- Loading...

IRS Release Status: FINAL

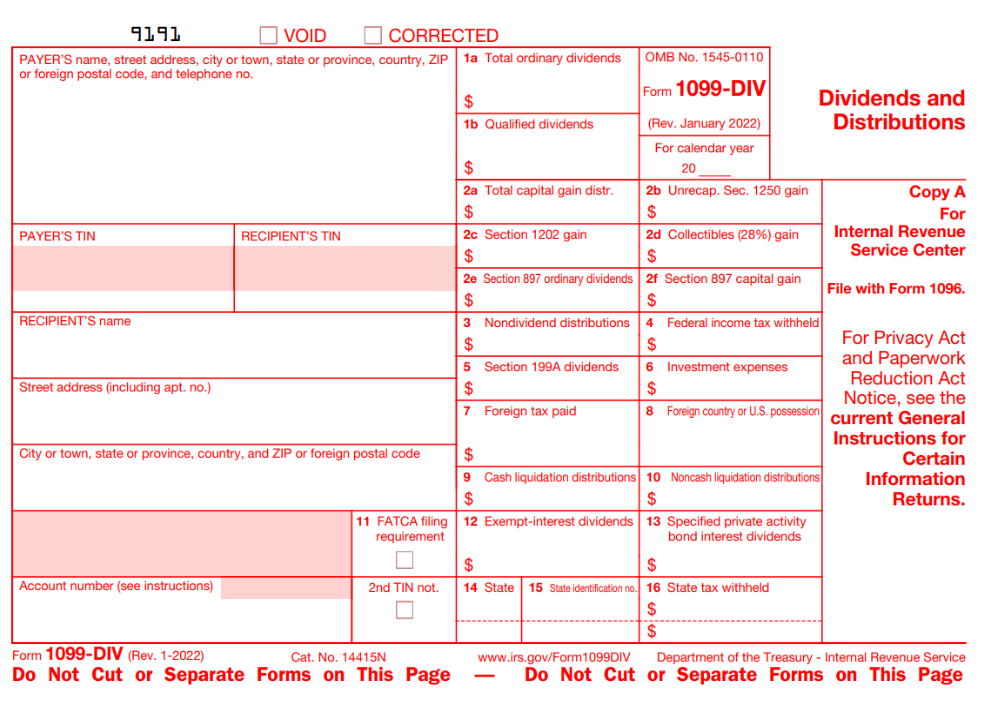

Sample Excel Import File: 1099-DIV 2022.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| 2nd TIN Notice | 1 | Checkbox | 2nd TIN Notice | X / Y / T / 1 = Checked |

| Box 1a Amount | 12 | Amount | Box 1a: Total Ordinary Dividends | |

| Box 1b Amount | 12 | Amount | Box 1b: Qualified Dividends | |

| Box 2a Amount | 12 | Amount | Box 2a: Total Capital Gain Distribution | |

| Box 2b Amount | 12 | Amount | Box 2b: Unrecap Sec. 1250 Gain | |

| Box 2c Amount | 12 | Amount | Box 2c: Section 1202 Gain | |

Box 2d Amount | 12 | Amount | Box 2d: Collectibles (28%) Gain | |

Box 2e Amount | 12 | Amount | Box 2e: Section 897 Ordinary Dividends | |

Box 2f Amount | 12 | Amount | Box 2f: Section 897 Capital Gain | |

| Box 3 Amount | 12 | Amount | Box 3: Nondividend Distributions | |

| Box 4 Amount | 12 | Amount | Box 4: Federal Income Tax Withheld | |

| Box 5 Amount | 12 | Amount | Box 5: Section 199A Dividends | |

| Box 6 Amount | 12 | Amount | Box 6: Investment Expenses | |

| Box 7 Amount | 12 | Amount | Box 7: Foreign Tax Paid | |

| Box 8 Foreign | 12 | Amount | Box 8: Foreign Country Or U.S. Possession | |

| Box 9 Amount | 12 | Amount | Box 9: Cash Liquidation Distributions | |

| Box 11 FATCA Checkbox | 1 | Checkbox | FATCA filing requirement | X / Y / T / 1 = Checked |

| Box 12 Amount | 12 | Amount | Box 12: Exempt-Interest Dividends | |

| Box 13 Amount | 12 | Amount | Box 13: Specified Private Activity Bond Interest Dividends | |

| Box 14 State | 2 | Text | Box 14: State Name | Use state abbreviation |

| Box 15 ID Number | 20 | Text | Box 15: State Identification Number | Given by State Department of Revenue |

| Box 16 Amount | 12 | Amount | Box 16: State Tax Withheld | |

| See Form Common Fields | Form fields common to all form types. | |||

1099-DIV Form:

IRS 1099-DIV Form: 1099-DIV 2022 Form

IRS 1099-DIV Instructions: 1099-Div 2022 Instructions

Overview

Content Tools