- Loading...

Release Notes

*Please refer to IRS instructions for full detail of 2020 changes (http://www.irs.gov/pub/irs-pdf/i1042s.pdf)

UPDATED:

- Built in reports have been updated form the form changes.

- All default maps and sample import files have been updated for 2020.

- Print layouts for all copies have been updated for 2020.

- All help files have been updated for 2020.

FORM CHANGES:

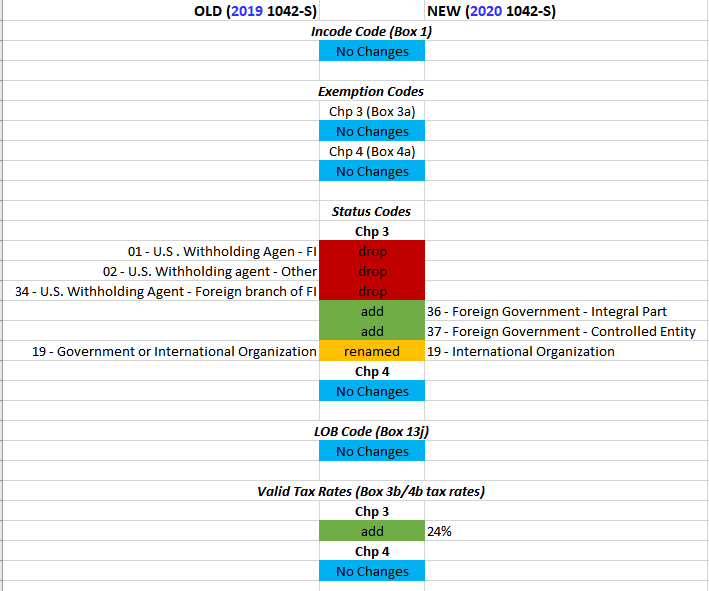

- Box 3b/4b - tax rates - Revised backup withholding rate under section 3406 (24%) has been added to Valid Tax Rate Table.

- Boxes 12b, 12c, 13f, 13g, 15b, 15c, 16d, and 16e (Chapter 3 Status Code)

- Deleted: Chapter 3 Status Codes: 01 (U.S. Withholding Agent - FI), 02 (U.S. Withholding Agent - Other), 34 (U.S. Withholding Agent - Foreign branch of FI)

- Added: Chapter 3 Status Codes: 36 (Foreign Government - Integral Part), 37 (Foreign Government - Controlled Entity)

- Updated: Chapter 3 Status Code: 19 is updated from “Government or International Organization” to “International Organization.”

- Box 7c Checkbox "Check if withholding occurred in subsequent year with respect to a partnership interest" has been added.

- Box 12f - country code - If the withholding agent is a U.S. person or a foreign branch of a U.S. person, filers are now permitted to enter “US” in box 12f even though "US" is not a code on the list IRS.gov/CountryCodes

IMPORTANT: Please review the following 2020 1042-S code changes and make any required changes to your data or imports.

Overview

Content Tools