- Loading...

IRS Release Status: FINAL

Sample Excel Import File: 1099-B 2020.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| 2nd TIN notice | 1 | Checkbox | 2nd TIN notice | X / Y / T / 1 = Checked |

| FATCA Checkbox | 1 | Checkbox | FATCA filing requirement Checkbox | X / Y / T / 1 = Checked |

| CUSIP No. | 13 | Text | For transactional reporting by brokers, enter the CUSIP... | |

| 8949 Code | 1 | Text | Use this box to enter a one-letter code... | A / B / D / E / X |

Box 1a Description | 45 | Text | Box 1a: Description of property | |

| Box 1b Date | 10 | Date | Box 1b: Date acquired | MM/DD/YYYY or M/D/YYYY |

Box 1c Date | 10 | Date | Box 1c: Date sold or Disposed | MM/DD/YYYY or M/D/YYYY |

Box 1d Amount | 12 | Amount | Box 1d: Proceeds | |

| Box 1e Amount | 12 | Amount | Box 1e: Cost or other basis | |

Box 1f Amount | 12 | Amount | Box 1f: Accrued market discount | |

| Box 1g Amount | 12 | Amount | Box 1g: Wash sale loss disallowed | |

| Box 2 Checkbox 1 | 1 | Checkbox | Box 2: Short-term | X / Y / T / 1 = Checked |

| Box 2 Checkbox 2 | 1 | Checkbox | Box 2: Long-term | X / Y / T / 1 = Checked |

| Box 2 Checkbox 3 | 1 | Checkbox | Box 2: Ordinary | X / Y / T / 1 = Checked |

| Box 3 Checkbox 1 | 1 | Checkbox | Box 3 Check if proceeds from: Collectibles | X / Y / T / 1 = Checked |

| Box 3 Checkbox 2 | 1 | Checkbox | Box 3 Check if proceeds from: QOF | X / Y / T / 1 = Checked |

| Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5 Checkbox | 1 | Checkbox | Box 5: Check if Noncovered security | X / Y / T / 1 = Checked |

| Box 6 Checkbox 1 | 1 | Checkbox | Box 6: Gross proceeds | X / Y / T / 1 = Checked |

| Box 6 Checkbox 2 | 1 | Checkbox | Box 6: Net proceeds | X / Y / T / 1 = Checked |

| Box 7 Checkbox | 1 | Checkbox | Box 7: Check if loss is not allowed on based on amount in 1d | X / Y / T / 1 = Checked |

| Box 8 Amount | 12 | Amount | Box 8: Profit or (Loss) Realized in 2020 on Closed Contracts | |

| Box 9 Amount | 12 | Amount | Box 9: Unrealized Profit or (Loss) on Open Contracts—12/31/2019 | |

| Box 10 Amount | 12 | Amount | Box 10: Unrealized Profit or (Loss) on Open Contracts—12/31/2020 | |

| Box 11 Amount | 12 | Amount | Box 11: Aggregate Profit or (Loss) on Contracts | |

| Box 12 Checkbox | 1 | Checkbox | Box 12: Check if basis reported to IRS | X / Y / T / 1 = Checked |

| Box 13 Amount | 12 | Amount | Box 13: Bartering | |

| Box 14 State | 2 | Text | Box 14: State name | Use state abbreviation |

| Box 15 ID Number | 20 | Text | Box 15: State identification no. | Given by State Department of Revenue |

| Box 16 Amount | 12 | Amount | Box 16: State tax withheld | |

| See Form Common Fields | Form fields common to all form types. | |||

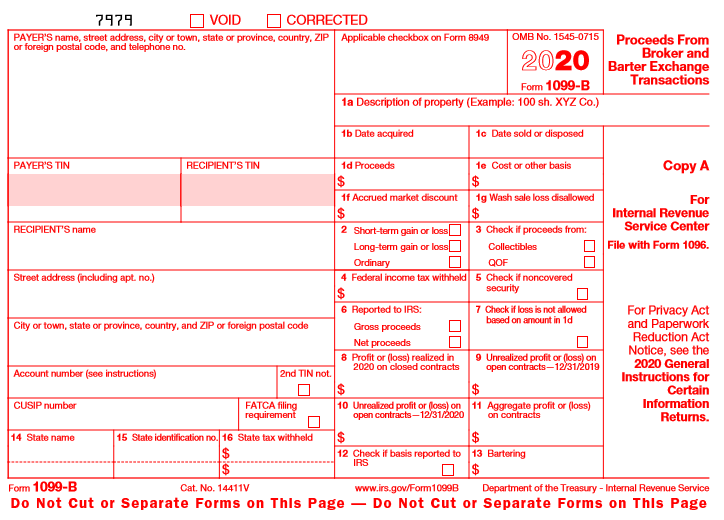

1099-B Form:

IRS 1099-B Form: 1099-B 2020 Form

IRS 1099-B Instructions: 1099-B 2020 Instructions

Overview

Content Tools