- Loading...

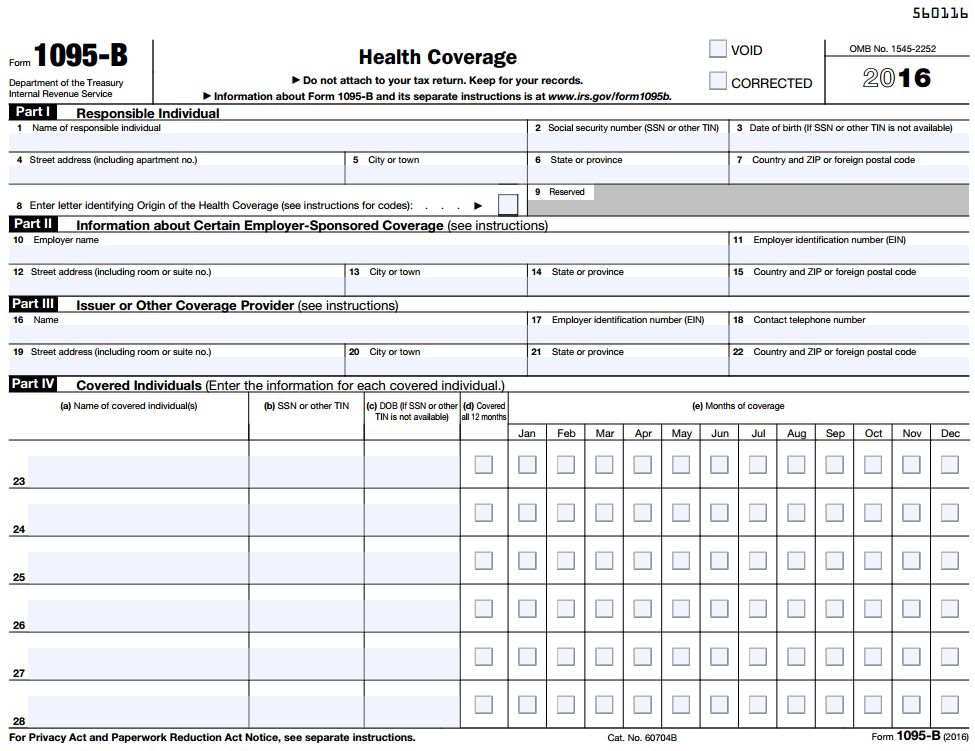

IRS Release Status: FINAL

Sample Excel Import File: 1095-B 2016.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | ||||

| See Recipient Common Fields | ||||

| Rcp Email | 65 | Text | ||

| Rcp IMB | 65 | Text | ||

| Tax State | 2 | Text | ||

| Emp TIN | 11 | Numeric | Part II: Employer EIN | |

| Emp TIN Type | 1 | Numeric | Part II: Employer TIN Type | EIN=1, SSN=2, Unknown type=0 or blank |

| Emp Address Type | 1 | Text | Part II: Employer Address Type | |

| Emp Country Code | 2 | Text | Part II: Country Code | |

| Emp Country Key | 1 | Numeric | Part II: Country Key | |

| Emp Name 1 | 40 | Text | Part II: Employer Name 1 | |

| Emp Name 2 | 40 | Text | Part II: Employer Name 2 | |

| Emp Address 1 | 40 | Text | Part II: Employer Street Address | |

| Emp Address 2 | 40 | Text | Part II: Employer Suite/Apt | |

| Emp City | 40 | Text | Part II: City | |

| Emp State | 23 | Text | Part II: Employer State/Province | |

| Emp Zip | 15 | Text | Part II: Employer Zip/Postal Code | |

| Rcp Date of Birth | 8 | Date | Recipient date of birth | MM/DD/YYYY or M/D/YYYY |

| Policy Origin Code | 2 | Text | Letter identifying the origin of the policy | |

| Ind All Coverage Chk | 1 | Checkbox | Individual: Covered all 12 months checkbox | X / Y / T / 1 = Checked |

| Ind Apr Coverage Chk | 1 | Checkbox | Individual: Covered for April checkbox | X / Y / T / 1 = Checked |

| Ind Aug Coverage Chk | 1 | Checkbox | Individual: Covered for August checkbox | X / Y / T / 1 = Checked |

| Ind Dec Coverage Chk | 1 | Checkbox | Individual: Covered for December checkbox | X / Y / T / 1 = Checked |

| Ind Feb Coverage Chk | 1 | Checkbox | Individual: Covered for February checkbox | X / Y / T / 1 = Checked |

| Ind Jan Coverage Chk | 1 | Checkbox | Individual: Covered for January checkbox | X / Y / T / 1 = Checked |

| Ind Jul Coverage Chk | 1 | Checkbox | Individual: Covered for July checkbox | X / Y / T / 1 = Checked |

| Ind Jun Coverage Chk | 1 | Checkbox | Individual: Covered for June checkbox | X / Y / T / 1 = Checked |

| Ind Mar Coverage Chk | 1 | Checkbox | Individual: Covered for March checkbox | X / Y / T / 1 = Checked |

| Ind May Coverage Chk | 1 | Checkbox | Individual: Covered for May checkbox | X / Y / T / 1 = Checked |

| Ind Nov Coverage Chk | 1 | Checkbox | Individual: Covered for November checkbox | X / Y / T / 1 = Checked |

| Ind Oct Coverage Chk | 1 | Checkbox | Individual: Covered for October checkbox | X / Y / T / 1 = Checked |

| Ind Sep Coverage Chk | 1 | Checkbox | Individual: Covered for September checkbox | X / Y / T / 1 = Checked |

1095-B Form:

IRS 1095-B Form: 1095-B Form

IRS 1095-B Instructions: 1095-B Instructions

Overview

Content Tools