- Loading...

IRS Release Status:FINAL

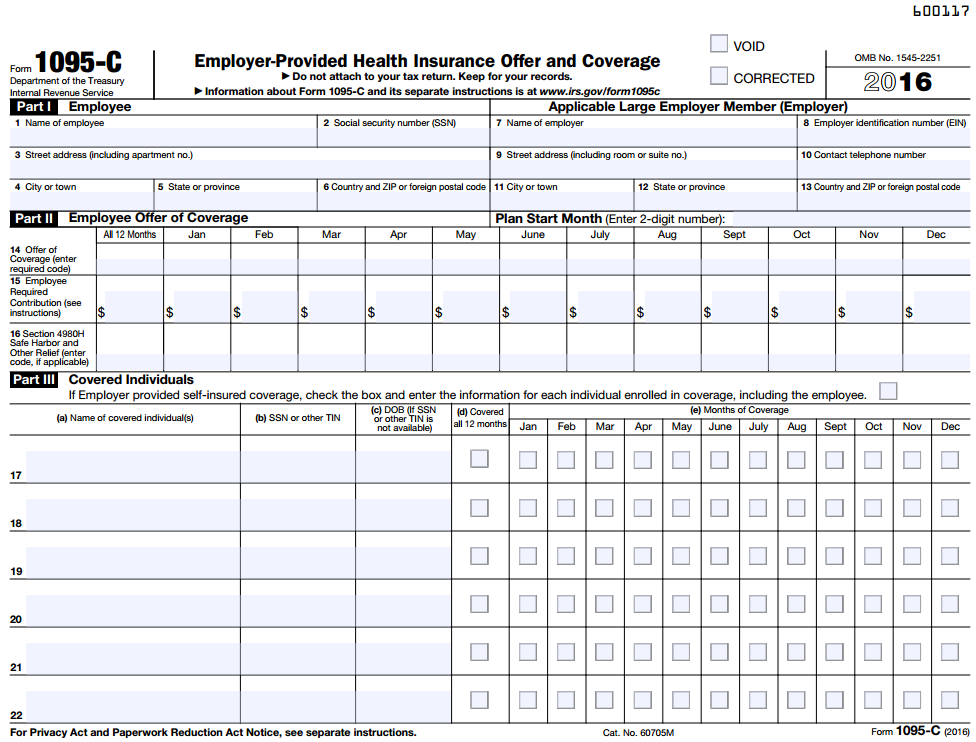

Sample Excel Import File: 1095-C 2016.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes | Part |

|---|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | ||||

| See Recipient Common Fields | Recipient fields common to all form types. | ||||

| Box 1 - 6 Employee | Character | Employee | Filer Info | Part I | |

| Box 7-13 ALE MEMBER (Employer) | Character | Applicable Large Employer Member | Recipient Info | Part I | |

Box 1 Name | 40 | Text | Box 1: Name of employee | Part I | |

| Box 2 TIN | 11 | TIN | Box 2: Social security number (ssn) | Part I | |

| Box 3 Address Deliv/Street | 40 | Character | Box 3: employee address | Recipient address line 1 | Part I |

Box 4 City | 40 | Character | Box 4: employee city | Recipient city | Part I |

| Box 5 State | 2 | Character | Box 5: employee State or province | Recipient US state or Canadian province (Use state abbreviation) | Part I |

| Box 6 Zip | 10 | Character | Box 6: employee zip | Recipient US zip or Canadian postal code | Part I |

| Box 7 Name | 40 | Character | Box 7: Name of employer | Filer Name or company name | Part I |

| Box 8 TIN | 11 | Character | Box 8: Employer identification number (EIN) | Filer TIN (EIN or SSN) | Part I |

| Box 9 Address Deliv/Street | 40 | Character | Box 9: Employer street address (including room or suite) | Filer address line 1 | Part I |

| Box 10 Contact | 20 | Character | Box 10: Contact telephone number | Filer contact phone number | Part I |

| Box 11 City | 40 | Character | Box 13: Employer city | Filer city | Part I |

| Box 12 State | 2 | Character | Box 14: Employer State | Filer US state or Canadian province (Use state abbreviation) | Part I |

| Box 13 Zip | 10 | Character | Box 13: Employer Zip | Filer US zip or Canadian postal code | Part I |

| Box 14 Offer coverage | 2 | Code | Box 14: Offer of Coverage (enter required code) | 1A / 1B / 1C / 1D / 1E / 1F / 1G / 1H / 1J / 1K (All12Months or Jan - Dec) | Part II |

| Box 15 Month Premium | 12 | Amount | Box 15: Employee Share of lowest cost monthly premium.... | All12Months or Jan - Dec | Part II |

| Box 16 Safe harbor | 2 | Code | Box 16: Applicable Section 408H Safe Harbor.... | 2A / 2B / 2C / 2D / 2E / 2F / 2G / 2H / (All12Months or Jan - Dec) | Part II |

| Box 17- 34 Covered Individuals | Character | Covered Individuals | Employee Dependents | Part III | |

| Last Name/Company | 40 | Character | Covered Individual last name | Part III | |

| Middle Initial | 12 | Character | Covered Individual Middle initial | Part III | |

| First Name | 40 | Character | Covered Individual first name | Part III | |

| Suffix | 2 | Character | Covered Individual suffix | Jr , Sr | Part III |

| Name Line 2 | 40 | Character | Covered Individual name line 2 | Additional name line | Part III |

| Social Security Number | 11 | TIN | Covered Individual SSN | Part III | |

| Date of Birth | 10 | Date | Covered Individual DOB (if SSN is not available) | MM/DD/YYYY or M/D/YYYY | Part III |

| Covered All 12 Months | 1 | Checkbox | Covered Individual covered all 12 months | X / Y / T / 1 = Checked | Part III |

January Coverage | 1 | Checkbox | January Coverage | X / Y / T / 1 = Checked | Part III |

| February Coverage | 1 | Checkbox | February Coverage | X / Y / T / 1 = Checked | Part III |

| March Coverage | 1 | Checkbox | March Coverage | X / Y / T / 1 = Checked | Part III |

| April Coverage | 1 | Checkbox | April Coverage | X / Y / T / 1 = Checked | Part III |

| May Coverage | 1 | Checkbox | May Coverage | X / Y / T / 1 = Checked | Part III |

| June Coverage | 1 | Checkbox | June Coverage | X / Y / T / 1 = Checked | Part III |

| July Coverage | 1 | Checkbox | July Coverage | X / Y / T / 1 = Checked | Part III |

| August Coverage | 1 | Checkbox | August Coverage | X / Y / T / 1 = Checked | Part III |

| September Coverage | 1 | Checkbox | September Coverage | X / Y / T / 1 = Checked | Part III |

| October Coverage | 1 | Checkbox | October Coverage | X / Y / T / 1 = Checked | Part III |

| November Coverage | 1 | Checkbox | November Coverage | X / Y / T / 1 = Checked | Part III |

| December Coverage | 1 | Checkbox | December Coverage | X / Y / T / 1 = Checked | Part III |

| See Form Common Fields | Form fields common to all form types. |

1095-C Form:

IRS 1095-B Form: 1095-C Form

IRS 1095-B Instructions: 1095-C Instructions

Overview

Content Tools