You are viewing an old version of this page. View the current version.

Compare with Current

View Page History

« Previous

Version 8

Next »

IRS Release Status: FINAL

What's New for 2016

- New due date for filing with SSA. The due date for filing 2016 Forms W-2, W-2AS, W-2CM, W-2GU, W-2VI, W-3 and W-3SS with the SSA is now January 31, 2017, whether you file using paper forms or electronically.

- Extensions of time to file. Extensions of time to file Form W-2 with the SSA are no longer automatic. For filings due on or after January 1, 2017, you may request one 30-day extension to file Form W-2 by submitting a complete application on Form 8809, Application for Extension of Time to File Information Returns, including a detailed explanation of why you need additional time and signed under penalties of perjury. The IRS will only grant the extension in extraordinary circumstances or catastrophe. See Extension to file for more information. This does not affect extensions of time to furnish Forms W-2 to employees. See Extension of time to furnish Forms W-2 to employees for more information.

- The sum of social security wages and social security tips is less than the minimum yearly earnings subject to social security and Medicare tax withholding for a household employee, and

- The Medicare wages and tips are less than the minimum yearly earnings subject to social security and Medicare tax withholding for a household employee. If the above conditions occur in an electronic wage report, the SSA will notify the submitter by email or postal mail to correct the report and resubmit it to the SSA.

If the above conditions occur in an electronic wage report, the SSA will notify the submitter by email or postal mail to correct the report and resubmit it to the SSA. If the above conditions occur in a paper wage report, the SSA will notify the employer by email or postal mail to correct the report and resubmit it to the SSA.

Note: Do not write “corrected” or “amended” on any resubmitted reports.

Household employers, see Pub. 926, Household Employer's Tax Guide.

- Social security numbers. Do not truncate social security numbers shown on Forms W-2, W-2AS, W-2GU, and W-2VI. Social security numbers are required on Forms W-2. See Taxpayer identification numbers, later. See also Regulations section 301.6109-(4)(b)(2).

Filers of other forms, such as certain Forms 1099/1098, may truncate the social security number (XXX-XX-4567) to combat identity theft.

- Limit on health flexible spending arrangement (FSA). For 2016, a cafeteria plan may not allow an employee to request salary reduction contributions for a health FSA in excess of $2,550. The salary reduction contribution limitation of $2,550 does not include any amount (up to $500) carried over from a previous year. For more information, see Health flexible spending arrangement (FSA).

- Additional Medicare Tax. In addition to withholding Medicare tax at 1.45%, an employer is required to withhold a 0.9% Additional Medicare Tax on any Federal Insurance Contributions Act (FICA) wages or Railroad Retirement Tax Act (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages or compensation in excess of $200,000 to an employee and continue to withhold it until the end of the calendar year. Additional Medicare Tax is only imposed on the employee. There is no employer share of Additional Medicare Tax. All wages and compensation that are subject to Medicare tax are subject to Additional Medicare Tax withholding if paid in excess of the $200,000 withholding threshold.

For more information on Additional Medicare Tax, go to IRS.gov and enter “Additional Medicare Tax” in the search box.

Unless otherwise noted, references to Medicare tax include Additional Medicare Tax.

- Medicaid waiver payments. Notice 2014-7 provides that certain Medicaid waiver payments are excludable from income for federal income tax purposes. See Notice 2014-7, 2014-4 I.R.B. 445 available at www.irs.gov/irb/ 2014-4_IRB/ar06.html. Also, see www.irs.gov/Individuals/ timely Form W-2 to your employee. For more information, see section 10 in Pub. 15 (Circular E), Employer's Tax Guide.

- Electronic statements for employees. Furnishing Copies B, C, and 2 of Forms W-2 to your employees electronically may save you time and effort. See Pub. 15-A, Employer's Supplemental Tax Guide, Furnishing Form W-2 to employees electronically, for additional information.

- E-filing. The SSA encourages all employers to e-file. E-filing can save you time and effort and helps ensure accuracy. You must e-file if you are required to file 250 or more Forms W-2 or W-2c. If you are required to e-file but fail to do so, you may incur a penalty

- January 31 due date for e-filers. The due date for e-filing 2016 Form W-2 with the SSA is January 31, 2017.

Waiver from e-filing. You can request a waiver from this requirement by filing Form 8508, Request for Waiver From Filing Information Returns Electronically. Submit Form 8508 to the IRS at least 45 days before the due date of Form W-2, or 45 days before you file your first Form W-2c. See Form 8508 for information about filing this form.

The SSA’s BSO website makes e-filing easy by providing two ways to submit your Forms W-2 or W-2c Copy A and Forms W-3 or W-3c information.

- If you need to file 50 or fewer Forms W-2 or 25 or fewer Forms W-2c at a time, you can use BSO to create them online. BSO guides you through the process of creating Forms W-2 or W-2c, saving and printing them, and submitting them to the SSA when you are ready. You do not have to wait until you have submitted Forms W-2 or W-2c to the SSA before printing copies for your employees. BSO generates Form W-3 or W-3c automatically based on your Forms W-2 or W-2c.

- If you need to file more than 50 Forms W-2 or more than 25 Forms W-2c, BSO’s “file upload” feature might be the best e-filing method for your business or organization. To obtain file format specifications, visit the SSA’s Employer W-2 Filing Instructions & Information website at www.socialsecurity.gov/employer, select “Publications & Forms”, click on “Specifications for Filing Forms W-2 and W-2c Electronically (EFW2/EFW2C)”, and select the appropriate document. This information is also available by calling the SSA’s Employer Reporting Service Center at 1-800-772-6270 (toll free).

- If you e-file, do not file the same returns using paper forms.

