- Loading...

Release Notes

NEW:

Printing:

- 2021 W-2G new print layout v5 to accommodate new multi-year format plus text change from “I.D”. to “Identification”. This change will now only affect printing 2021 forms and up. (CS-3216)

Reports:

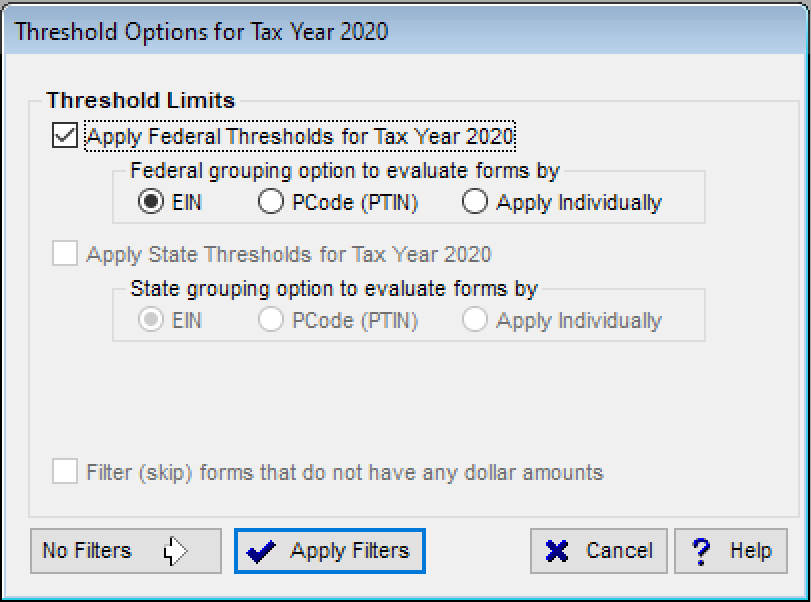

- Unfiled Forms and Form Counts by Filer - Now allow the user to apply Federal Thresholds to the report. (CS-2754)

- For example, users can now exclude records, that are below federal thresholds, from showing up on the Unfiled Forms Summary Report. This makes it so that the report only shows records that are above threshold and should have been filed.

- See the Help File for a complete walk through on how to use the feature.

State Filing:

- State Quarterly Filing - Added Quarterly Withholding Excel output file type for Maine (ME) only. This is to be utilized for 941ME quarterly reporting. (CS-1554)

UPDATED:

2021 IRS/SSA Updates:

- 2021 1099-NEC - Removed FATCA checkbox. (CS-3272)

- 2021 1099-PATR IRS Updates (CS-3260)

- 3 box 12 credits have been removed

- Bio fuels credit incl 2nd gen biofuel

- Renewal elec, refined/Indian coal credit

- Indian employment credit

- 3 box 12 credits have been removed

- 2021 W-2G - Renamed Box 11 & 12 (CS-3215)

- 2021 1042-S - New code for box 3A - Code 24 "Exempt under section 892".

FIXED:

Electronic Filing:

- 2019 480.6SP/6G mag generation. (CS-3270)

- Modified mag to not remove ‘Miss’ prefix from first name if not followed by a space (now allows for first name Missy, Missouri, etc.) (CS-3021)

- 1042-S - Box 7c correction now uses 2-step correction process. (CS-3204)

- 1042-S - Changed subsequent year W/H for corrections from 1-step to 2-step correction process. (CS-3204)

State Filing:

- State Subset, Puerto Rico & Quarterly - Implemented record filtering for Single Form Selection. (CS-3255)

Form Entry:

- Zip Code Lookup - State abbreviation is now case insensitive. (CS-229)

- 1099-S - Cannot create correction when unchecking box 5. (CS-3241)

Federal Thresholds:

- 1099-DIV IRS Threshold updated to spec for 2016 - 2021 (CS-1399)

Printing:

- 1042-S - Add batch option to Print Mail Forms Myself. (CS-3224)

- 1042-T - Added 1e checkbox to state version of 1042-T.

- Advanced Print Options for all recipient copies C and 2, similar to the standard copy B handling, is now available. (CS-3220)

- 1099-LS Copy C is now enabled in Advanced Options selection. (CS-3152)

Reports:

- 1099-R>Report> Forms Total Report - Headers for box amounts were missing. (CS-2978)

- 2020 State Quarterly Report - Performed Illegal operation error when attempting to process report. (CS-3263)

Business Rules & Validations:

- Consolidating 1095-B R14 and R15 into a single rule R14: Incomplete P II employer info. (CS-3230)

Security & Administration:

- Fixed incorrect Administrator/Security Setting Pop-Up when tagging all forms if form was being filtered (no access rights.) (CS-3245)

General:

- Large Update Statement caused SQL Server to Crash. (CS-3237)

- Fixed issue with Update statement being executed more than once in State SubSet process.

- Improvements to State Thresholds to speed up the process. (CS-2039)

Import:

- Import Wizard Header text is cut off within the window. (CS-3250)

Scheduler:

- 1099-NEC, 1099-K and 592-B - Service Bureau Upload would fail to complete when scheduled in Scheduler. (CS-2723)

Overview

Content Tools