- Loading...

IRS Release Status: FINAL

Sample Excel Import File: 1099-LS 2018.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Box 1 Amount | 12 | Amount | Amount paid to payment recipient | |

| Box 2 Date | 10 | Date | Date of sale | |

Issuer Name | 40 | String | Name of Issuer | |

Extra address line 1 | 40 | String | Acquirer's information contact entity name, street address, city or town, stat or province, country, ZIP or foreign postal code, and telephone no. (if different from ACQUIRER) | |

| Extra address line 2 | 40 | String | Acquirer's information contact entity name, street address, city or town, stat or province, country, ZIP or foreign postal code, and telephone no. (if different from ACQUIRER) | |

| Extra address line 3 | 40 | String | Acquirer's information contact entity name, street address, city or town, stat or province, country, ZIP or foreign postal code, and telephone no. (if different from ACQUIRER) | |

| Extra address line 4 | 40 | String | Acquirer's information contact entity name, street address, city or town, stat or province, country, ZIP or foreign postal code, and telephone no. (if different from ACQUIRER) | |

| Extra contact name | 40 | String | Acquirer's information contact entity name, street address, city or town, stat or province, country, ZIP or foreign postal code, and telephone no. (if different from ACQUIRER) | |

| Extra contact phone | 10 | String | Acquirer's information contact entity name, street address, city or town, stat or province, country, ZIP or foreign postal code, and telephone no. (if different from ACQUIRER) | |

| Rcp Account | 40 | String | Policy Number | |

| See Form Common Fields | Form fields common to all form types. | |||

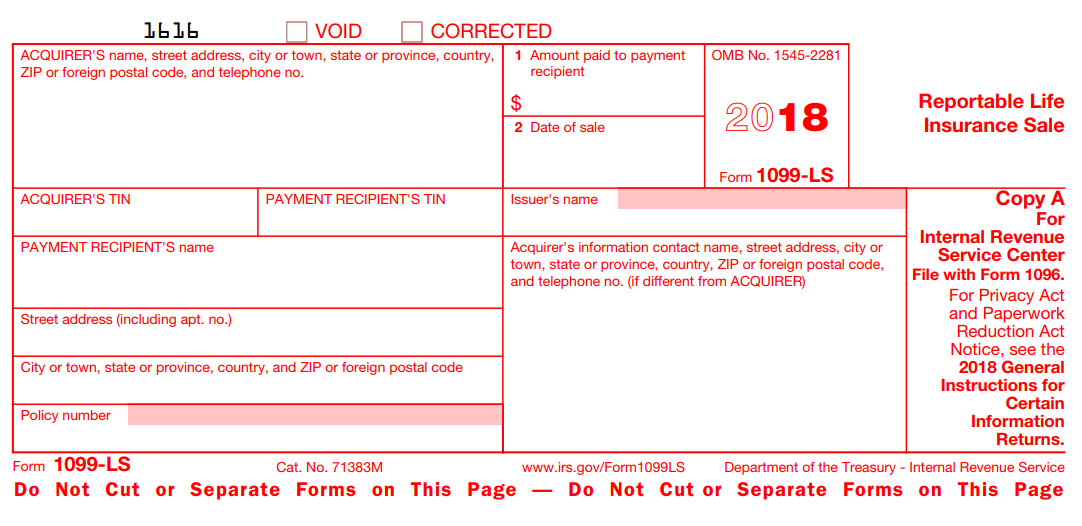

1099-LS Form:

IRS 1099-LS Form: 1099-LS

IRS 1099-LS Instructions: 2018 1099-LS Instructions