- Loading...

Eligible Records

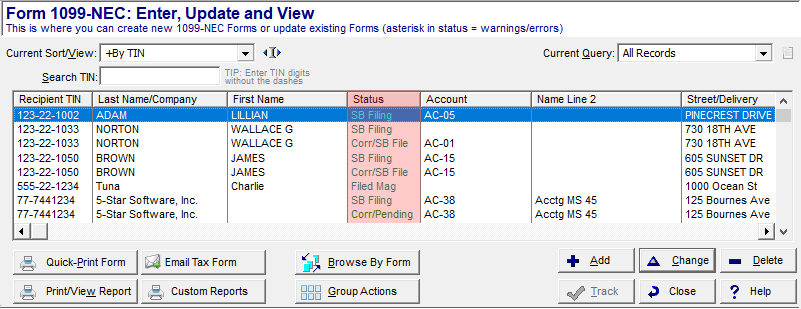

Only filed records are eligible for corrections. View a record's status at the Work With My Tax Forms screen in your software.

- Records with an SB Filing, SB Print+File, or Filed Mag status are eligible to correct. See Correct a Form.

- Records with a Corr/SB File or Corr/Mag status have been corrected and filed. There is a special process to correct an already corrected form, see How to Correct a Corrected Form, below.

- Records with a Pending or Corr/Pending status can be edited simply by selecting the "Change" button.

- Records with an SB Printed or Printed status can also be edited via the "Change" button; but first you will need to reset them to pending status when prompted.

Correct a Form

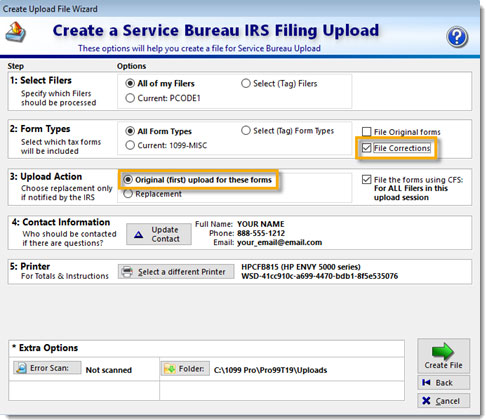

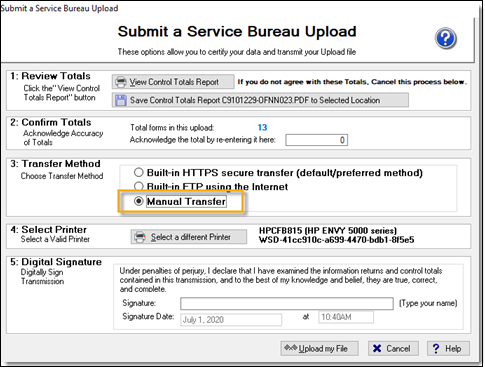

Most 1099 Pro software corrections must be processed manually, one-by-one, at the Work With My Tax Forms screen (the exception is Corporate Suite). Watch a video tutorial on corrections, click here, or view detailed instructions under Corrections FAQs. Most correction uploads do not require a Service Bureau appointment (the exception is Force Type 1 Corrections, as discussed later).

Correction FAQs

______________________________________________

If you require further information, please visit our revised website:

https://desktop.1099pro.com/ or email us directly at sb@1099pro.com.

Overview

Content Tools