- Loading...

1099 Pro Case Study : Global Processes Vol 3

The Situation

Big Four Accounting had long been plagued with the difficulties associated with global operations. Global operations required Big Four Accounting to coordinate functions across time zones, languages, and systems that would then need to be synchronized by a central tax management team and system. The central tax management team soon identified that their major concerns for tax software stemmed from two key functions: global access and automated processes. Furthermore, any future solution would need to be intuitive, allowing for new users to move along the learning curve quickly, and would also need to be able to process high volumes of file transfers quickly and securely.

Company Background

Big Four Accounting is a multinational service firm that offers a plethora of professional services. Since inception, in the mid-1800’s, Big Four Accounting has grown its empire to include offices in 159 countries, across in 776 cities, and employment of over 180,000 people. Big Four Accounting is recognized as the leading provider of tax services worldwide - both in terms of size and scope of its tax practice and reputation. Furthermore, Big Four Accounting is also acknowledged as the leader in the debate for tax policy reform with tax authorities and governments around the world. As such, Big Four Accounting’s tax processing obligation has grown to a volume of 100,000 records over seven form types of: 1099-B, 1099-DIV, 1099-INT, 1099-MISC, 1099-OID, & 1042-S.

Worldwide Access

Big Four Accounting opted to use 1099 Pro in an externally hosted environment in which users are able to securely access 1099 Pro Corporate Suite from anywhere in the world. 1099 Pro’s ability to provide SSL-VPN connections for terminal sessions to the Corporate Suite software and secure HTTPS connections through 1099Pro.NET allowed for distinction between administrative (terminal) and lower-level (1099Pro.NET web portal) access while also providing global access required by Big Four Accounting. Secondly, 1099Pro.NET’s web portal accessibility through a wide variety of browsers such as Internet Explorer, Google Chrome, Mozilla Firefox, and Apple Safari further supported Big Four Accounting’s global structure as different offices operate with different browsers.

Interestingly, Big Four Accounting realized a second, unexpected, benefit from the Corporate Suite software. The Corporate Suite software provided for generalized access groups to be pre-configured, with specified access and security settings, to which new user profiles could simply be added without management have to individually set up tens of thousands of employees.

