- Loading...

Release Notes

IMPORTANT: You will need a 2018 Authorization Code starting with the letter 'B' BEFORE installing this update!

NEW: 2018 Forms are now available

Form Changes for 2018:

- Form 1098: After box 8, all boxes shifted down by 1, box 9 is now “Number of Properties”.

- Form 1098-T: Removed box 2 "Amounts billed for qualified tuition and related expenses".

- Form 1099-DIV: New box 5 added “Section 199A dividends”, all the following boxes we renumbered.

- Form 1099-R: New box added “Date of payment”.

- Form 5498 - New PO code supported.

- Form 1042-S - 2017 Box 11 has now moved to Box 9: Overwithheld tax repaid to recipient pursuant to adjustment procedures; Box 9 has now moved to Box 11: Tax paid by Withholding Agent

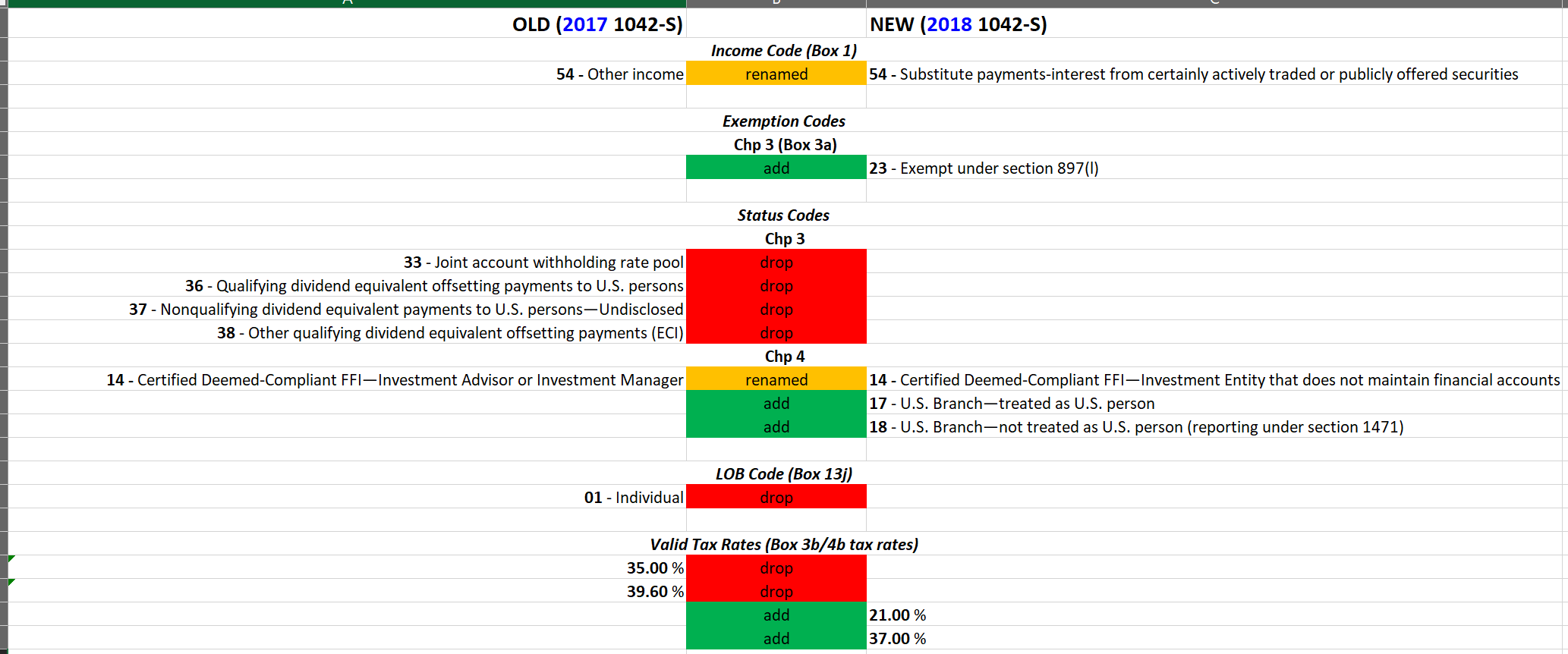

IMPORTANT: Please review the following 2018 1042-S code changes and make any required changes to your data or imports. - W-2 - New GG box 12 codes supported.

NEW: All final 2018 IRS PDF's & Instructions added.

NEW: Report to display unfiled forms.

NEW: User preference added for TIN conversion for zero tins on import.

NEW: Pro Central home screen that provides high level task overview, due dates, links to help videos and services.

UPDATED: 2018 W-2 maxiumum/limits.

UPDATED: Latest GIIN list included.

UPDATED: Visual enhancements to overall user interface.

UPDATED: Business rules are updated for the 2018 form changes.

UPDATED: Comprehensive help file is overhauled.

UPDATED: Scheduler, Forms and Report Manager services updated to log more information.

UPDATED: The electronic filing module has been activated for creating electronic files for submission to the IRS/SSA.