- Loading...

The IRS penalty for each Name/TIN mismatch is now $280! With this huge penalty increase, companies need to lessen their exposure, and we recommend the following procedures:

- Institute streamlined processes when setting up new Vendor accounts.

- When setting up a vendor account, validate TIN & Name via www.TINCheck.com

- For companies with large volumes of new vendor accounts, consider TINCheck’s interactive Web Service. Compatible with any Prepaid or Monthly plan. Specs available here: https://www.tincheck.com/pages/developer

- Check New Vendor TIN/Name combinations prior to printing your 1099’s in January.

- A $100 Prepaid 100 TINCheck account will pay for itself if you find just 1 TIN/Name Mismatch!

- A $100 Prepaid 100 TINCheck account will pay for itself if you find just 1 TIN/Name Mismatch!

- Bulk TIN/Name Matching on your existing or last year’s 1099 filing database, exposing all SSNs or EINs that do not match the IRS’ database. Valid as an add to any Prepaid or Monthly Plan starting at $185 per upload.

- For mismatches, check your source documentation, e.g. W-9. If there was a typo on the name or TIN, make the correction in your system and correct any 1099’s that were issued.

- If there is no typo or transposition error, issue a new W-9 (or W-8 if a foreign person). This penalty abatement strategy can have 3 possible results:

- A new TIN or Name

- A validation of the current W-9 on file

- A non-response

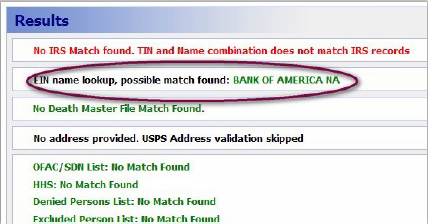

- Research EIN mismatches using TINCheck’s EIN Name Lookup (For Companies, Trusts, and LLCs only).

- Type in the EIN (Employer Identification Number) and the associated name. TINCheck will inform you if the EIN and name match. If the combination does not match, TINCheck’s EIN Name Lookup will tell you the name of the company associated with the EIN. To verify that you have a match with the IRS, type in the newly provided company name and the EIN, and click “Run Validation.”

Regardless of the results, you have helped to establish a “reasonable person” defense for when you receive any penalties. For consultations with penalty abatement, contact the specialists at www.IRSCompliance.org, who hire many ex-IRS officials.

A PDF copy of this document can be downloaded here: TINCheck Cleaning up Recipient TIN-Name Information

Overview

Content Tools