Process Automation

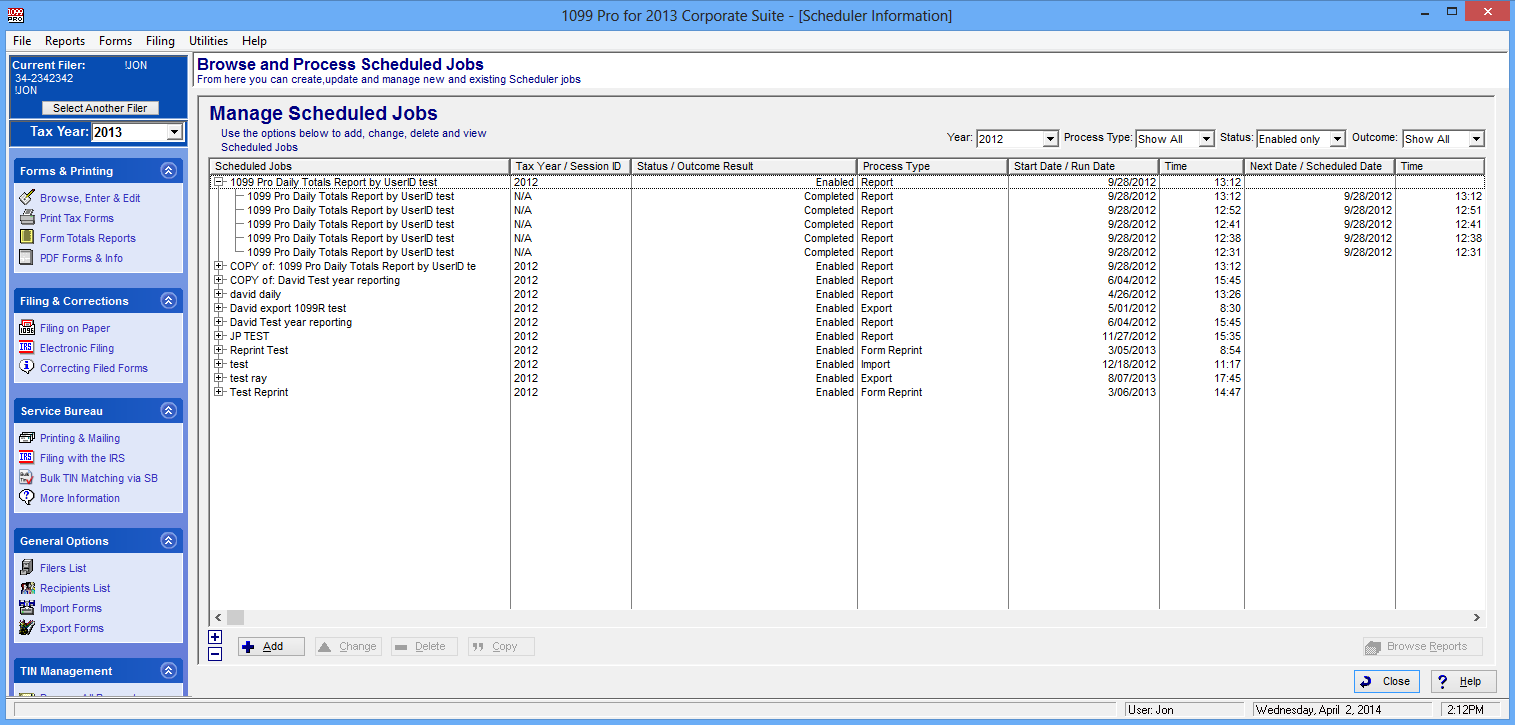

The second key feature required by Big Four Accounting was the ability to automate processes. Rather than coordinate functions across 159 countries, Big Four Accounting preferred to set up standard protocols that would allow Corporate Suite software functions to run without repeat coordination by the central tax management team. Corporate Suite’s Scheduler served this purpose exactly. As an example, the Scheduler feature allowed management to designate specific directories to import files from - directories that are then scanned every five minutes by Scheduler. This process also insured that Big Four Accounting’s information was continuously up to date.

Furthermore, management was able to schedule certain directories, with extremely large files, to only be scanned and imported during off-business hours. This proved to decrease the server load and increase productivity during business hours in major offices. As the benefit of this process gained traction, Big Four Accounting began applying the scheduler timing feature regionally in order to further realize the related benefits. As an additional advantage, the Scheduler feature allowed management to configure it so that email reports were sent in the case of any import files that contained errors or warnings.

Most recently, Big Four Accounting has applied the Scheduler feature to other responsibilities, such as report generation, in order to further decrease manual activity in favor of automation.

