- Loading...

IRS Release Status: FINAL

Sample Excel Import File (W-2 Professional): W2 2023.xlsx

Sample Excel Import File (Corporate Suite): W2 2023 (CS).xlsx

Sample Excel Import File with internal recipient fields (Corporate Suite) : W2 2023 with rcp fields.xlsx

Import Form Fields:

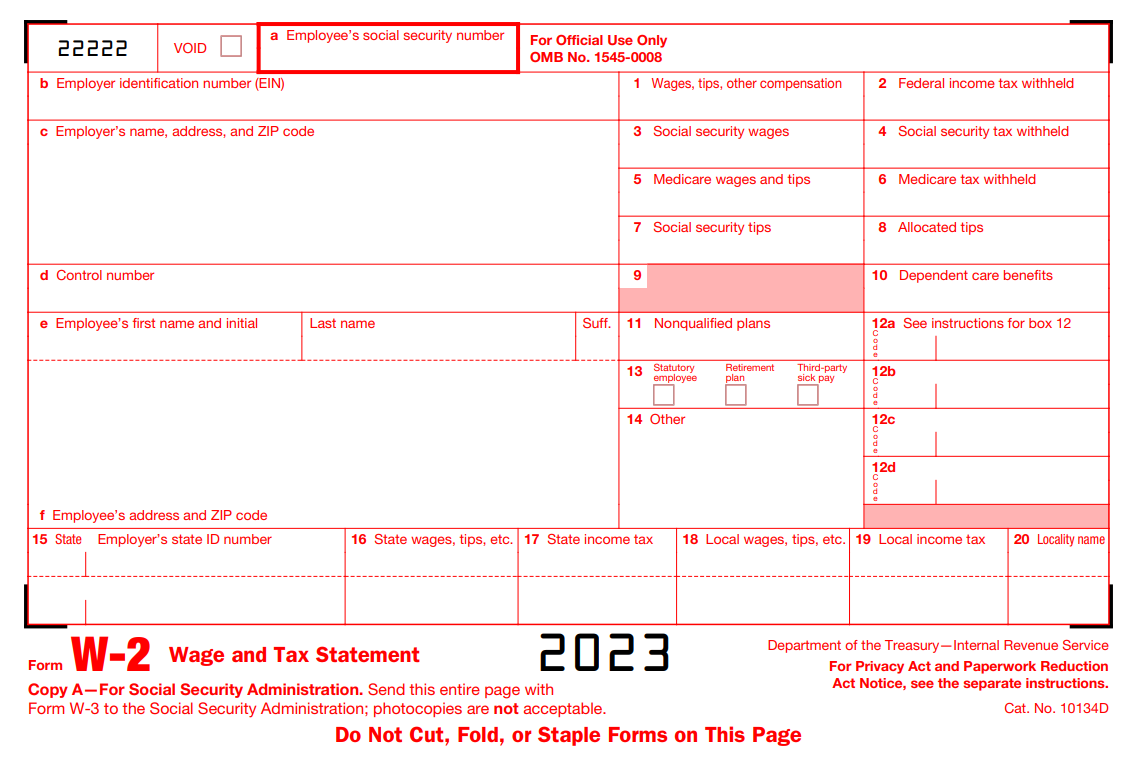

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Box 1 Amount | 12 | Amount | Box 1: Wages, tips, other compensation | |

| Box 2 Amount | 12 | Amount | Box 2: Federal income tax withheld | |

| Box 3 Amount | 12 | Amount | Box 3: Social security wages | |

| Box 4 Amount | 12 | Amount | Box 4: Social security tax withheld | |

| Box 5 Amount | 12 | Amount | Box 5: Medicare wages and tips | |

| Box 6 Amount | 12 | Amount | Box 6: Medicare tax withheld | |

| Box 7 Amount | 12 | Amount | Box 7: Social security tips | |

| Box 8 Amount | 12 | Amount | Box 8: Allocated tips | |

| Box 10 Amount | 12 | Amount | Box 10: Dependent care benefits | |

| Box 11 Amount | 12 | Amount | Box 11: Nonqualified plans | |

| Box 11 is Sect 457 | 1 | Checkbox | Box 11: Sec 457 checkbox | X / Y / T / 1 = Checked |

| Box 12a Amount | 12 | Amount | Box 12a: See instructions. | |

| Box 12a Code | 2 | Text | Box 12a: See instructions. | |

| Box 12b Amount | 12 | Amount | Box 12b: See instructions. | |

| Box 12b Code | 2 | Text | Box 12b: See instructions. | |

| Box 12c Amount | 12 | Amount | Box 12c: See instructions. | |

| Box 12c Code | 2 | Text | Box 12c: See instructions. | |

| Box 12d Amount | 12 | Amount | Box 12d: See instructions. | |

| Box 12d Code | 2 | Text | Box 12d: See instructions. | |

| Box 13 Checkbox 1 | 1 | Checkbox | Box 13: Statutory employee checkbox | X / Y / T / 1 = Checked |

| Box 13 Checkbox 2 | 1 | Checkbox | Box 13: Retire plan checkbox | X / Y / T / 1 = Checked |

| Box 13 Checkbox 3 | 1 | Checkbox | Box 13: Third-party sick pay checkbox | X / Y / T / 1 = Checked |

| Box 14 Line 1 | 14 | Text | Box 14: Other | |

| Box 14 Line 2 | 14 | Text | Box 14: Other | |

| Box 14 Line 3 | 14 | Text | Box 14: Other | |

| Box 15(1) State | 2 | Text | Box 15: Withholding State | Use state abbreviation |

| Box 15(1) ID Number | 20 | Text | Box 15: Employer's state ID number | Provided by State |

| Box 16(1) Amount | 12 | Amount | Box 16: State wages, tips, etc | |

| Box 17(1) Amount | 12 | Amount | Box 17: State income tax | |

| Box 18(1) Amount | 12 | Amount | Box 18: Local wages, tips, etc | |

| Box 19(1) Amount | 12 | Amount | Box 19: Local income tax | |

| Box 20(1) Locality | 8 | Text | Box 20: Locality name | |

| See Form Common Fields | Form fields common to all form types | |||

Additional Import Form Fields for W-2 Corporate Suite only:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

Rcp Acct/Identifier | 25 | Character | Recipient Account Number | Optional Account / Import match ID (as displayed on UI manual entry) |

| Alt Rcp Account | 60 | Character | Alternate Recipient Account | The Alternate Account/Info field is a secondary, internal reference value and does not print on the tax form. |

W-2 Form:

IRS W-2 Form: https://www.irs.gov/pub/irs-pdf/fw2.pdf

IRS W-2 Instructions: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

Overview

Content Tools