- Loading...

It is ALWAYS your best option to locate an internal backup of your data files. Please check with your IT to determine if a backup of your data exists. If a backup cannot be located, the Service Bureau may be able to assist with data restoration; however our data is only as accurate as the last upload file we received. Further, our data recovery files may not reflect the correct upload statuses in your software - thus some manipulation may be required. It really is best to locate an internal data backup!

- Data Recovery Fee = $100 per upload

- Turnaround = Typically 1- 2 business days

Email requests for data recovery services to SB@1099pro.com. The Service Bureau will authenticate your request prior to performing services.

Data FAQs

Restoring Data via the Service Bureau

Single Data File

- Email your request to SB@1099pro.com.

- If approved for data recovery service, pay the invoice. We perform data recovery upon receipt of payment.

- Your data recovery files will be posted in an encrypted ZIP file on our secure FTP site. We will email you when your file is available for download.

- We will separately email you your ZIP file password.

- You must have the appropriate tax year software installed. You can download software from our WIKI at https://wiki.1099pro.com/. Also run the update.

- Extract the contents of your data recovery ZIP file into the C:\1099 Pro\Pro99TXX\Data folder.

- XX = the tax year of the software product

- You must use WINZIP, a shareware utility, to extract your ZIP file.

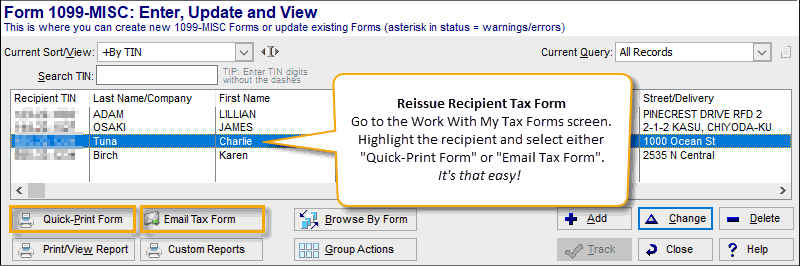

- When you open the 1099 Pro 20XX software your data should appear at the Work With My Tax Forms Screen.

- If you don't see your data, verify the correct Filer and Form Type are selected.

Multiple Data Files

If you submitted multiple IRS/SSA Filing or Full Service uploads, a clean data restoration is not possible. Rather, you must copy over your data folders and navigate between them to view contents.

- Email your request to SB@1099pro.com.

- If approved for data recovery service, pay the invoice. We perform data recovery upon receipt of payment.

- Your data recovery files will be posted in an encrypted ZIP file on our secure FTP site. We will email you when your file is available for download.

- We will separately email you your ZIP file password.

- You must have the appropriate tax year software installed. You can download software from our WIKI at https://wiki.1099pro.com/. Also run the update.

- Extract the contents of your first (initial) data recovery ZIP file into the C:\1099 Pro\Pro99TXX\Data folder.

- XX = the tax year of the software product

- You must use WINZIP, a shareware utility, to extract your ZIP file.

- When you open the 1099 Pro 20XX software your data should appear.

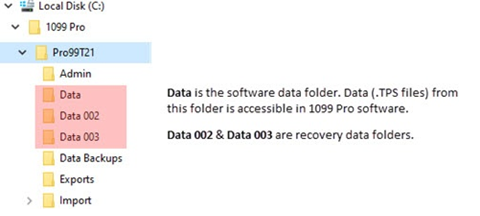

Create subfolders in C:\1099 Pro\Pro99TXX for each of the additional data recovery files. Using Image 1 as an example, folders would be named C:\1099 Pro\Pro99TXX\Data_002, C:\1099 Pro\Pro99TXX\Data_003, etc.

Extract the contents of each data recovery ZIP file into its corresponding folder.

To view the contents of each data recovery folder, exit the 1099 Pro software.

Rename folder "Data" to "Data-Orig".

Then name the data recovery folder that you want to view "Data".

- When you open the 1099 Pro 20XX software your data should appear at the Work With My Tax Forms Screen.

- If you don't see your data, verify the correct Filer and Form Type are selected.

Image 1 — Multiple Data Recovery Files in File Explorer

Need Help? Contact Support

If you have any questions or need additional guidance with data recovery, our support team is here to help.

Starting November 12, 2025, you can now connect with an agent through live chat for the fastest assistance.

How to access live chat:

- Login to your account.

- Click the support chat widget in the bottom-right corner of any page.

(If you don’t have an account yet, you can create one easily.)

You'll still be able to reply to any existing cases by email, but all new requests will need to go through the support portal.

______________________________________________

If you require further information, please visit our revised website:

https://desktop.1099pro.com/ or email us directly at sb@1099pro.com.