Additional Services

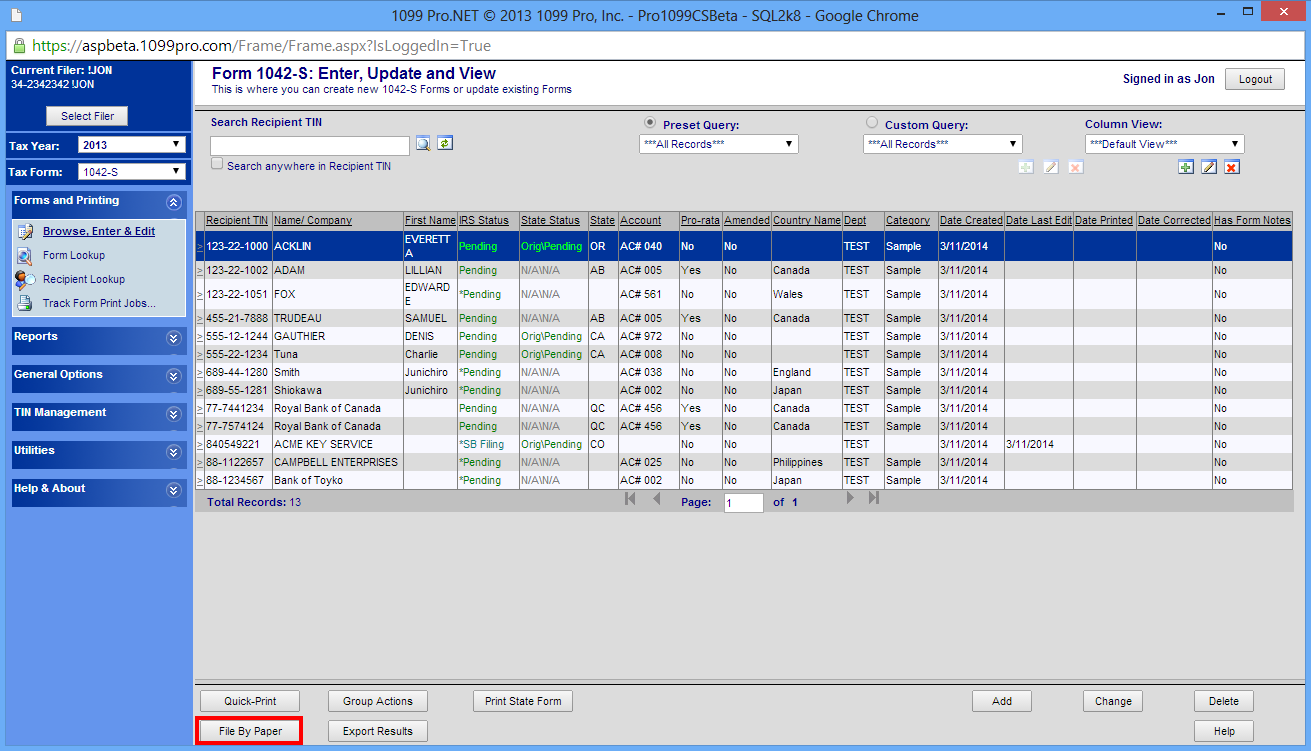

In an effort to further streamline the information reporting function, Big Four Accounting chose to use 1099 Pro’s Service Bureau for printing, mailing, and e-filing services. This effort served the two key purposes of standardizing the methodology and format for the printing, mailing, and e-filing processes as well as to provide a uniform job tracking mechanism (as the Corporate Suite software automatically tracks all printing, mailing, and e-filing jobs sent through the Service Bureau).

In the case of single print jobs, management opted for Corporate Suite’s 1099Pro.NET web interface to email encrypted PDF’s to the recipient. Management, no doubt, recognized the cost-savings and time-savings involved with handling the single jobs immediately and benefitted from quick service levels in tandem with the built-in security of the encrypted PDF mailer.

Process Specialization

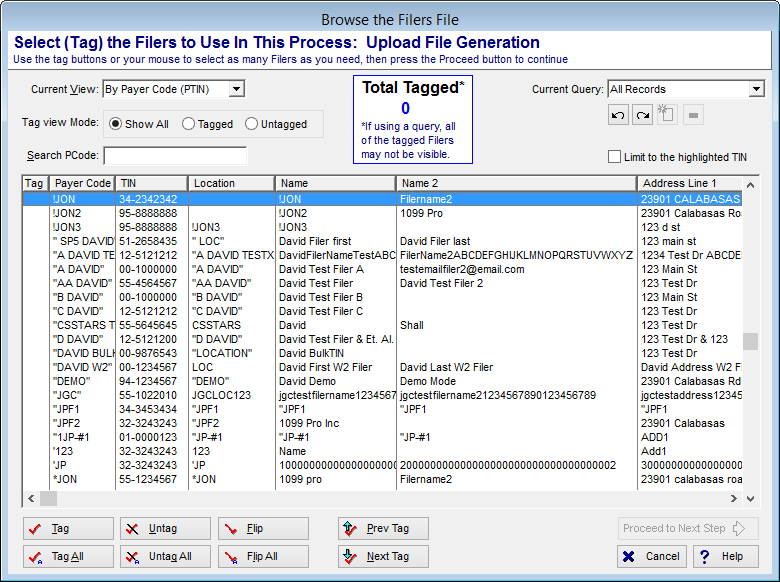

One year from the initial software rollout had passed and Big Four Accounting felt confident that they had mastered the many value-added features of the software. However, Big Four Accounting felt that there could be vast internal efficiency improvements if certain new features could be added to accommodate them.

One such feature was to introduce a specific filter for searching through the thousands of filing entities when selecting just a small number to submit data from. Shortly after, 1099 Pro setup a conference call to discuss the aspects of the new feature as well as the possible implementation and timeframe. To management’s surprise, 1099 Pro quickly introduced a beta version of the concept and further refined the concept around Big Four Accounting’s feedback.

Reflection

The overall relationship between Big Four Accounting and 1099 Pro continues to prove beneficial on both ends. While not every new feature or request is integrated into the software, the central tax management team feels that their opinion is taken very seriously and have voiced support of 1099 Pro’s Corporate Suite software by continuously renewing their contract as well as expanding the software into the furthest countries of Big Four Accounting’s operations.

Exhibit 1: Managing Scheduled Jobs through Scheduler

Exhibit 2: Filing 1042-S by Paper from 1099Pro.NET

Exhibit 3: Browse the Filers File During Service Bureau Filing Wizard

A PDF copy of this case study can be downloaded here : 1099 Pro Case Study - Global Processes Vol 3.pdf