- Loading...

IRS Release Status: FINAL

Sample Excel Import File: 1099-G 2023.xlsx

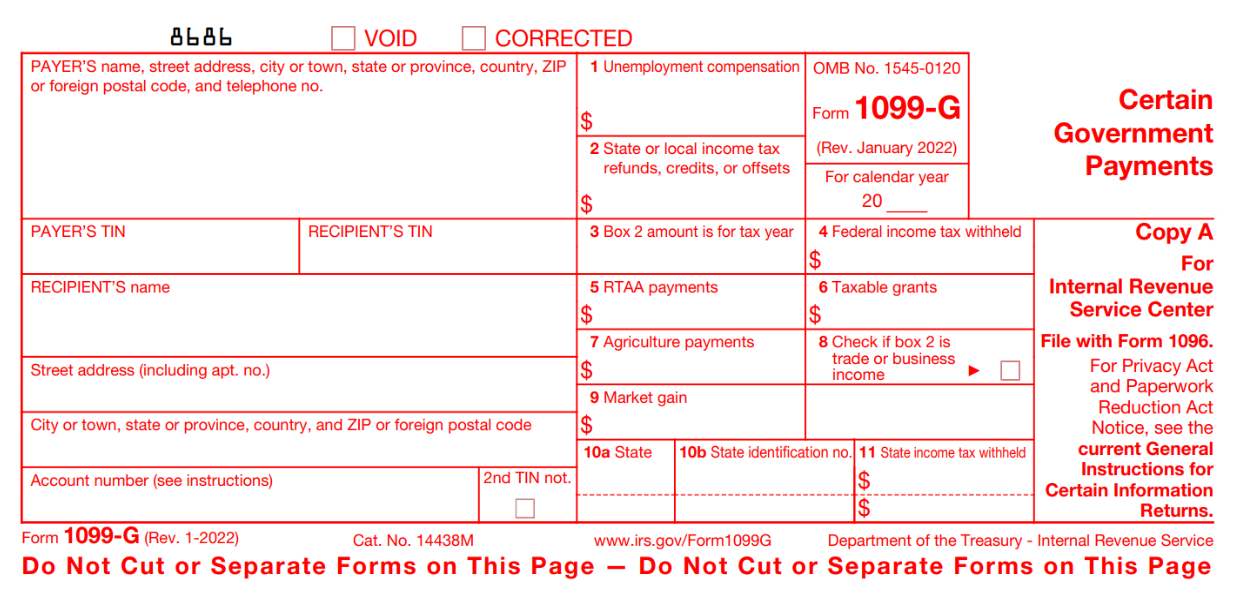

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| 2nd TIN Notice | 1 | Checkbox | 2nd TIN Notice checkbox | X / Y / T / 1 = Checked |

Box 1 Amount | 12 | Amount | Box 1: Unemployment compensation | |

Box 2 Amount | 12 | Amount | Box 2: State or local income tax refunds, credits, or offsets | |

Box 3 Year | 4 | Date | Box 3: Box 2 amount is for tax year | MM/DD/YYYY or M/D/YYYY |

| Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5 Amount | 12 | Amount | Box 5: RTAA payments | |

| Box 6 Amount | 12 | Amount | Box 6: Taxable grants | |

| Box 7 Amount | 12 | Amount | Box 7: Agricultural payments | |

| Box 8 Checkbox | 1 | Checkbox | Box 8: Check if box 2 is trade or business income | X / Y / T / 1 = Checked |

| Box 9 Amount | 12 | Amount | Box 9: Market gain | |

| Box 10a State | 2 | Text | Box 10a: State Name | Use state abbreviation |

| Box 10b ID Number | 20 | Text | Box 10b: State Identification Number | Given by State Department of Revenue |

| Box 11 Amount | 12 | Amount | Box 11: State Income Tax Withheld | |

| See Form Common Fields | Form fields common to all form types. | |||

1099-G Form:

IRS 1099-G Form: https://www.irs.gov/pub/irs-pdf/f1099g.pdf

IRS 1099-G Instructions: https://www.irs.gov/pub/irs-pdf/i1099g.pdf

Overview

Content Tools