- Loading...

Release Notes

FIX: IDES Packager - fixed the Open Output Directory button as it would sometimes fail to open

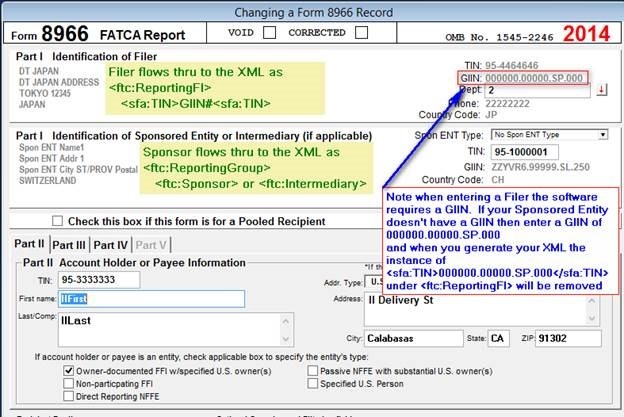

ENHANCEMENT: If you add the GIIN # 000000.00000.SP.000 to the Filer/FI the resulting XML will have the <sfa:TIN>000000.00000.SP.000</sfa:TIN> element stripped from under the <ftc:ReportingFI> element.

Clarification: Several users have encountered the situation where “The reporting FI is the Sponsored FFI and the Sponsoring FFI is identified in the Sponsor group.” However the 8966 Software will always create the XML with the Filer Information going under the FI and the Sponsored Entity / Intermediary info going under the Reporting Group as shown below:

Filer Information will always flow thru to here in the XML with 8966 Pro

<sfa:ResCountryCode>JP</sfa:ResCountryCode>

<sfa:TIN>000000.00000.SP.000</sfa:TIN>

<sfa:Name>DT JAPAN</sfa:Name>

Sponsor / Intermediary information will always to the XML with 8966 Pro as shown below:

Sponsor | Intermediary |

<ftc:ReportingGroup> | |

So you may need to fill in the Filer with the Sponsored FFI and the Sponsor with the Sponsoring FFI. Another complication is GIIN #’s are not required for the Sponsoring Entity but the software requires GIIN #’s at the Filer level. If this is the case use the GIIN # 000000.00000.SP.000 and the XML will have the <sfa:TIN>000000.00000.SP.000</sfa:TIN> element stripped from under the <ftc:ReportingFI>

Shown Below is where Filer/FI & Sponsor/Intermediary information flow thru to the XML:

IMPORTANT

1099 Pro, Inc. does not give tax, accounting or legal advice. Our updates describe use of the 8966 software and IDES Packager ™. If you need tax, accounting or legal advice consult with your tax, accounting or legal professionals. To contact government agencies regarding the filing of FATCA Report 8966 the following email address may be of assistance.

IRS Issues

IDES issues

Reference & Links:

Update to IRS Form 8966 Instructions March 10 2015: http://www.irs.gov/Businesses/Corporations/Update-to-the-Instructions-for-Form-8966-For-2014

FATCA IDES Technical FAQ’s

http://www.irs.gov/Businesses/Corporations/FATCA-IDES-Technical-FAQs

IV. Reporting FI – from http://www.irs.gov/pub/irs-pdf/p5124.pdf

Identifies the financial institution that maintains the reported financial account or that makes the reported payment. Examples:

The reporting FI is the financial institution that has agreed to treat another financial institution as an owner documented FFI.

The reporting FI is the financial institution that makes a reported payment to a territory organized financial institution that is acting as an intermediary and that has not elected to be treated as a U.S. person

The reporting FI is the Sponsored FFI and the Sponsoring FFI is identified in the Sponsor group

IRS 2014 Instructions for Form 8966- from http://www.irs.gov/pub/irs-pdf/i8966.pdf (pg 9)

The reporting FI is the Sponsored FFI and the Sponsoring FFI is identified in the Sponsor group and A Sponsored FFI or Sponsored Direct Reporting NFFE is not required to have obtained a GIIN prior to January 1, 2016. If the Sponsored FFI or Sponsored Direct Reporting NFFE does not have a GIIN, leave this line blank.

Do not enter the GIIN of the Sponsoring Entity or Trustee on line 9. That information is reported on line 4.