- Loading...

IRS Release Status: FINAL

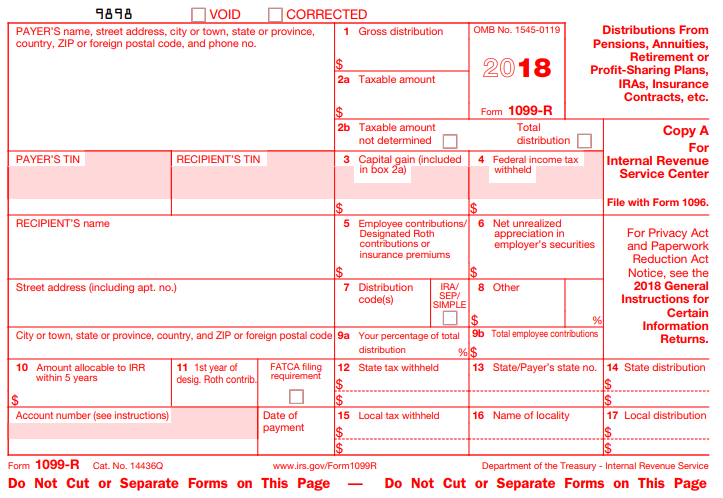

Sample Excel Import File: 1099-R 2018.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| FATCA Checkbox | 1 | Checkbox | FATCA filing requirement | X / Y / T / 1 = Checked |

Box 1 Amount | 12 | Amount | Gross distribution | |

Box 2a Amount | 12 | Amount | Taxable amount | |

| Box 2b Checkbox 1 | 1 | Checkbox | Taxable amount not determined | X / Y / T / 1 = Checked |

| Box 2b Checkbox 2 | 1 | Checkbox | Total distribution | X / Y / T / 1 = Checked |

| Box 3 Amount | 12 | Amount | Capital gain (included in box 2a) | |

| Box 4 Amount | 12 | Amount | Federal income tax withheld | |

| Box 5 Amount | 12 | Amount | Employee contributions/Designated Roth contribution or insurance premiums | |

| Box 6 Amount | 12 | Amount | Net unrealized appreciation in employer's securities | |

| Box 7 Code(s) | 2 | Text | Distribution Code | See IRS instructions |

| Box 8 Amount | 12 | Amount | Other | |

| Box 8 Number | 2 | Numeric | Other percentage | 0 - 99 |

Box 9a Number | 2 | Numeric | Your percentage of total distribution | 0 - 99 |

| Box 9b Amount | 12 | Amount | Total employee contributions | |

| Box 10 Amount | 12 | Amount | Amount allocable to IRR within 5yrs | |

| Box 11 Roth Year | 4 | Numeric | 1st year of Roth contribution | YYYY |

| Box 12 Amount | 12 | Amount | State tax withheld | |

| Box 13 ID Number | 20 | Text | State/Payer's state no. | Given by State Department of Revenue |

| Box 13 State | 2 | Text | State abbreviation code | Use state abbreviation |

| Box 14 Amount | 12 | Amount | State distribution | |

| Box 15 Amount | 12 | Amount | Local tax withheld | |

| Box 16 Name | 15 | Text | Name of locality | |

| Box 17 Amount | 12 | Amount | Local distribution | |

| See Form Common Fields | Form fields common to all form types. | |||

1099-R Form:

IRS 1099-R Form: 2018 1099-R Form

IRS 1099-R Instructions: 2018 1099-R Instructions

Overview

Content Tools