- Loading...

IRS Release Status: FINAL

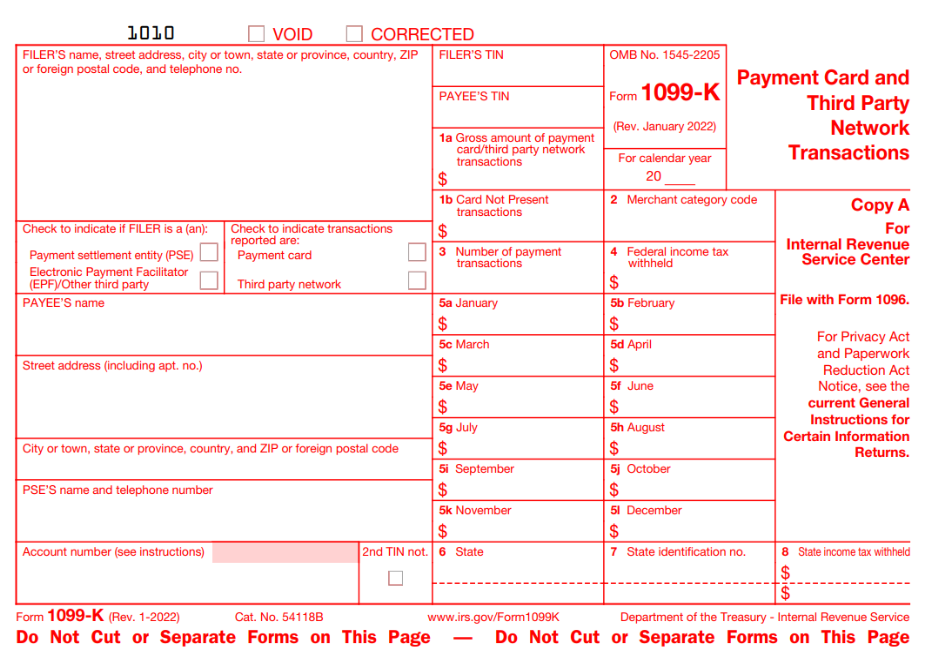

Sample Excel Import File: 1099-K 2022.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| 2nd TIN Notice | 1 | Checkbox | 2nd TIN Notice | X / Y / T / 1 = Checked |

Payment Card Chkbox | 1 | Checkbox | Payment card | X / Y / T / 1 = Checked |

| 3rd Party Chkbox | 1 | Checkbox | Third party network | X / Y / T / 1 = Checked |

Box 1a Amount | 12 | Amount | Box 1a: Gross amount of payment card/third party... | |

Box 1b Amount | 12 | Amount | Box 1b: Card Not Present transactions | |

| Box 2 MCC | 4 | Numeric | Box 2: Merchant category code | See IRS Instructions |

Box 3 Number | 13 | Number | Box 3: Number of payment transactions | |

| Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5a Amount | 12 | Amount | Box 5a: January | |

| Box 5b Amount | 12 | Amount | Box 5b: February | |

| Box 5c Amount | 12 | Amount | Box 5c: March | |

| Box 5d Amount | 12 | Amount | Box 5d: April | |

| Box 5e Amount | 12 | Amount | Box 5e: May | |

| Box 5f Amount | 12 | Amount | Box 5f: June | |

| Box 5g Amount | 12 | Amount | Box 5g: July | |

| Box 5h Amount | 12 | Amount | Box 5h: August | |

| Box 5i Amount | 12 | Amount | Box 5i: September | |

| Box 5j Amount | 12 | Amount | Box 5j: October | |

| Box 5k Amount | 12 | Amount | Box 5k: November | |

| Box 5l Amount | 12 | Amount | Box 5l: December | |

| Box 6 State | 2 | Text | Box 6: State Name | Use state abbreviation |

| Box 7 ID Number | 20 | Text | Box 7: State Identification Number | Given by State Department of Revenue |

| Box 8 Amount | 12 | Amount | Box 8: State Income Tax Withheld | |

| See Form Common Fields | Form fields common to all form types. | |||

1099-K Form:

IRS 1099-K Form: 1099-K 2022 Form

IRS 1099-K Instructions: 1099-K 2022 Instructions

Overview

Content Tools