For more information about e-filing Forms W-2 or W-2c and a link to the BSO website, visit the SSA’s Employer W-2 Filing Instructions & Information website at www.socialsecurity.gov/employer.

In a few situations, reporting instructions vary depending on the filing method you choose. For example, you can include every type of box 12 amount in one employee wage record if you upload an electronic file. If you file on paper or create Forms W-2 online, you can include only four box 12 amounts per Form W-2. See the TIP for Box 12—Codes under Specific Instructions for Form W-2.

- Penalties increased. Higher penalties apply for:

- Failure to file correct Forms W-2 by the due date,

- Intentional disregard of filing requirements,

- Failure to furnish Forms W-2, and

- Intentional disregard of payee statement requirements.

The higher penalty amounts apply to returns required to be filed after December 31, 2015 and are indexed for inflation. See Penalties for more information

- New penalty safe harbor. Forms W-2 with incorrect dollar amounts may fall under a new safe harbor for certain de minimis errors. See Penalties for more information.

- Same-sex marriage. For federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. The term “spouse” includes an individual married to a person of the same sex. However, individuals who have entered into a registered domestic partnership, civil union, or other similar relationship that is not considered a marriage under state law are not considered married for federal tax purposes. For more information, see Revenue Ruling 2013-17, 2013-38 I.R.B. 201, available at https:// www.irs.gov/irb/2013-38_IRB/ar07.html. Notice 2013-61 provides special administrative procedures for employers to make claims for refunds or adjustments of overpayments of social security and Medicare taxes with respect to certain same-sex spouse benefits before expiration of the period of limitations. Notice 2013-61, 2013-44 I.R.B. 432 is available at https://www.irs.gov/irb/2013-44_IRB/ar10.html.

- Third-party sick pay recap reporting. See Form 8922, Third-Party Sick Pay Recap.

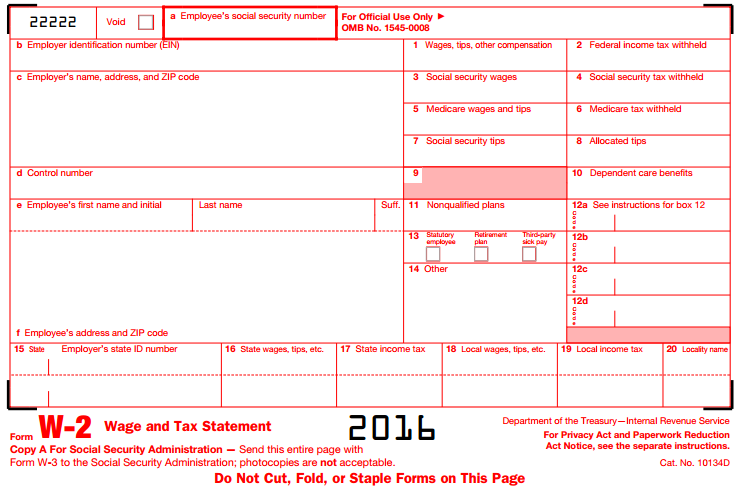

| Field Name | Size | Type | Description | Notes |

|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |

| See Recipient Common Fields | Recipient fields common to all form types. | |

Box 1 Amount | 12 | Amount | Wages, tips, other compen. | |

| Box 2 Amount | 12 | Amount | Federal income tax withheld | |

| Box 3 Amount | 12 | Amount | Social security wages | |

| Box 4 Amount | 12 | Amount | Social security tax withheld | |

| Box 5 Amount | 12 | Amount | Medicare wages and tips | |

| Box 6 Amount | 12 | Amount | Medicare tax withheld | |

| Box 7 Amount | 12 | Amount | Social security tips | |

| Box 8 Amount | 12 | Amount | Allocated tips | |

| Box 10 Amount | 12 | Amount | Dependent care benefits | |

| Box 11 Amount | 12 | Amount | Nonqualified plans | |

| Box 11 is Sect 457 | 1 | Checkbox | Sec 457 checkbox | X / Y / T / 1 = Checked |

| Box 12a Amount | 12 | Amount | See instructions. | |

| Box 12a Code | 2 | Text | See instructions. | |

| Box 12b Amount | 12 | Amount | See instructions. | |

| Box 12b Code | 2 | Text | See instructions. | |

| Box 12c Amount | 12 | Amount | See instructions. | |

| Box 12c Code | 2 | Text | See instructions. | |

| Box 12d Amount | 12 | Amount | See instructions. | |

| Box 12d Code | 2 | Text | See instructions. | |

| Box 13 Checkbox 1 | 1 | Checkbox | Statutory employee checkbox | X / Y / T / 1 = Checked |

| Box 13 Checkbox 2 | 1 | Checkbox | Retire plan checkbox | X / Y / T / 1 = Checked |

| Box 13 Checkbox 3 | 1 | Checkbox | Third-party sick pay checkbox | X / Y / T / 1 = Checked |

| Box 14 All lines | 60 | Text | Other | |

| Box 14 Line 1 | 20 | Text | Other | |

| Box 14 Line 2 | 20 | Text | Other | |

| Box 14 Line 3 | 20 | Text | Other | |

| Box 15 SUTA State | 2 | Text | Withholding State | Use state abbreviation |

| Box 15(1) State ID number | 20 | Text | Employer's state ID number | Provided by State |

| Box 16(1) Amount | 12 | Amount | State wages, tips, etc | |

| Box 17(1) Amount | 12 | Amount | State income tax | |

| Box 18(1) Amount | 12 | Amount | Local wages, tips, etc | |

| Box 19(1) Amount | 12 | Amount | Local income tax | |

| Box 20(1) Locality | 20 | Text | Locality name | |

| See Form Common Fields | Form fields common to all form types | |