- Loading...

Release Notes

NEW:

- Service Bureau - Now enabled for printing, mailing, and electronic filing.

- Electronic Filing - Electronic filing has been enabled per EFW2 standards.

- Paper Filing - Paper filing has been enabled.

- This includes W-3 generation.

- State Electronic Filing - State electronic filing has been enabled.

- Note: Please review the help file for how to accommodate special state cases (such as Oregon Statewide Transit Tax).

- See "Step 3 - Filing My Forms" → "Electronic Filing" → "State Filing" → "Special Cases for State Filing"

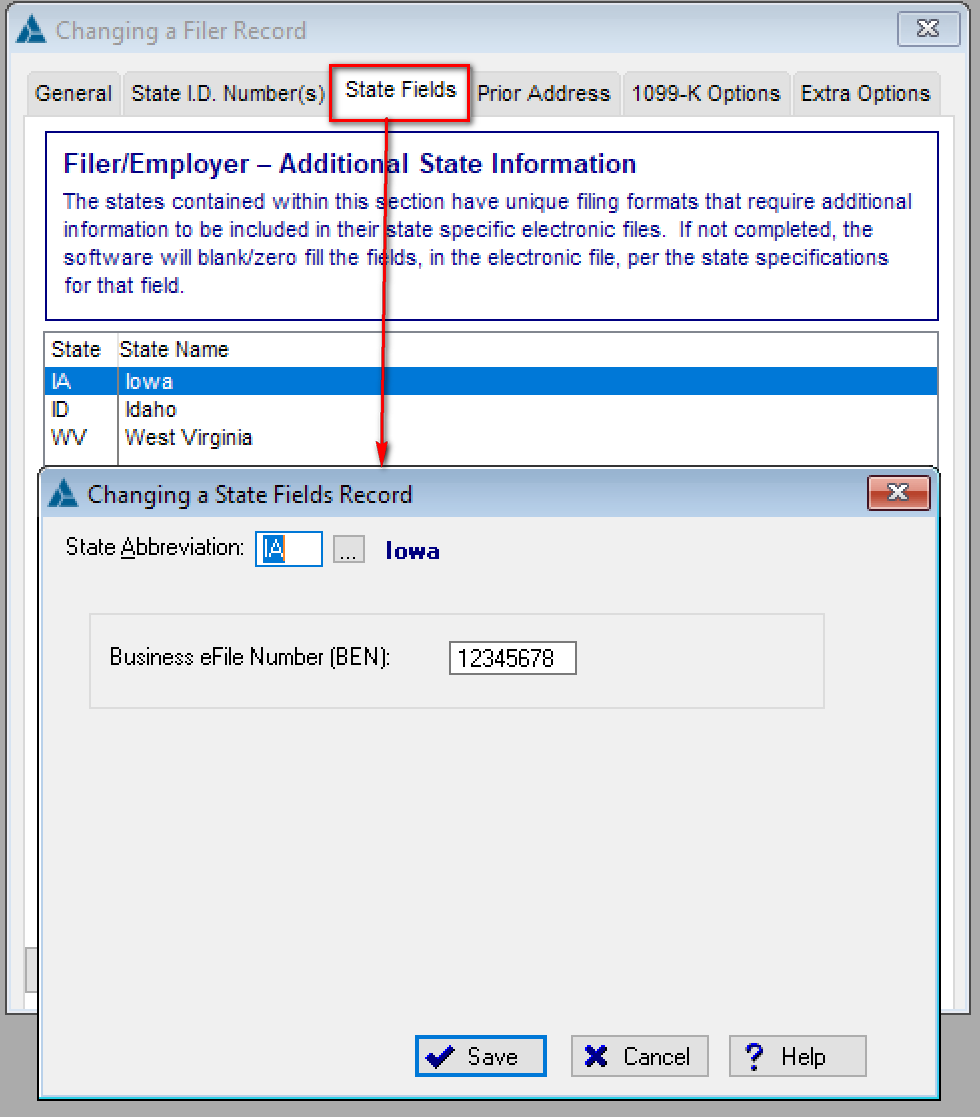

- State Filing - An extra tab was entered to the Filers record called "State Fields". This field captures special information for Iowa (IA) that must be entered in order to accurately file with the state.

- To find this tab, please go to "Manage" filers → Select a Filer → Click on the "State Fields" tab → Click "Add". More information is also in the Help File under the "Special Cases for State Reporting" topic.

- An example of this feature, for Iowa (IA), is below. It depicts how to enter your Business eFile Number (BEN) into the software.

- eFileViewer:

- Latest eFileViewer included, see - eFileViewer v2020.12.10 Release Notes.

FIXED:

- Report Options - Print Summary totals only option has been added back.

Overview

Content Tools