- Loading...

Release Notes

Confirmation: the IRS confirmed on 6/2/15 our processing of special characters by the IDES Packager ™

From http://www.irs.gov/Businesses/Corporations/FATCA-IDES-Technical-FAQs

C17. Are there any characters that pose a security threat and should be avoided in submitted XML documents?

Use of the apostrophe (‘), double dash (--), quotation mark ("), and hash (#) symbols are prohibited as they can be used in a security threat and will cause the transmission to be rejected with a failed threat detection error notification. Replacing the characters with an entity reference will still cause a rejection.

New: FIN numbers are supported. To add your FIN number click on File & and Transmitter Information.

Background: the FIN concept was introduced on May 8th - If you are a third party preparer ((not a sponsoring entity) or commercial software vendor and you are submitting the FATCA XML Schema on behalf of another entity (or on behalf of several other entities), enter your FIN, which you obtained to enroll and use IDES, in

(1) “SendingCompanyIN” data element in the FATCA XML Schema Message Header and

(2) "FATCAEntitySenderID" data element in the FATCA XML Metadata Schema

Note: the FIN number is the same format as a GIIN.

New: NIL Report. Sponsored Entity or Intermediary information if present will pass thru to the XML. Note NIL reports can only be generated if the Filer has the “Filer is used ONLY for NIL Reporting” checkbox checked.

New: Business Rule 13 - If the GIIN has SP in it but the “Spon ENT Type” is not set to Sponsored Entity or If Sponsored Entity Data is on the form but the “Spon ENT Type” is not set will flag an error.

Note to apply Business Rules to existing form you must click on the Menu item Utilities & then click on Check / Update Error Status for all forms.

Note: 8966 Pro allows for situations where a Sponsoring Entity does not have a GIIN. If you are getting error messages because of this situation if you wish you can turn off the business rules for Sponsored Entities / Intermediary by clicking on File, Security & Administration, Program Options, Tax Form Validations for import and Entry, then change the drop down to 8966, double click on R13 and either deactivate the rule or change the severity if you wish.

New: More control over the Sponsored Entity / Intermediary

A new field “Spon ENT Type” This field can be accessed from:

Intermediary/Sponsored … under #1 on the left side.

Work With My Tax Forms under #2 on the left side

From the import using the new field name “Spon ENT Type”

Acceptable import values for this new import field are:

- 1 or I or i =intermediary

- 2 or S or s=sponsored entity

Any other values including 0, blank are ignored. New XLS sample files with this field were included with this update and are typically found at:

C:\1099 Pro\Pro66T14\Import\Samples\XLS Samples with the file names:

8966 Excel Pooled & Not Pooled_Sample Import.xls

8966 Not Pooled_Sample Import.xls

8966 Pooled_Sample Import.xls

To use this indicator on previously entered data you must go and change each form selecting either Sponsored Entity or Intermediary. Alternatively you can re-import your data by creating a new map to bring in your data with the “Spon ENT Type” field added to your data and your map(s). You can copy & update your existing map(s) to do this or if you are using one of our built in maps you can use our updated Import maps which we included with this update. If you choose to use any of these maps the step to import these maps into the software is shown below.

Importing New 8966 maps

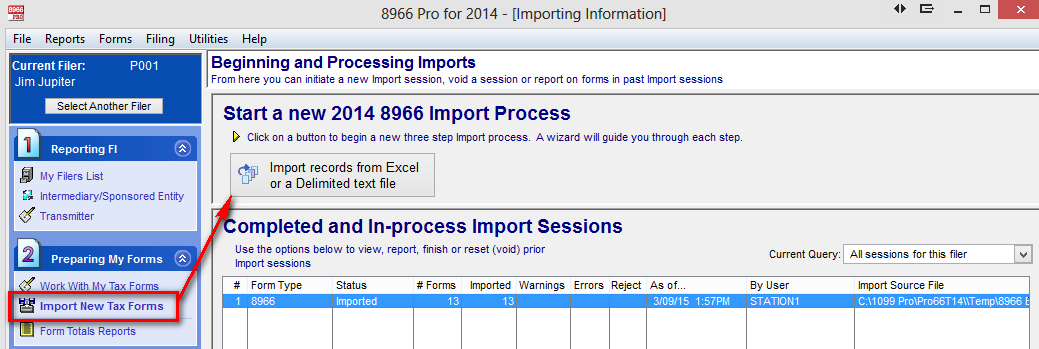

- Go to Import New Tax Forms and select Import Records from Excel or a Delimited text file.

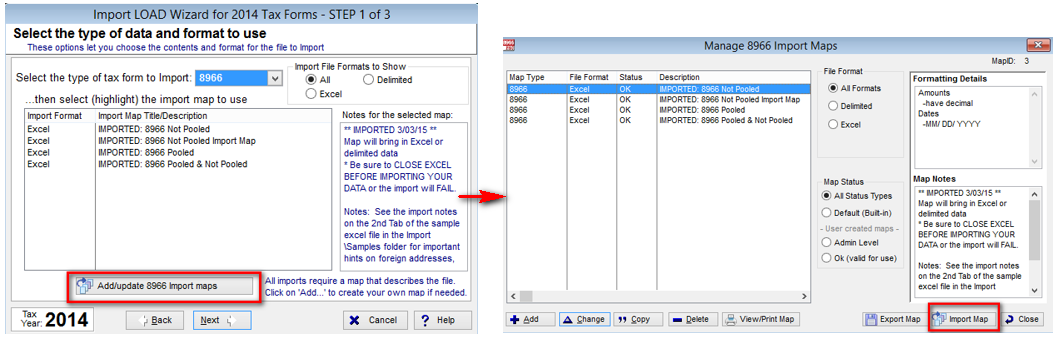

- Start the import wizard then select Add/update 8966 Import maps and then select Import map

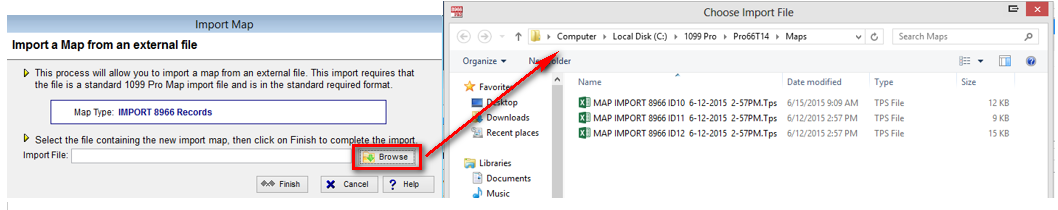

- Browse to import maps folder (C:\1099 Pro\Pro66T14\Maps)

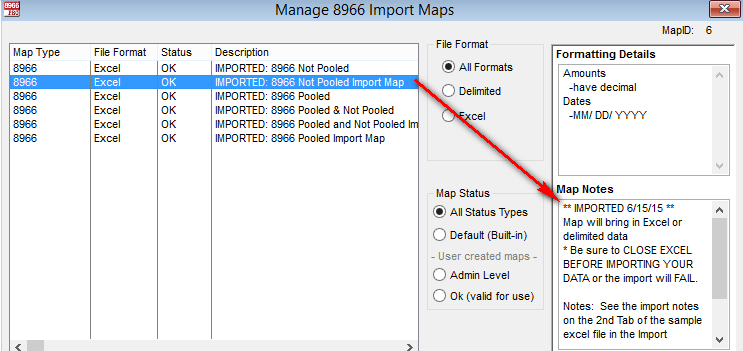

- Repeat step 2 & 3 for each map. Map notes will indicate the most current map by date.