- Loading...

Release Notes

IMPORTANT: You will need a 2019 Authorization Code starting with the letter 'C' BEFORE installing this update!

NEW:

- Importing - The import Load Wizard has been converted to a flat wizard.

- Flat Wizard - An interface that combines the options from the different steps (i.e 10-15 different steps) into a single interactive screen where the user can see, and select from, all available options.

- Importing - The import Post Wizard has been converted to a flat wizard.

- Service Bureau - Mail Tracking ability has been added for forms that have been printed & mailed through the Secure 1099 Pro Service Bureau. Simply select the form, from the "Work With My Tax Forms" screen, that has been printed through the Service Bureau and click the "Track" button near the bottom right.

- Mail Tracking - Shows real-time results, from the USPS, of when/where the piece of mail was last scanned into the mail stream. This can be used as proof that a form was mailed and to estimate the time of delivery.

- Mail Tracking is not Certified Mail (which requires a signature upon acceptance).

- Electronic Filing - Flat wizards are available for 1099, W-2, & 1042-S federal electronic filing wizards (similar to the Service Bureau flat wizards).

- Other filing processes, such as state direct reporting or quarterly reporting, will be converted to flat wizards in future updates.

- State Filing - Added a progress bar to the process of resetting multiple state sessions.

- General - Print/Report Page Length - That software now supports print jobs, or extended reports, with an unlimited number of pages.

- The previous limit was ~65,000 pages.

- 2019 IRS/SSA Updates - All final 2019 IRS PDF's & Instructions included.

- 2019 IRS/SSA Updates - 2019 samples files are included. A complete set can also be found here - 2019 Tax Year - Import Templates and Maps.

- 2019 Forms are now available. New forms and changes are listed below.

- Form 1098: New Box 11 Mortgage Acquisition Date

- Form 1098-T: Removed Box 3

- Form 1098-F: Fines, Penalties and Other Amounts (*New Form*).

- Form 1099-G: New Checkbox for 2nd TIN Notice

- Form 1099-PATR : New Box 7 Qualified Payments

- Form 1099-B:

- 2018 Check Box 3 → 2019 Check Box 12,

- 2018 Check Box 12 → 2019 Check Box 3 Part 1

- New Check Box 3 -Part 2 Qualified Opportunity Fund (QOF)

- Form W-2: Box 9 removed.

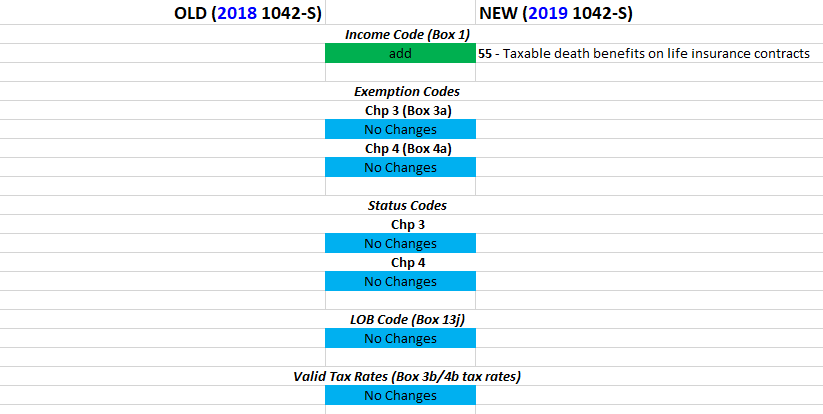

- Form 1042-S:

- New Box 1 Income Code.

- New Checkbox 7c.

- New and Updated 1042-S form codes

IMPORTANT: Please review the following 2019 1042-S code changes and make any required changes to your data or imports.

UPDATED:

- 2019 IRS/SSA Updates - 2019 W-2 maximums/limits.

- 2019 IRS/SSA Updates - Latest GIIN list included.

- 2019 IRS/SSA Updates - Business rules are updated for the 2019 form changes.

- 2019 IRS/SSA Updates - W-2G withholding options updated.

- Electronic Filing - Updated threshold processing to improve electronic filing speed.

- Form Entry - Name Line 3 is now able to be viewed/edited when correcting a 1042-S.

- Printing - The "Force X in Void Checkbox" option has been removed from Advanced Printing Options. This is because the Void checkbox is no longer included on the IRS forms.

- Reports - Address Corrections are no longer counted as "Need to File" on the Unfiled Forms Summary Report.

- Recipient List - Optimized performance (improved speed) of the "Delete All With No Forms" option from the Recipient List.

- Security & Administration - Removed ASP update options for how to control form status changes from an ASP Quick Print. This now exclusively controlled from the ASP Module preferences.

- General - Visual enhancements to modernize the user interface.

- General - Comprehensive help file is overhauled.

FIXED:

- Electronic Filing - Name Line 3 was not being generated in a 1042-S eFile (Pub 1187 format).

- Electronic Filing - CFS corrections were being updated with the incorrect "Filed via CFS" status.

- ACA - ALE members starting with 0 on 1094-C was software to crash.

- General - A number of other small fixes and enhancements are also included in this release.

Overview

Content Tools