- Loading...

IRS Release Status: FINAL

Import Form Fields:

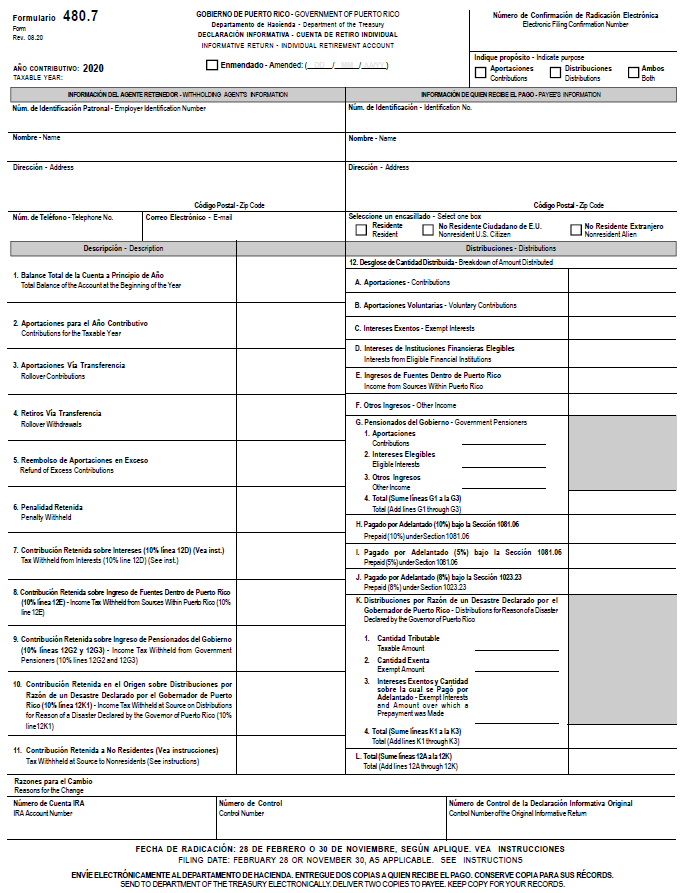

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| Box Resident PR Chk | 1 | Checkbox | Recipient Status - Resident | X / Y / T / 1 = Checked Only one Recipient Status Checkbox can be selected per form. |

| Box Nonres US Chk | 1 | Checkbox | Recipient Status - Nonresident U.S. Citizen | X / Y / T / 1 = Checked Only one Recipient Status Checkbox can be selected per form. |

| Box Nonres Alien Chk | 1 | Checkbox | Recipient Status - Nonresident Alien | X / Y / T / 1 = Checked Only one Recipient Status Checkbox can be seleced per form. |

| Type Both Chk | 1 | Checkbox | Indicate Form Purpose - Contributions | X / Y / T / 1 = Checked Only one Recipient Type Checkbox can be selected per form. |

| Type Contributions | 1 | Checkbox | Indicate Form Purpose - Distributions | X / Y / T / 1 = Checked Only one Recipient Type Checkbox can be selected per form. |

| Type Distributions | 1 | Checkbox | Indicate Form Purpose - Both | X / Y / T / 1 = Checked Only one Recipient Type Checkbox can be selected per form. |

Box 1 Amount | 12 | Amount | Total balance at the beginning of year | |

| Box 2 Amount | 12 | Amount | Contributions for the taxable year | |

| Box 3 Amount | 12 | Amount | Rollover contributions | |

| Box 4 Amount | 12 | Amount | Rollover withdrawals | |

| Box 5 Amount | 12 | Amount | Refund of excess contributions | |

| Box 6 Amount | 12 | Amount | Penalty withheld | |

| Box 7 Amount | 12 | Amount | Tax w/h from interest (10% line 12D) | |

| Box 8 Amount | 12 | Amount | Tax w/h inc from PR (10% line 12E) | |

| Box 9 Amount | 12 | Amount | Tax w/h inc gov pension (10% 12G2-12G3) | |

| Box 10 Amount | 12 | Amount | Tax w/h at source on eligible dist (declared disaster) 10% line 12K1) | |

| Box 11 Amount | 12 | Amount | Tax w/h at source to nonresidents | |

| Box 12a Amount | 12 | Amount | Contributions | |

| Box 12b Amount | 12 | Amount | Voluntary contributions | |

| Box 12c Amount | 12 | Amount | Exempt interest | |

| Box 12d Amount | 12 | Amount | Interest from eligible financial ins | |

| Box 12e Amount | 12 | Amount | Income from sources within PR | |

| Box 12f Amount | 12 | Amount | Other income | |

| Box 12g1 Amount | 12 | Amount | Gov pensioners contributions | |

| Box 12g2 Amount | 12 | Amount | Gov pensioners eligible interest | |

| Box 12g3 Amount | 12 | Amount | Gov pensioners other income | |

| Box 12g4 Amount | 12 | Amount | Total (Add lines G1 through G3) | |

| Box 12h Amount | 12 | Amount | Prepaid (10%) under section 1081.06 | |

| Box 12i Amount | 12 | Amount | Prepaid (5%) under section 1081.06 | |

| Box 12j Amount | 12 | Amount | Prepaid (8%) under section 1023.23 | |

| Box 12 K1 Amount | 12 | Amount | Taxable amount (declared disaster) | |

| Box 12 K2 Amount | 12 | Amount | Exempt amount (declared disaster) | |

| Box 12 K3 Amount | 12 | Amount | Exempt interest and amount over which a prepayment was made (declared disaster) | |

| Box 12 K4 Amount | 12 | Amount | Total (Add lines K1 through K3) | |

| Box 12l Amount | 12 | Amount | Total (Add lines 12A through 12K) | |

| See Form Common Fields | Form fields common to all form types. | |||

480.7 Form:

Hacienda form and instructions: 480.7_2020_informativo.pdf

Overview

Content Tools