Now supports decryption or encryption. See the radio check buttons at the top.

- IDES Packager Verification for certificates is now turned on. When a certificate fails verification, information on why is logged to the text box.

- Validation for XML is significantly improved, and will also log to the text box. IDES Packager should now reliably prevent you from packaging up a file that would cause problems when sent to IDES

- Added drag and drop functionality.

- Double clicking in the “Output Log:” area opens a window for saving the results or for cutting & pasting.

- Note a standalone version of the IDES Packager is also available which does the IDES Encryption & Decryption.

All 8966 products are available at https://www.1099pro.com/prod-FATCA-8966-Software.asp

Creating a NIL Report

8966 Pro only allows a NIL Filer to create a NIL Report. To create a NIL Filer:

- Click on “My Filers List” (under #1 on the left side), Add and then fill in the information. Be sure to check the box “Filer is used ONLY for NIL Reporting”.

- Note the Filer/Agent EIN is not required but a Payer Code is required.

- To add the Filer for the NIL report:

- Under “Preparing My Forms” click on “Work With My Tax Forms”

- Click on “Add” in the lower right

- If you need to associate a Sponsored Entity or Intermediary with your Filer then then right click on the “TIN” box to the right of “Part I Identification of Sponsored Entity or Intermediary (if applicable) and select the Sponsored Entity or Intermediary or if not there then click on “Add” in the lower left to add one.

- Click on “Save” in the lower right and you will see the record that will be passed for the NIL Report

- To generate the XML for the NIL Report go to #3 Create XML and click on the XML V1.1 File. You will see the icon “Create a NIL Report” in the upper right.

See: https://www.1099pro.com/videos.asp “How to Create a NIL Report with 8966 Professional

NIL Report Reference:

http://www.irs.gov/Businesses/Corporations/FATCA-IDES-Technical-FAQs

Which users are required to submit a Nil report? What is the procedure for submission of these reports?

Only Direct Reporting Non-Financial Foreign Entities (NFFEs) are required to submit nil reports. For all other entities, submission of nil reports is not mandatory and submission of these reports is optional. While nil reporting might not be required by the IRS, it might be required by the local jurisdiction. Please check with your local tax administration. Nil reports that are submitted must provide Reporting FI information. The report contains Reporting Group, but it does not contain any account reports or pooled reports. Reporting group can be empty or can contain Sponsor or Intermediary information.

UK financial institutions (FIs) that have no US-reportable accounts will not be required to submit annual 'nil returns' in order to ensure compliance with new rules designed to prevent tax evasion by US citizens, HM Revenue and Customs (HMRC) has confirmed

The change comes after the US Internal Revenue Service (IRS) updated its own Foreign Accounts Tax Compliance Act (FATCA) information to clarify that it itself does not require nil returns but that they might be required by the FI's local tax authority.

New Videos:

- FATCA 8966 Software Tutorial

- How to Create a NIL Report with 8966 Professional

- Cantonese Version - How to Create a NIL Report with 8966 Professional

- Spanish Version - How to Create a NIL Report with 8966 Professional (coming soon)

See https://www.1099pro.com/videos.asp

Fixed:

- Importing data:

- First Name Fields if used will hold 40 characters (optional)

- Last Name/Company fields will hold 180 characters

- City fields will hold 40 characters (but displays only 38 at the Rcp field)

- Zip Postal Fields hold 12 characters but display less

- The State US/Canada fields are only valid for US & Canada

- Country is assumed it be US unless the Address Type is o for Other or c for Canada

- Address Free will hold 180 characters.

- Note you should still put in the City, Zip/Postal & Country in addition to Address Free.

- Fixed Group Actions from the Work with My Tax Forms Screen

- 8966 Form printout is enhanced

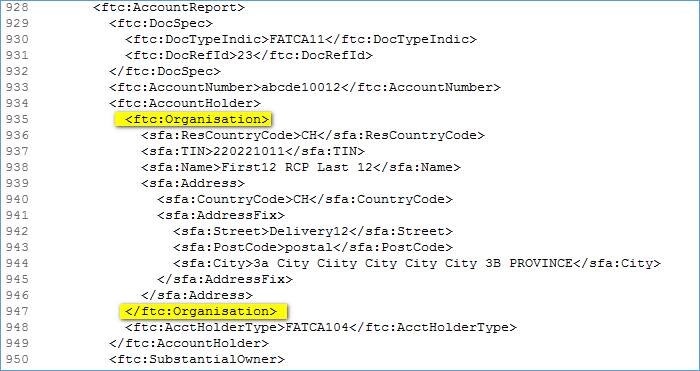

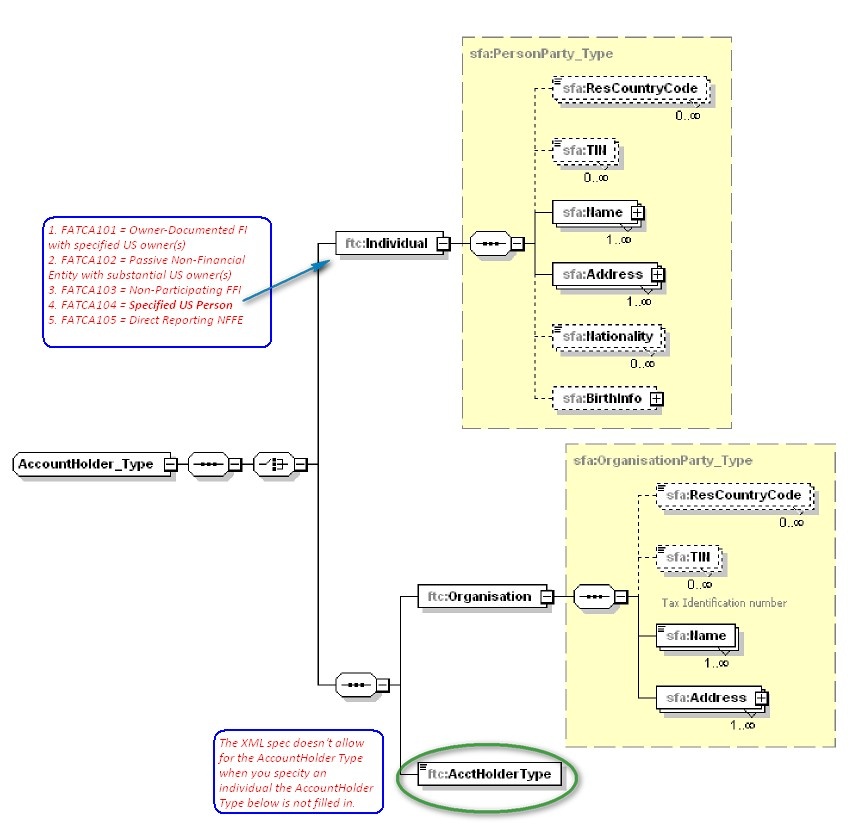

- The XML was creating group <ftc:Organisation> regardless of what was checked in Part II. Now the XML shows <ftc:Individual> if Specified U.S. Person is checked or if nothing is checked. See below:

Figure shown Below example of XML when nothing was checked:

- Clarification:

When Part II has a FI or NFFE checked the ftc:AcctHolderType in the XML is filled in along with the ftc:Organisation. When Specified U.S. Person or nothing is checked the XML Schema for an Individual is used which does not have ftc:AcctHolder as all Individuals would have to be FATCA104. See page 29 of V1.1 IRS Publication 5124 which documents the ftc:AcctHolderType being used just for Organisations. See Attached.

Attachment 1